FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

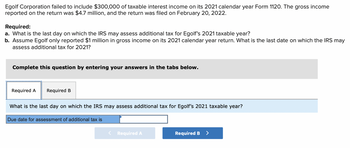

Transcribed Image Text:Egolf Corporation failed to include $300,000 of taxable interest income on its 2021 calendar year Form 1120. The gross income

reported on the return was $4.7 million, and the return was filed on February 20, 2022.

Required:

a. What is the last day on which the IRS may assess additional tax for Egolf's 2021 taxable year?

b. Assume Egolf only reported $1 million in gross income on its 2021 calendar year return. What is the last date on which the IRS may

assess additional tax for 2021?

Complete this question by entering your answers in the tabs below.

Required A Required B

What is the last day on which the IRS may assess additional tax for Egolf's 2021 taxable year?

Due date for assessment of additional tax is

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- For tax year 2019, the IRS assesses a deficiency against David for $500,000. a. Disregarding the interest component, enter David's penalty if the deficiency is attributable to negligence: $fill in the blank 25590105cfe4f81_1. b. Disregarding the interest component, enter David's penalty if the deficiency is attributable to civil fraud: $fill in the blank e5c80bf76f8702a_1.arrow_forwardThe following facts relate to Crane Corporation. Deferred tax liability, January 1, 2025, $30,600. Deferred tax asset, January 1, 2025, $10,200. Taxable income for 2025,$107,100. Cumulative temporary difference at December 31,2025 , giving rise to future taxable amounts, $234,600. Cumulative temporary difference at December 31,2025 , giving rise to future deductible amounts, $96,900. Tax rate for all years, 20%. No permanent differences exist. The company is expected to operate profitably in the future. (a) Compute the amount of pretax financial income for 2025. Pretax financial income $arrow_forwardShirmp Tempura Company reported an excess of warranty expense over warranty deductions of P720,000 for the year ended December 31, 2019. This temporary difference will reverse in equal amounts over the years 2020 through 2022. The enacted tax rates are as follows: 2019 - 30% 2020 - 32% 2021 - 34% 2022 - 36% The reporting for this temporary difference at December 31, 2019 would be a A. deferred tax liability of P244,800. B. deferred tax asset of P216,000. C. deferred tax asset of P244,800. D. deferred tax liability of P216,000.arrow_forward

- 1. In 2021, Dunder Mifflin's warranty deduction for tax purposes exceeded its warranty expense for book purposes by $654. Its pretax financial income in 2021 was $42800, and its tax rate was 27%. What amount of deferred tax liability should be reported on Dunder Mifflin's 2021 balance sheet? Assume no prior deferred tax balance. Choose the closest answer (round to the nearest two decimal places). a. $654.00 b. $11556.00 c. $176.58 d. None; Dunder Mifflin reports a deferred tax asset on its 2021 balance sheet.arrow_forwardMs. Schmidt didn't request an extension of time to file a 2021 income tax return and didn't mail the completed return to the IRS until August 8, 2022. Ms. Schmidt enclosed a check for $1,490, the correct balance of tax due with the return. Required: a. Assuming that Ms. Schmidt can't show reasonable cause for filing a delinquent return, compute the late-filing and late-payment penalty.arrow_forwardOn December 31, 2019, an entity reported a deferred tax liability of P600,000 and a deferred tax asset of P150.000 On December 31, 2020, the deferred tax liability is P900,000 and the deferred tax asset is zero. What is the deferred tax expense for 2020?arrow_forward

- CC corporation (a calendar-year C corporation) has a net operating loss (NOL) carryover to 2021 in the amount of $30,000. How much tax will SCC pay for 2021 if it reports taxable income from operations of $20,000 before considering loss carryovers under the following assumptions? (Leave no answer blank. Enter zero if applicable.) a. The NOL originated in 2017. SCC Taxable Income in 2021 b. The NOL originated in 2018. SCC Tax in 2021arrow_forwardMs. Dela filed an unextended 2021 Form 1040 on November 2, 2022, and had no reasonable cause for the delinquency. The return showed a $22,840 balance of tax due. Compute Ms. Dela's late-filing and late-payment penalty. $5,938 $7,994 $4,568 $5,710arrow_forwardFor tax year 2019, the IRS assesses a deficiency against David for $500,000. a. Disregarding the interest component, enter David's penalty if the deficiency is attributable to negligence: $fill in the blank 00862dfde01c05d_1. b. Disregarding the interest component, enter David's penalty if the deficiency is attributable to civil fraud: $fill in the blank c83f71023f93fbc_1.arrow_forward

- 11arrow_forwardOn April 15, 2021, the Bureau of Internal Revenue is in the process of examining Chala’s tax returns for 2018 and 2019 but has not proposed a deficiency assessment. Management feels an assessment is reasonably possible and if an assessment is made, an unfavorable settlement of up to P5,000,000 is reasonably possible. 1. Chala will accrue (disclose) in relation to the BIR examination an amount of:arrow_forwardNow assume that Syer does account for its NOL under the CARES Act. Prepare the appropriate journal entry to record Syer’s 2020 income taxes, and indicate Syer’s 2020 net income(loss). Syer Company reports net operating income (loss) for financial reporting and tax purposes in each year as follows ($ in millions): 2016 2017 2018 2019 2020 $ 330) $ 130 $ 0 $0 $ (660) Syer’s 2020 NOL is driven by an unfortunate obsolescence of its primary product. Given great uncertainty in Syer’s future profitability, Syer’s management does not believe it is more likely than not that it will be able to realize deferred tax assets in future years. Syer’s federal tax rate decreased from 35% to 21% starting in 2018.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education