ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

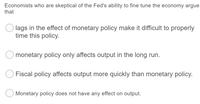

Transcribed Image Text:Economists who are skeptical of the Fed's ability to fine tune the economy argue

that

O lags in the effect of monetary policy make it difficult to properly

time this policy.

monetary policy only affects output in the long run.

Fiscal policy affects output more quickly than monetary policy.

O Monetary policy does not have any effect on output.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assuming a constant money supply, government expenditures can be financed by which of the following? Check all that apply. Borrowing Money supply Interest rate Taxesarrow_forwardExplain the interaction of monetary policy and fiscal policy at full employmentarrow_forwardIf the Bank of Canada believes the economy is about to fall into recession, what actions should it take? If the Bank of Canada believes the inflation rate is about to increase, what actions should it take? If the Bank of Canada believes the economy is about to fall into recession, it should A. use an expansionary fiscal policy to increase the interest rate and shift AD to the right. B. use a contractionary monetary policy to lower the interest rate and shift AD to the left. OC. use its judgment to do nothing and let the economy make the self adjustment back to potential GDP. O D. use an expansionary monetary policy to lower the interest rate and shift AD to the right. If the Bank of Canada believes the inflation rate is about to increase, it should O A. use a contractionary fiscal policy to increase the interest rate and shift AD to the left. O B. use an expansionary monetary policy to lower the interest rate and shift AD to the right. OC. use a combination of tax increases and…arrow_forward

- OMOs are the buying and selling of Gov’t bonds. Explain the relationship between the Gov’t bonds and the FED in relation to this macro tool.arrow_forwardLet’s study the crowding-out effect which is triggered by a discretionary fiscal policy. How does a temporary increase in government purchase affect the interest rate based on the money supply-demand model? Why? Suppose we are having stagflation because of a supply shock. Please show the temporary increase in government purchases can restore the long-run macroeconomic equilibrium using a graph. What is the meaning of the crowding-out effect? Please show the short-run crowding out effect using a graph.arrow_forwardExplain the difference between fiscal policy and monetary policy. Explain also 2 advantages and 2 disadvantages of both policies.arrow_forward

- In the most recent FOMC meeting, the Federal Reserve increased the Federal Funds rate. By doing this, this suggests the Federal Reserve: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. is willing to sacrifice higher prices to save jobs a is willing to sacrifice jobs to keep prices stable is trying to counter fiscal policy actions d believes the Federal Funds rate is not importantarrow_forwardSuppose that government spending is increased at the same time when an autonomous monetary policy tightening occurs. What will happen to the position of the aggregate demand curve?arrow_forwardQuestion: A recent article (federalreserve.gov/econres/feds/files/2020049pap.pdf) published by the Federal Reserve (the central bank of the USA), suggests "the massive lockdown of the economy" has led to "a large negative demand shock. However, an accompanying increase in unemployment benefits has increased the income of some low-and middle-income households at least temporarily, which could helpfully support aggregate demand". The excerpt above suggests an increase in household income, which might lead to improved aggregate demand. a. Draw a diagram to explain the above situation to show the impact of increased income and how it affects aggregate demand.arrow_forward

- Fiscal policy is conducted by the U.S. Treasury the U.S. Mint the federal government the Federal Reserve bank and involves government spending and taxes. quantitative easing. printing money. open market operations.arrow_forwardReview the rubric to make sure you understand the criteria for earning your grade. Read the articles An Update on the Economy and Monetary Policy and Recent and Near-Term Fiscal Policy Write a five- to six-page paper answering the following regarding fiscal and monetary policy changes: Explain the key aspects of today’s monetary policy and how they are affecting GDP and aggregate demand/aggregate supply. Explain the key aspects of today’s fiscal policy and how they are affecting GDP and aggregate demand/aggregate supply. Are these policies being well coordinated today? In essence, are they both working in unison to address current economic conditions? Explain. What are these policies’ effects on aggregate supply and aggregate. Do understand they affect supply as well as demand. You must use a minimum of five sources for your research paper, at least three of which are scholarly. Use proper spelling, grammar, and APA formatting for your analysis paper. When you have completed your…arrow_forwardWhat does a positive output gap indicate about the economy? The economy has slack, and the Central Bank will be on the lookout for deflation. The economy is running below its potential, and the Central Bank will be on the lookout for inflation. The economy is running above its potential and the Central Bank will be on the lookout for inflation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education