Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

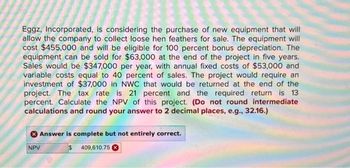

Transcribed Image Text:Eggz, Incorporated, is considering the purchase of new equipment that will

allow the company to collect loose hen feathers for sale. The equipment will

cost $455,000 and will be eligible for 100 percent bonus depreciation. The

equipment can be sold for $63,000 at the end of the project in five years.

Sales would be $347,000 per year, with annual fixed costs of $53,000 and

variable costs equal to 40 percent of sales. The project would require an

investment of $37,000 in NWC that would be returned at the end of the

project. The tax rate is 21 percent and the required return is 13

percent. Calculate the NPV of this project. (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

$ 409,610.75

NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- DDR Enterprises is analyzing an expansion project. The project's installed cost is $80,000. It is eligible for 100% bonus depreciation. The project has a $12,000 salvage value at the end of its five year expected life. The project will requie an additional $8,000 investment in net working capital. The tax rate is 25%. What is the project's initial investment? If you could show the steps in calcualtion too that would be great!arrow_forwardCrane Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.85 million. This investment will consist of $2.70 million for land and $9.15 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.05 million, which is $2.50 million above book value. The farm is expected to produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.80 million. The marginal tax rate is 35 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 15.25.) NPV The project should bearrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.35 million. The fixed asset qualifies for 100 percent bonus depreciation in the first year. The project is estimated to generate $1,745,000 in annual sales, with costs of $648,000. The project requires an initial investment in net working capital of $320,000, and the fixed asset will have a market value of $285,000 at the end of the project. a. If the tax rate is 22 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) a. Year 0 cash flow a. Year 1 cash…arrow_forward

- Ivanhoe Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.85 million. This investment will consist of $2.15 million for land and $9.70 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.25 million, which is $2.00 million above book value. The farm is expected to produce revenue of $2.10 million each year, and annual cash flow from operations equals $1.90 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment? (Do not round factor values. Round final answer to 2 decimal places, e.g. 15.25.)arrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $171,000 and be depreciated on a 3- year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $108,000, variable costs of $27,650, and fixed costs of $12,250. The project will also require net working capital of $2,850 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 10 percent. What is the net present value of this project? Multiple Choice $19,125 $28.518 $17,031 $14,520 $15,840arrow_forwardMotion Metrics is considering a four-year project to improve its production efficiency. Buying a new production equipment for $414,000 is estimated to result in $154,000 in annual pre-tax cost savings. The equipment falls into Class 8 for CCA purposes (CCA rate of 20% per year), and it will have a salvage value at the end of the project of $55,400. The project also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,500 in inventory for each succeeding year of the project. If the firm's tax rate is 35% and its discount rate is 9%. Calculate the NPV of this project. (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) O NPVarrow_forward

- A proposed cost-saving device has an installed cost of $905,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $65,000, the tax rate is 22 percent, and the project discount rate is 9 percent. The device has an estimated Year 5 salvage value of $125,000. What level of pretax cost savings do we require for this project to be profitable? (MACRS schedule) Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Required cost savingsarrow_forwardKolby's Korndogs is looking at a new sausage system with an installed cost of $735,000. The asset qualifies for 100 percent bonus depreciation and can be scrapped for $101,000 at the end of the project's 5-year life. The sausage system will save the firm $215,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $67,000. If the tax rate is 21 percent and the discount rate is 8 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV =arrow_forwardYour company is considering a project which will require the purchase of $715,000 in new equipment. The company expects to sell the equipment at the end of the project for 25% of its original cost, but some assets will remain in the CCA class. Annual sales from this project are estimated at $256,000. Initial net working capital equal to 32.00% of sales will be required. All of the net working capital will be recovered at the end of the project. The firm requires a 10.00% return on similar investments. The tax rate is 35%, and the project life is 5 years. There are no other operating expenses. If the equipment is in a 33.00% CCA class, what is the present value of the CCA tax shield? Options $153,510 $157,348 $161,186 $165,024 $168,861arrow_forward

- Cori's Meats is looking at a new sausage system with an installed cost of $435,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $61,000. The sausage system will save the firm $255,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $20,000. If the tax rate is 24 percent and the discount rate is 9 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forwardLakeside Winery is considering expanding its winemaking operations. The expansion will require new equipment costing $697,000 that would be depreciated on a straight-line basis to zero over the 5-year life of the project. The equipment will have a market value of $192,000 at the end of the project. The project requires $62,000 initially for net working capital, which will be recovered at the end of the project. The operating cash flow will be $187,600 a year. What is the net present value of this project if the relevant discount rate is 14 percent and the tax rate is 21 percent? Multiple Choice -$19,132 -$3,975 -$16,142 -$22,893 -$21,257arrow_forwardA proposed cost-saving device has an installed cost of $730,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $140,000, the marginal tax rate is 22 percent, and the project discount rate is 10 percent. The device has an estimated Year 5 salvage value of $101,000. What level of pretax cost savings do we require for this project to be profitable? (MACRS schedule) (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Pretax cost savings $ 216,693.04arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education