FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

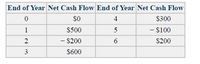

The cash flow profile for an investment is given below and the interest rate is 8% compounded annually.a. Find the present worth of this series using the actual

Transcribed Image Text:End of Year Net Cash Flow End of Year Net Cash Flow

$0

4

$300

1

$500

5

- $100

2

- $200

$200

3

$600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year A B C 1 $ 18,000 $ 18,000 2 18,000 3 18,000 4 18,000 5 18,000 $ 18,000 6 18,000 90,000 7 18,000 8 18,000 9 18,000 10 18,000 18,000 (Click on the icon in order to copy its contents into a spreadsheet.) Assuming an annual discount rate of 23 percent, find the present value of each investment. Question content area bottom Part 1 a. What is the present value of investment A at an annual discount rate of 23 percent? $ enter your response here (Round to the…arrow_forwardFor the cash flows shown, calculate the future worth in year 13 using i = 12% per year. Year 0 1 2 3 4 5 6 Cash flow, $ 200 200 200 200 300 300 300 The future worth is calculated to be $ ____.arrow_forwardConsider the following cash flow diagram. What is the value of X if the present worth of the diagram is $400 and the interest rate is 15% compounded annually? a. $246 b. $165 c. $200 d. $146.arrow_forward

- Using Microsoft Excel, create an investment cash-flow diagram that will have a present worth of zero using MARR = 14.5%. The study period needs to be exactly 8 years and each year should have at least one unique cash flow that is different from the cash flows over the other years. Your answer should contain a table showing the cash flows for each year and a graphical representation of the cash flows (cash-flow diagram).arrow_forwardDetermine the rate of return for the cash flows shown in the diagram. Use trial and error (start with two trials with 5% and 10% interest rates) and then use interpolation (or more trials) to approximate the result. Roh?? S7000 1- ? Year 590 s90 s90 sz00 sz00 sz00 $3000arrow_forward1. Discounted Payback (DCPB) and IRR analysis. Use the cash flow situation (table below) to answer. a. Determine the DCPB based on a MARR rate of 8.0% b. Determine the IRR Year Cash Flow (in $1000's) 0 1 -5500 +1500 2 +1800 3 +1500 4 +1800 5 6 +1500 +1800 7 +1500arrow_forward

- Find the internal rate of return (IRR) for the following cash flows. Enter your answer as a percent and include at least two decimal points, e.g., 8.35 for 8.35 %, not 0.08. Year Cash Flow 0 750 1 200 2 375 3 250 4 100 5 75arrow_forwardUSING EXCEL SHOW HOW TO SOLVE THE FOLLOWING:arrow_forwardWhich of the following cash flows has the highest future value? A. $1000 invested for two years in the future when the interest rate is 4% ⚫B. $1000 invested for two years in the future when the interest rate is 6% • C . $1000 invested for three years in the future when the interest rate is 4% ⚫ D. $1000 invested for three years in the future when the interest rate is 6%arrow_forward

- Consider two assets with the following cash flow streams: Asset A generates $4 at t=1, $3 at t=2, and $10 at t=3. Asset B generates $2 at t=1, $X at t=2, and $10 at t=3. Suppose X=6 and the interest rate r is constant. For r=0.1, calculate the present value of the two assets. Determine the set of all interest rates {r} such that asset A is more valuable than asset Draw the present value of the assets as a function of the interest rate. Suppose r=0.2. Find the value X such that the present value of asset B is 12. Suppose the (one-period) interest rates are variable and given as follows: r01=0.1,r12=0.2, r23=0.3. Calculate the yield to maturity of asset A. (You can use Excel or ascientific calculator to find the solution numerically.)arrow_forwardFind the present worth in year 0 for the cash flows shown. Let i = 10% per year. Please solve it with formula not table, Thank youarrow_forwardTake me to the text The following table indicates the net cash flows of a capital asset: Year Net Cash Flow 0 $-13,900 1 $5,500 2 $9,600 Do not enter dollar signs or commas in the input boxes. Use the negative sign where appropriate. Round the factor to 4 decimal places and the NPV to the nearest whole number. Assume the required rate of return is 13%. Determine the net present value of this asset. Year Net Cash Flow 0 1 2 Total $-13,900 $5,500 $9,600 Factor Net Present Value SA $ Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education