EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:b. Assume that after the funds are invested, EBIT amounts to $14,900. Also assume the company pays $4,300 in dividends or $4,300

in interest depending on which source of financing is used. Based on a 40 percent tax rate, determine the amount of the increase in

retained earnings that would result under each financing option.

Bonds

Stock

Additional

Retained Earnings

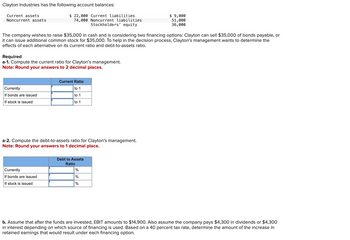

Transcribed Image Text:Clayton Industries has the following account balances:

Current assets

Noncurrent assets

$ 22,000 Current liabilities

74,000 Noncurrent liabilities

Stockholders' equity

$ 9,000

51,000

36,000

The company wishes to raise $35,000 in cash and is considering two financing options: Clayton can sell $35,000 of bonds payable, or

it can issue additional common stock for $35,000. To help in the decision process, Clayton's management wants to determine the

effects of each alternative on its current ratio and debt-to-assets ratio.

Required

a-1. Compute the current ratio for Clayton's management.

Note: Round your answers to 2 decimal places.

Currently

If bonds are issued

If stock is issued

Current Ratio

to 1

to 1

to 1

a-2. Compute the debt-to-assets ratio for Clayton's management.

Note: Round your answers to 1 decimal place.

Currently

If bonds are issued

If stock is issued

Debt to Assets

Ratio

%

%

%

b. Assume that after the funds are invested, EBIT amounts to $14,900. Also assume the company pays $4,300 in dividends or $4,300

in interest depending on which source of financing is used. Based on a 40 percent tax rate, determine the amount of the increase in

retained earnings that would result under each financing option.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Proforma balance sheet for the upcoming year is given. The estimated net income is $2,621.60. If the company is planning to pay $500 dividends, what should be the external financing needs (EFN)? Proforma (Balance Sheet Assets $20,972.80 Total $20,972.80 )(Debt $11,000.00 Equity $10,181.60 Total $21,181.60) Multiple Choicea. -$208.8.b. $291.2.c. $208.8.d. $500.e. -$500.arrow_forwardA DI has the following balance sheet (in millions). Assets: Cash=9$ ; Loans=95 ; Securities= 26; total assets=130 Liabilities and equity: deposits= 75; purchased funds= 40; equity=15 ; total liabilites and equity= 130 The DI’s securities portfolio includes $16 million in T-bills and $10 million in GNMA securities. The DI has a $20 million line of credit to borrow in the repo market and $5 million in excess cash reserves (above reserve requirements) with the Fed. The DI currently has borrowed $22 million in Fed funds and $18 million from the Fed discount window to meet seasonal demands. 1) What is the DI’s total available (sources of) liquidity? 2) What is the DI’s current total uses of liquidity? 3) What is the net liquidity of the DI? 4) Calculate the financing gap. 5) What is the financing requirement? 6) The DI expects a net deposit drain of $20 million. Show the DI's balance sheet if the following conditions occur: a. The DI purchases liabilities to offset this expected drain. b.…arrow_forwardRing & Bell Bhd. has prepared the next year's pro forma balance sheet which shows the external financing needed (EFN) of RM100,000. To bring the pro forma balance sheet into balance, Ring & Bell should __________. Select one: a. invest in marketable securities totalling RM100,000 b. repurchase common stock totalling RM100,000 c. repay notes payable of RM100,000 d. borrow long-term capital of RM100,000arrow_forward

