FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

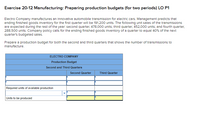

Transcribed Image Text:Exercise 20-12 Manufacturing: Preparing production budgets (for two periods) LO P1

Electro Company manufactures an Innovative automobile transmission for electric cars. Management predicts that

ending finished goods Inventory for the first quarter will be 191,200 units. The following unit sales of the transmisslons

are expected during the rest of the year. second quarter, 478,000 units; third quarter, 452,000 units; and fourth quarter,

288,500 units. Company policy calls for the ending finished goods Inventory of a quarter to equal 40% of the next

quarter's budgeted sales.

Prepare a production budget for both the second and third quarters that shows the number of transmissions to

manufacture.

ELECTRO COMPANY

Production Budget

Second and Third Quarters

Second Quarter

Third Quarter

Required units of available production

Units to be produced

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- keep costs down, CGC maintains a warehouse but no showroom or retail sales outlets. CGC has the following information for the second quarter of the year: 1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively. 2. Cost of goods sold is 45 percent of expected sales. 3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold. 4. Monthly operating expenses are estimated to be: . Salaries: $33,000. ° Delivery expense: 8 percent of monthly sales. • Rent expense on the warehouse: $2,500. • Utilities: $500. • Insurance: $330. • Other expenses: $430. Required: 1. Compute the budgeted cost of purchases for each month in the second quarter. 2. Complete the budgeted income statement for each month in the second quarter. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the budgeted cost of purchases for each month in the second quarter. Total Cost of…arrow_forwardSunland Company estimates its sales at 180000 units in the first quarter and that sales will increase by 17000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $25. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Cash collections for the third quarter are budgeted at O $5273500. O $3026500. O $4387000. O $6057389.arrow_forwardValley's managers have made the following additional assumptions and estimates: Estimated sales for July and August are $345,000 and $315,000 respectively Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July Each month's ending inventory must equal 20% of the cost of the next month's sales. The Cost of Goods Sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred The company does not plan to buy or sell any plant and…arrow_forward

- At January 1, 2022, Oriole Company has beginning inventory of 3000 surfboards. Oriole estimates it will sell 11000 units during the first quarter of 2022 with a 10% increase in sales each for the following quarters. Oriole's policy is to maintain an ending finished goods inventory equal to 25% of the next quarter's sales. Each surfboard costs $100 and is sold for $155. What is the budgeted sales revenue for the third quarter of 2022 $2247500 $2063050 $13310 5542500arrow_forwardGraham Potato Company has projected sales of $12,000 in September, $15,000 in October, $22,000 in November, and $18,000 in December. Of the company's sales, 30 percent are paid for by cash and 70 percent are sold on credit. Experience shows that 40 percent of accounts receivable are paid in the month after the sale, while the remaining 60 percent are paid two months after. Determine collections for November and December. Also assume Graham's cash payments for November and December are $18,500 and $11,000, respectively. The beginning cash balance in November is $5,000, which is the desired minimum balance. a. Prepare a cash receipts schedule for November and December. Graham Potato Company Cash Receipts Schedule Sales Credit sales Cash sales One month after sale Two months after sale Total cash receipts September October November Decemberarrow_forwardFilmore Enterprises reports the year-end information from December 31, 2023 as follows: Sales (90,000 units) $1,170,000 Cost of goods sold $409,500 Gross margin $760,500 Operating expenses $620,100 Operating income $140,400 Filmore Enterprises is developing the next twelve- month budget. In January 2024, the company would like to increase selling prices by 3%. As a result, it is expected there will be a decrease in sales volume of 7%. All other operating expenses are expected to remain constant. Assume that COGS is a variable cost and that operating expenses are a fixed cost. Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. What is the budgeted operating income for the year? Budgeted Sales $Answer Budgeted cost of goods sold $Answer Budgeted gross margin $Answer Operating expenses $Answer Budgeted operating income $Answerarrow_forward

- Narai Co. has a desired ending inventory of 30% of the next months forecasted sales. In turn, their cost of goods sold is 60%, and their forecasted sales for the months of March, April, May, June, and July are as follows: $750,000, $880,000, $700,000, $800,000, and $900,000 respectively. Purchases for the months of February and March were $500,000 and $360,000 and their purchases are paid as follows: 10% during the month of the purchase 80% in the next month and the final 10% in the next month. Required: Prepare budget schedules for the months of April, May, and June for required purchases and also for disbursements for purchases.arrow_forwardTrailers Company expects to sell 6,500 units for $155 each for a total of $1,007,500 in January and 2,300 units for $200 each for a total of $460,000 in February. The company expécts cost of goods sold to average 50% of sales revenue, and the company expects to sell 5,000 units in March for $200 each. Trailers' target ending inventory is $20,000 plus 50% of the next month's cost of goods sold. Prepare Trailers' inventory, purchases, and cost of goods sold budget for January and February. Trailers Company Inventory, Purchases, and Cost of Goods Sold Budget Two months Ended January 31 and February 28 January Cost of goods sold Plus: Desired ending merchandise inventory Total merchandise inventory required Less: Beginning merchandise inventory Budgeted purchases 503750 135000 638750 February 230000 520000 750000arrow_forwardMillen’s managers have made the following additional assumptions and estimates: Estimated sales for July and August are $310,000 and $330,000, respectively. Each month’s sales are 20% cash sales and 80% credit sales. Each month’s credit sales are collected 30% in the month of sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July. Each month’s ending inventory must equal 20% of the cost of next month’s sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July. Monthly selling and administrative expenses are always $70,000. Each month $10,000 of this total amount is depreciation expense and the remaining $60,000 relates to expenses that are paid in the month they are incurred. The company does not plan to buy or sell any plant and equipment…arrow_forward

- Valley's managers have made the following additional assumptions and estimates: Estimated sales for July and August are $345,000 and $315,000 respectively Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July Each month's ending inventory must equal 20% of the cost of the next month's sales. The Cost of Goods Sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred The company does not plan to buy or…arrow_forwardGreenThumb Organic Fertilizer Company plans to sell 210,000 units of finished product in July and anticipates a growth rate in sales of 3 percent per month. The desired monthly ending inventory in units of finished product is 85 percent of the next month's estimated sales. There are 178,500 finished units in inventory on June 30. Each unit of finished product requires 4 pounds of raw material at a cost of $1.25 per pound. There are 840,000 pounds of raw material in inventory on June 30. Required: 1. Compute the company's total required production in units of finished product for the entire three-month period ending September 30. Note: Round all intermediate calculations and your final answer to the nearest unit. 2. Independent of your answer to requirement 1, assume the company plans to produce 700,000 units of finished product in the three-month period ending September 30, and to have raw-material inventory on hand at the end of the three-month period equal to 25 percent of the use in…arrow_forwardCherboneau Novelties produces drink coasters (among many other products). During the current year (year 0), the company sold 522,000 units (packages of 6 coasters). In the coming year (year 1), the company expects to sell 544,000 units, and, in year 2, it expects to sell 648,000 units. The target ending finished goods inventory for each month is equal to the next month's sales. However, because of production issues, the ending inventory in the current year is expected to be only 13,000 units. Each unit requires 0.5 pound of cork. At the end of the current year, management expects to have 19,250 pounds of cork in inventory. Management has set a target to have cork on hand equal to one half of next month’s sales requirements. Sales and production take place evenly throughout the year. Required: a. Compute the total targeted production of the finished coaster for the coming year. b. Compute the required amount of cork to be purchased for the coming year. (540,000 units for a is incorrect…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education