Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

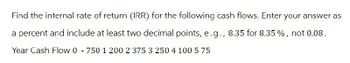

Transcribed Image Text:Find the internal rate of return (IRR) for the following cash flows. Enter your answer as

a percent and include at least two decimal points, e.g., 8.35 for 8.35 %, not 0.08.

Year Cash Flow 0 750 1 200 2 375 3 250 4 100 5 75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Determine the value of X that makes the following two cash flow diagrams equivalent when the interest rate is 10% per period. 800 800 800 800 800 800 800 1,000 1,000arrow_forwardCullumber Inc. owns and operates a number of hardware stores in the Atlantic region. Recently, the company decided to open another store in a rapidly growing area of Nova Scotia. The company is trying to decide whether to purchase or lease the building and related facilities. Currently, the cost of funds for Cullumber is 10%. Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,840,000. An immediate down payment of $405,000 is required, and the remaining $1,435,000 would be paid off over five years with payments of $347,000 per year (including interest payments made at the end of the year). The property is expected to have a useful life of 12 years, and then it will be sold for $590,000. As the owner of the property, the company will pay $51,000 in occupancy expenses at the end of each year. Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fixtures for…arrow_forwardCompute the following:arrow_forward

- Consider the following cash flows: Year Cash flow 0 -25000 1 7000 2 6000 3 5000 4 3000 5 3000 6 1500 7 1500 8 500 Compute the rate of return represented by the cash flows.arrow_forwardPlease correct answer and step by steparrow_forwardAssume the appropriate discount rate for the following cash flows is 10.3 percent. Year Cash Flow 1 $2,150 2,050 234 1,750 1,550 What is the present value of the cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present valuearrow_forward

- For each of the following annuities, calculate the annual cash flow. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Cash Flow Present Value Years Interest Rate $ 33,100 6 10 % 30,700 8 8 $ 170,000 17 13 $ 243,300 24 12 %24arrow_forwardFor the following stream of free cash flows, calculate the NPV if the discount rate is 11.9%. Year Free Cash Flows 0 -41,375 1 13,995 2 17,857 3 20,378 4 10,452 5 21,455arrow_forward7. Future value of annuities There are two categories of cash flows: single cash flows, referred to as "lump sums," and annuities. Based on your understanding of annuities, answer the following questions. Which of the following statements about annuities are true? Check all that apply. O An annuity is a series of egual payments made at fixed intervals for a specified number of periods. O Ordinary annuities make fixed payments at the beginning of each period for a certain time period. O An annuity due is an annuity that makes a payment at the beginning of each period for a certain time period. O An annuity due earns more interest than an ordinary annuity of equal time. Which of the following is an example of an annuity? O An investment in a certificate of deposit (CD) A lump-sum payment made to a life insurance company that promises to make a series of equal payments later for some period of time Luana loves shopping for clothes, but considering the state of the economy, she has decided…arrow_forward

- What is the NPV of the following cash flows if the required rate of return is 0.09? Year 0 1 2 3 4 CF -4,529 2,431 572 1,804 3,132 Enter the answer with 2 decimals (e.g. 1000.23).arrow_forwardA fixed stream of cash flows occurring at the beginning of each period for a fixed period of time is known as: Select one: a. Ordinary annuity b. Constant annuity c. Annuity due d. Financial annuityarrow_forwardWhat is the IRR of the following set of cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Year 0 1 2 3 IRR Cash Flow -$ 15,500 6,200 7,500 6,000 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education