- The liabilities and owners’ equity for Campbell Industries is found here. What percentage of the firm’s assets does the firm now finance using debt (liabilities)? If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm’s new debt ratio?arrow_forwardBroom Co. has a total debt of $420,000 and shareholders’ equity of $700,000. Broom is seeking capital to fund an expansion. Broom is planning to issue an additional $300,000 in common stock, and is negotiating with a bank to borrow additional funds. The bank is requiring a debt-to-equity ratio of 0.75. what is the maximum additional amount Broom will be able to borrow?arrow_forwardBinomial Tree Farm's financing includes $5 million of bank loans. Its common equity is shown in Binomial's Annual Report at $6.67 million. It has 500,000 shares of common stock outstanding, which trade on the Wichita Stock Exchange at $18 per share. What debt ratio should Binomial use to calculate its company cost of capital or asset beta? Note: Enter your answer as a percent rounded to 2 decimal places. Debt ratio %arrow_forward

- As an alternative to the bank loan, management is considering issuing $32 million in six-year bonds. The bonds pay 3% interest semi-annually and would be issued at 90.61 to yield 8%. Determine the company's long-term debt to equity and debt as a percentage of total capitalization ratios if it decides to borrow money using bonds and purchase the equipment.The statement of financial position as of December 31, 2024, for Cullumber Corporation as follows.Current Assets: 61000000Non-current Assets: 107000000Total Assets: 168000000Current Liabilities: 26000000Long-term Liabilities: 45000000Shareholder's Equity: 97000000Total liabilities and Shareholder's Equity: 168000000arrow_forwardRead the following case and then use your knowledge, skills and critical thinking to answer the questions below: You are hired to work as an accountant at African Company which has an active trading strategy for debt investments. African Company engaged in purchasing and selling several debt investments to make profits. On December 31, 2018, the company had 3 debt investments as follows: Egyptian Company 7% Bonds, the amortized cost is $310,000. Tunisia Company 8% Bonds, the amortized cost is $525,000. Morocco Company 6% Bonds, the amortized cost is $415,000. If the market values of Egyptian Company, Tunisia Company, and Morocco Company debt investments on December 31, 2018, were, $304,000, $538,000, $413,000, respectively. Required 1: Prepare the debt investments portfolio for African Company on December 31, 2018, and prepare the adjusting entry on the date? Required 2: Assume that African Company sold Tunisia Company 8% Bonds on April 1, 2019 for $519,000 at that time the amortized…arrow_forwardThrillville has $41 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillville’s total assets are $81 million, and its liabilities other than the bonds payable are $11 million. The company is considering some additional financing through leasing.Required:1. Calculate total stockholders’ equity using the balance sheet equation.2. Calculate the debt to equity ratio.3. The company enters a lease agreement requiring lease payments with a present value of $16 million. Record the lease.4. Will entering into the lease cause the debt to equity ratio to be in violation of the contractual agreement in the bond? Determine your answer by calculating the debt to equity ratio after recording the lease.arrow_forward

- please help me answeer the following given Debt analysis Springfield Bank is evaluating Creek Enterprises, which has requested a $3,780,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industr, averages and Creek's recent financial statements, evaluate and recommend appropriate action on the loan request. Industry averages Creek Enterprises Income Statement: Debt ratio 0 50 Times interest earned ratio 7.42 Fixed-payment coverage ratio 2.03 Creek Enterprises Balance Sheet: Creek Enterprises's debt ratio is _____ (Round to two decimal places.) Creek Enterprises's times interest earned ratio is ______ (Round to two decimal places.) Creek Enterprises's fixed-payment coverage ratio is. ______ (Round to two decimal places.) Complete the following summary of ratios and compare Creek Enterprises's ratios vs. the industry average: (Round to two decimal places.) Creek Debt ratio Industry 0.50 Times…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPQR Corporation is considering the following alternative plans of financing for raising$4,000,000: The following additional information is available for PQR Corporation: Earnings before bond interest and income taxes (EBIT) are $9,000,000. The tax rate is 35%. All bonds or stocks are issued at their par values. Interest is payable at the end of each year. Required: Which plan should company choose & why (i.e. Explain the rationale behind selecting the plan)? Provide all the detailed calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning