FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

2

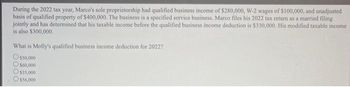

Transcribed Image Text:During the 2022 tax year, Marco's sole proprietorship had qualified business income of $280,000, W-2 wages of $100,000, and unadjusted

basis of qualified property of $400,000. The business is a specified service business. Marco files his 2022 tax return as a married filing

jointly and has determined that his taxable income before the qualified business income deduction is $330,000. His modified taxable income

is also $300,000.

What is Molly's qualified business income deduction for 2022?

O$50,000

$60,000

O$35,000

O$56,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 88 MULTIPLE CHOICE Question 6 Listen If f(x)= and g(x) = x²-16, then what is the value of f(g(4))? A 0 B 4 C undefinedarrow_forwardQ2) 4. What is sensitivity analysis?arrow_forwardProblem 9-25 Fudge factors An oil company executive is considering investing $10.1 million in one or both of two wells: well 1 is expected to produce oil worth $3.01 million a year for 10 years; well 2 is expected to produce $2.01 million for 15 years. These are real (inflation-adjusted) cash flows. The beta for producing wells is 0.91. The market risk premium is 9%, the nominal risk-free interest rate is 7%, and expected inflation is 3%. The two wells are intended to develop a previously discovered oil field. Unfortunately there is still a 21% chance of a dry hole in each case. A dry hole means zero cash flows and a complete loss of the $10.1 million investment. Ignore taxes and make further assumptions as necessary. a. What is the correct real discount rate for cash flows from developed wells? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Real discount rate b. The oil company executive proposes to add 20 percentage points to the…arrow_forward

- please explain the answer B ?arrow_forwardD nctions Question 10 Use the diagram below to find each of the following: sine of point a • cose of point b • tane of point c d earrow_forward3 3. At September 30, the end of Beijing Company’s third quarter, the following stockholders’ equity accounts are reported. Common stock, $10 par value $ 300,000 Paid-in capital in excess of par value, common stock 110,000 Retained earnings 320,000 In the fourth quarter, the following entries related to its equity are recorded. Date General Journal Debit Credit October 2 Retained Earnings 70,000 Common Dividend Payable 70,000 October 25 Common Dividend Payable 70,000 Cash 70,000 October 31 Retained Earnings 71,000 Common Stock Dividend Distributable 34,000 Paid-In Capital in Excess of Par Value, Common Stock 37,000 November 5 Common Stock Dividend Distributable 34,000 Common Stock, $10 Par Value 34,000 December 1 Memo—Change the title of the common stock account to reflect the new par value of $4. December 31 Income Summary 300,000 Retained Earnings 300,000 Required:2. Complete the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education