FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 1 of 5

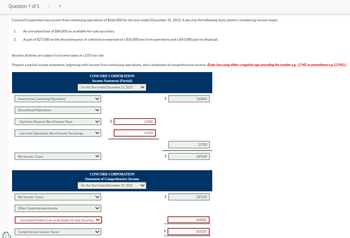

Concord Corporation has income from continuing operations of $266,000 for the year ended December 31, 2022. It also has the following items (before considering income taxes).

1.

2

An unrealized loss of $84,000 on available-for-sale securities.

A gain of $27,000 on the discontinuance of a division (comprised of a $16,000 loss from operations and a $43,000 gain on disposal).

Assume all items are subject to income taxes at a 21% tax rate.

>

Prepare a partial income statement, beginning with income from continuing operations, and a statement of comprehensive income. (Enter loss using either a negative sign preceding the number eg. -2,945 or parentheses e.g. (2,945).)

Income from Continuing Operations

Discontinued Operations

Gain from Disposal, Net of Income Taxes

Net Income /(Loss)

Loss from Operations, Net of Income Tax Savings

Net Income /(Loss)

Other Comprehensive Income

CONCORD CORPORATION

Income Statement (Partial)

For the Year Ended December 31, 2022

Comprehensive Income/(Loss)

CONCORD CORPORATION

Statement of Comprehensive Income

For the Year Ended December 31, 2022

Unrealized Holding Gain on Available-for-Sale Securities ✓

27000

(5670)

$

$

266000

S

21330

287330

DO A

287330

(84000)

203330

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2020, Livernois Corporation had net income from operations of $100,000. In addition, Livernois recognized a long-term capital gain of $25,000 a short-term capital gain of $5,000 and a short-term capital loss of $45,000. Which of the following statements is correct? Select one: a. Livernios Corporation will have taxable income in 2020 of $100,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years. b. Livernois Corporation will have taxable income of $125,000 and will have a net capital loss of $40,000 that can be carried back 3 years and forward 5 years. c. Livernois Corporation may deduct $30,000 of the capital loss from operating income in 2020. d. Livernois Corporation will have taxable income of $85,000 for 2020. e. None of the above.arrow_forwardRequired information [The following information applies to the questions displayed below.] Hafnaoui Company reported pretax net income from continuing operations of $903,500 and taxable income of $712,500. The book-tax difference of $191,000 was due to a $242,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $117,000 due to an increase in the reserve for bad debts, and a $66,000 favorable permanent difference from the receipt of life insurance proceeds. b. Compute Hafnaoui Company's deferred income tax expense or (benefit). Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit. X Answer is complete but not entirely correct. Deferred income tax expense $ 712,500arrow_forwardDuring the current year, Dale Corporation sold a segment of its business at a gain of $315,000.Until it was sold, the segment had a current period operating loss of $112,500. The company had$1,275,000 from continuing operations for the current year.Prepare the lower part of the income statement, beginning with the $1,275,000 income fromcontinuing operations. Follow tax allocation procedures, assuming that all changes in incomeare subject to a 20% income tax rate. Disregard earnings per share disclosures. (Round all calculations to nearest dollar amount.)arrow_forward

- In its proposed 2022 income statement, Swifty Corporation reports income before income taxes $775,000, income taxes $155,000 (not including unusual items), loss on operation of discontinued music division $93,000, gain on disposal of discontinued music division $62,000, and unrealized loss on available-for-sale securities $232,500. The income tax rate is 20%. Prepare a correct statement of comprehensive income, beginning with income before income taxes. SWIFTY CORPORATIONPartial Statement of Comprehensive Incomearrow_forwardCadillac Square Corporation determined that $1,128,800 of its research tax credit on its current-year tax return was uncertain, but that it was more likely than not to be sustained on audit. Management made the following assessment of the company's potential tax benefit from the deduction and its probability of occurring. Individual Cumulative Potential Estimated Benefit (000s) $1,128,800 $ 964,500 $ 233,250 0 Probability of Probability of Occurring (%) Occurring (%) 47 30 15 8 Tax benefit amount recognized 47 77 92 100 What amount of the tax benefit related to the uncertain tax position from the research tax credit can Cadillac Square Corporation recognize in calculating its income tax provision in the current year?arrow_forwardLi Corporation reported pretax book income of $605,000. Tax depreciation exceeded book depreciation by $401,000. Li's beginning book (tax) basis in its fixed assets was $1,905,000 ($1,704,000) and its ending book (tax) basis is $1,805,000 ($1,206,000). In addition, the company received $305,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $69,000. Assuming a tax rate of 21 percent, compute the company's deferred income tax expense or benefit. Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit. Deferred income tax expensearrow_forward

- Lanco Corporation, an accrual-method corporation, reported taxable income of $1,720,000 this year and paid Federal income tax of $361,200. Included in the computation of taxable income were the following items: • MACRS depreciation of $253,000. Depreciation for earnings and profits purposes is $124,000. • A net capital loss carryover of $13,700 from last year. • A net operating loss carryover of $31,000 from last year. $76,750 capital gain from the distribution of land to the company's sole shareholder (see below). Not included in the computation of taxable income were the following items: • Tax-exempt income of $8,600. • Life insurance proceeds of $267,000. • Excess current-year charitable contribution of $2,300 (to be carried over to next year). • Tax-deferred gain of $21,300 on a like-kind exchange. • Nondeductible life insurance premium of $4,700. • Nondeductible interest expense of $3,600 on a loan used to buy tax-exempt bonds. . Lanco's accumulated E&P at the beginning of the…arrow_forwardThe following items were taken from the adjusted trial balance of the Dylex Corporation for the year ended December 31, 2020. Assume an average 25% income tax on all ens. The accounting period ends December 31, and all amounts given are pre-tax. Dylex Corporation had 11,000 common shares outstanding in 2020 and follows IFRS Cost of goods sold Depreciation expense, building Gain on exchange Gain on sale of assets from discontinued operations Insurance expense Interest expense Interest income Loss on sale of trading investment 140,000 23,000 a) Prepare a multi-step income statement in good form. Please make sure your final anewarts) are accurate to 2 decimal places Dylex Corporation For the Year Ended December 31, 200 125,000 100,000 54,000 52,000 X 58,000 135,000 Operating loss of discontinued operation to disposal date 100,000 Salaries expense 160.000 Sales ** 900,000 REQUIRED DISCLOSURES b) Calculate basic eamings per share (EPS) from continuing operations. Please make sure your final…arrow_forwardMunabhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education