FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

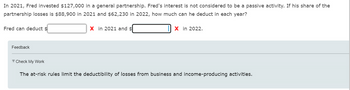

Transcribed Image Text:In 2021, Fred invested $127,000 in a general partnership. Fred's interest is not considered to be a passive activity. If his share of the

partnership losses is $88,900 in 2021 and $62,230 in 2022, how much can he deduct in each year?

Fred can deduct $

Feedback

▼Check My Work

X in 2021 and $

X in 2022.

The at-risk rules limit the deductibility of losses from business and income-producing activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- not use ai pleasearrow_forwardNoah Yobs, who has $97,000 of AGI (solely from wages) before considering rental activities, has $87,300 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $48,500 of income. He has other passive activity income of $31,040. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year? b. Compute Noah’s AGI on Form 1040 [pages 1 and 2; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss. What amounts should go on lines 1, 6, & 7 on page 2 of FORM 1040? What amount s go on lines 17, & 22 on schedule one of FORM 1040?arrow_forwardThis answer is wrong . please give me the right answer.arrow_forward

- Q1 Decker has a $1,000 loss from an activity in which he materially participates. He has $500 of basis in the activity and his at risk basis is $300. How much of the $1,000 loss may Decker deduct against ordinary income ? Q2 Hope and Joy formed a partnership by each contributing $3,000. This year, the partnership borrowed $60,000 as a nonrecourse loan. The loan is considered qualified nonrecourse debt. Each partner took a $1,000 distribution this year. What is each partner's at-risk amount at the end of the year please answer 1 ,2arrow_forwardVishalarrow_forwardSteve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O’Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2019, O’Donnell invests a building worth $74,000 and equipment valued at $44,000 as well as $32,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O’Donnell to join this partnership, Reese draws up the following profit and loss agreement: O’Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year.O’Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $6,000, whichever is larger. All remaining income is credited to Reese.Neither partner is allowed to withdraw funds from the partnership during 2019.…arrow_forward

- Haresharrow_forward. At the end of last year, Catherine, a 30% partner in the KLM partnership, had an outside basis of $50,000 in her partnership interest. She sold her partnership interest for $90,000. The partnership had $100,000 of unrealized receivables, and no debt. Calculate the amount and character of Catherine’s recognized gain or loss.arrow_forwardMichael works as an accountant at a large accounting firm. Michael is also a partner in XYZ partnership. In 2020, Michael spends 240 hours working in XYZ. His business partner, Beth, only spends 210 hours working in the partnership. The partnership has no employees other than the two partners who contribute their time. Michael has materially participated in the partnership. Group of answer choices True Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education