The following changes in economic conditions will affect either the aggregate demand curve or the

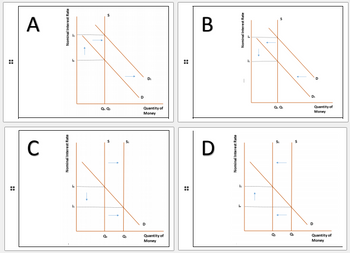

During a time of economic recession, the Federal Open Market Committee targets a lower federal funds rate by buying bonds on the open market.

An increased use of credit cards causes consumers to hold less money.

An increase in the price level means it takes more money to purchase the same basket of consumer goods.

The Fed raises the interest rate paid on the

The real incomes of consumers in the economy falls.

A decrease in the discount rate signals that the Fed would like to see an increase in lending by banks.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- If a recessionary gap occurs in the short run, then in the long run a new equilibrium arises when input prices and expectations adjust downward, causing the short-run aggregate supply curve to shift downward and to the right and pushing equilibrium real GDP per year back to its long-run value. The Federal Reserve can eliminate a recessionary gap in the short run by undertaking a policy action that increases aggregate demand. Which of the following is one monetary policy action that could eliminate the recessionary gap in the short run? A. The Fed can increase the money supply through an open market purchase of Treasury securities. B. The Fed can lower taxes. C. The Fed can increase the money supply through an open market sale of Treasury securities. D. The Fed can decrease the money supply through an open market purchase of Treasury securities.arrow_forwardA monetary policy that reduces the amount of money and loans in the economy is a contractionary monetary policy or a “tight” monetary policy. A monetary policy that expands the quantity of money and loans is known as an expansionary monetary policy or a “loose” monetary policy. Tight or contractionary monetary policy that leads to higher interest rates and a reduced quantity of loanable funds will reduce two components of aggregate demand. Conversely, a loose or expansionary monetary policy that leads to lower interest rates and a higher quantity of loanable funds will tend to increase business investment and consumer borrowing for big-ticket items. If loose monetary policy seeking to end a recession goes too far, it may push aggregate demand so far to the right that it triggers inflation. If tight monetary policy seeking to reduce inflation goes too far, it may push aggregate demand so far to the left that a recession begins. Note:- Do not provide handwritten solution. Maintain…arrow_forwardAssume that the housing market is in equilibrium in year 1. In year 2, the mortgage rate that banks charge consumers increases, but producers are not affected. Which of the following is most likely to be the equilibrium change? a The equilibrium will be at point C before the change in expectations and point A after the change b The equilibrium will be at point A before the change in expectations and point B after the change c The equilibrium will be at point A before the change in expectations and point C after the change d The equilibrium will be at point E before the change in expectations and point C after the changearrow_forward

- An increase in the money supply occurs when Question 16 options: the price level falls. the interest rate increases. the Fed makes open-market purchases. money demand increases.arrow_forwardThe aggregate demand-aggregate supply model graph below illustrates the change to the economy before the Fed's recent change in interest rates. On the graph, drag the appropriate curve to illustrate what changed in the U.S. economy for the Fed to have acted the way it did. To refer to the graphing tutorial for this question type, please click here. Price level AD-AS LRAS GRASTarrow_forwardUse of discretionary policy to stabilize the economyarrow_forward

- Match the term with the correct description. fiscal policy monetary policy money multiplier discount rate open market operations Question 6 the interest rate that the Fed sets for inter-bank borrowing represents the same thing as GDP the setting of the level of government spending and taxation by government policymakers 1/(1-MPC) deposits that banks have received but have not loaned out the interest rate that the Fed charges banks for short-term loans the purchase and sale of U.S. government bonds by the Fedarrow_forward#6arrow_forwardIn an effort to increase output in the short run due to the poor economy, government officials have decided to cut taxes. They are considering two possible temporary tax cuts of equal size in terms of lost revenue. The first would reduce the taxes on people with incomes above $100,000 per year. The second would cut taxes on people with incomes below $60,000 for one year. Which change would have a greater impact on aggregate spending (i.e shift the aggregate demand curve further to the right)? Why?arrow_forward

- The following graph shows the economy in long-run equilibrium at the expected price level of 120 and the natural level of output of $600 billion. Suppose a stock market boom increases household wealth and causes consumers to spend more. Shift the short-run aggregate supply (AS) curve or the aggregate demand (AD) curve to show the short-run impact of the stock market boom. 240 AS 200 AD 160 AS 120 80 AD 40 200 400 600 800 1000 1200 OUTPUT (Billions of dollars) In the short run, the increase in consumption spending associated with the stock market expansion causes the price level to the price level people expected and the quantity of output to the natural level of output. The stock market boom will cause the unemployment rate to the natural rate of unemployment in the short run. Again, the following graph shows the economy in long-run equilibrium at the expected price level of 120 and the natural level of output of $600 billion, before the increase in consumption spending associated with…arrow_forwardShould the government use monetary and fiscal policy in an effort to stabilize the economy? The following questions address the issue of how monetary and fiscal policies affect the economy, as well as the pros and cons of using these tools to combat economic fluctuations. The following graph plots hypothetical aggregate demand (AD), short-run aggregate supply (AS), and long-run aggregate supply (LRAS) curves for the U.S. economy in May 2026. Suppose the government chooses to intervene in order to return the economy to the natural level of output by using policy. Depending on which curve is affected by the government policy, shift either the AS curve or the AD curve to reflect the change that would successfully restore the natural level of output. PRICE LEVEL 150 50 30 130 110 8 70 80 50 20 20 22 24 LRAS 28 AS OUTPUT (Trillions of dollars) AD 28 30 AD ਵੇ ㅁ AS ? Suppose that in May 2026 the government successfully carries out the type of policy necessary to restore the natural level of…arrow_forwardThe commodity market for a simple two-sector economy is in equilibrium when Y = C + I. The money market is in equilibrium when the supply of money (Ms) equals the demand for money (Md), which in turn is composed of the transaction-precautionary demand for money (Mt) and the speculative demand for money (Mz). Assume a two-sector economy where C = 5 + 0.8Y, I = 100 - 75i, Ms = 250, Mt= 0.3Y, and Mz = 50 - 150i. , find the IS and LM and equliprium in commodity and money markets. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education