ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

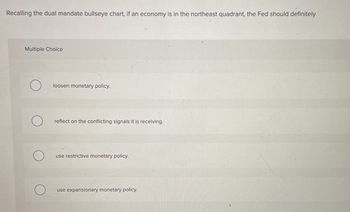

Transcribed Image Text:Recalling the dual mandate bullseye chart, if an economy is in the northeast quadrant, the Fed should definitely

Multiple Choice

loosen monetary policy.

reflect on the conflicting signals it is receiving.

use restrictive monetary policy.

use expansionary monetary policy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please correct answer and don't use hand ratingarrow_forwardThe Tools available when using fiscal policy are Interest Rates The Federal Reserve Open Market Operations Taxing policy and the required reserve None of the abovearrow_forwardIn what ways does the Fed utilize their monetary policy tools to affect or counter-balance fiscal policy?arrow_forward

- The primary instrument of monetary policy for the Fed is the discount rate. True Falsearrow_forwardDiscuss the main unconventional monetary policy tools. Give examples of central bank policies from around the world for each of your arguments.arrow_forwardTo achieve contractionary monetary policy, the Fed could decrease the discount rate increase the sale of bonds increase the tax rate All of the answers are correct. None of the answers are correct.arrow_forward

- As a governor of the Central Bank of Egypt, how could you use the THREE tools of monetary policy to control inflation and recession? Discuss each tool and use a table to demonstrate your analysis for the two scenariosarrow_forwardDescribe the Fiscal Policy and the monetary policy and explain how The two policies are used to control money supply in the economy.arrow_forwardThe central bank of a country facing economic and financial market difficulties asks for your advice. The bank cut its policy interest rate to the effective lower bound, but it wasn't enough to stabilize the economy. Drawing on the actions taken by the Federal Reserve during the financial crisis of 2007-2009, what might you advise this central bank to do? Multiple Choice O You should advise the central bank to use unconventional monetary policy tools such as quantitative easing, a policy in which the central bank alters the composition of its balance sheet, or credit easing, where aggregate reserves are provided beyond the level needed to lower the policy rate to zero. The central bank could also inform markets of its commitment to keep Interest rates low (forward guidance). Because the central bank has hit the zero bound with its policy Interest rate, there is nothing further it can do to Influence economic and financial market conditions. In the face of severe economic weakness, you…arrow_forward

- In response to the Great Recession, the Federal Reserve had to take drastic and largely untested measures to stabilize both the financial system and macroeconomy. These measures caused the monetary base to increase from approximately $850 billion to over $4 trillion. Indicate whether each school of macroeconomic thought—classical, Keynesian, monetarist, real business cycle, and secular stagnationist—would support the Fed’s actions.arrow_forwardThe Federal Open Market Committee can buy and sell government securities/bonds. Which of the following tools of monetary policy does this describe?arrow_forwardHigher unemployment rates for those 25 years old and younger in many European nations, in comparison to the United States, is best explained by the differing monetary policies between the European Central Bank and the Federal Reserve. True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education