FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

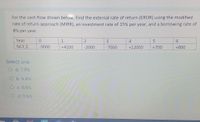

Transcribed Image Text:For the cash flow shown below. Find the external rate of return (EROR) using the modified

rate of return approach (MIRR), an investment rate of 15% per year, and a borrowing rate of

8% per year.

Year

3

4

NCF,$

-9000

+4100

-2000

-7000

+12000

+700

+800

Select one:

O a. 7.9%

Ob.9.9%

O c. 5.9%

O d. 11.9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the rate of return on the following investment. Year Cash Flow 0 1 2 3 4 5 - $8000 0 2600 2600 2600 2600arrow_forwardA firm expects to make payments of 1.1, 1.5, 1.2, 1.4 and 1.9 million for a particular supply over each of the next 5 years. What constant annual payment is this equivalent to if the annual rate is 10%? That is, what is the time-value weighted average of this mixed-cash flow stream?arrow_forwardUse the ERR method with = 10% per year to solve for a unique rate of return for the following cashflow diagram. How many IRRS (the maximum) are suggested by Descartes' rule of signs? The ERR is%. (Round to two decimal places.) A maximum of $45 IRR value(s) is(are) suggested by the Descartes' rule of signs. $220 $350 Enf of Year $190 Q MARR = 10%/yrarrow_forward

- Problem 07.037 - MIRR calculation For the net cash flow series, find the external rate of return (EROR) using the MIRR method with an investment rate of 20% per year and a borrowing rate of 10% per year. Year Net Cash Flow, $ The external rate of return is 1 4,000 2 -3,000 3 -7,000 4 12,000 5 -700arrow_forwardd. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 12%. Round to the nearest dollar.Annual Net Cash Flow fill in the blank 1 of 1$arrow_forwardAssuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forward

- Consider another set of net cash flows: Year Cash flow 0 1,000 1 1,000 2 0 3 1,500 4 2,000 5 3,500 What is the net present value of the stream if the opportunity cost of capital is 10 percent? a. What is the value of the stream at the end of year 5 if the cash flows are invested in an account that pays 10 percent annually? 2. What cash flows today (time 0), in lieu of the 1,000 cash flow, would be needed to accumulate $10,000 at the end of year 5? (Assume that the cash flows for years 1 through 5 remain the same.)arrow_forwardAssuming a 1-year, money market account investment at 2.51 percent (APY), a 1.1% inflation rate, a 25 percent marginal tax bracket, and a constant $40,000 balance, calculate the after-tax rate of return, the real return, and the total monetary return. What are the implications of this result for cash management decisions?arrow_forwardH3arrow_forward

- Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forwardhello, I need help pleasearrow_forwardAssuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education