ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

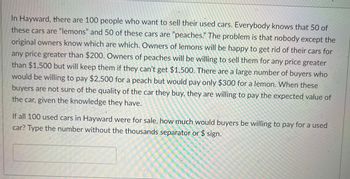

Transcribed Image Text:In Hayward, there are 100 people who want to sell their used cars. Everybody knows that 50 of these cars are "lemons" and 50 of these cars are "peaches." The problem is that nobody except the original owners know which are which. Owners of lemons will be happy to get rid of their cars for any price greater than $200. Owners of peaches will be willing to sell them for any price greater than $1,500 but will keep them if they can’t get $1,500. There are a large number of buyers who would be willing to pay $2,500 for a peach but would pay only $300 for a lemon. When these buyers are not sure of the quality of the car they buy, they are willing to pay the expected value of the car, given the knowledge they have.

If all 100 used cars in Hayward were for sale, how much would buyers be willing to pay for a used car? Type the number without the thousands separator or $ sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1)Describe an example of moral hazard that we may run into in the real world. Think of something that is legal and not inherently lethal, yet still demonstrates elevated risk for the participant who would likely act safer if insurance or protection was not available. Explain why someone might take this risky action. What are the benefits to the risky behavior? In your response to two of your peers, explain what an insurance company may do to reduce the likelihood that an individual would take this risk. Keep in mind, that we cannot always just deny coverage if an individual is participating in the risky behavior.arrow_forwardSuppose the inverse demand curve on ore is given by P = X - 0.47 Q. Ore can be either mined or obtained through a recycling program. The marginal cost of mining is MC1 = 8 q1. The marginal cost of obtaining ore through recycling is MC2 = 91 + 2 q2. What should be a maximum value of X so that recycling is NOT cost-effective?arrow_forwardFor distract drivingarrow_forward

- One method of solving this problem is through signaling. Signaling is a strategy one uses when they have information. The goal is to use a signal to convince the buyer that the good or service that is being sold is quality and will meet the buyer's wants. Offer an example of a company that uses a signal to help sell its product. What is the signal? What information is the signal trying to convey? Do you think the signal is effective? Why or why not? Does this signal improve market efficiency? Why or why not?arrow_forwardJohn wants to buy a used car. He knows that there are two types of car in the market, plums and lemons. Lemons are worse quality cars and are more likely to break down than plums. John is willing to pay £10, 000 for a plum and £2, 000 for a lemon. Unfortunately, however, he cannot distinguish between the two types. Sellers can offer a warranty that would cover the full cost of any repair needed by the car for y ∗ years. Considering the type and likelihood of problems their cars can have, owners of plums estimate that y years of guarantee would cost them 1000y, owners of lemons estimate that the cost would be 2000y. John knows these estimates and decides to offer £10, 000 if a car comes with y ∗ years of warranty, £2, 000 if a car comes without warranty. For which values of y ∗ is there a separating equilibrium where only owners of plums are willing to offer the y ∗ -years warranty? Clearly explain your reasoning.arrow_forwardAlana wishes to obtain auto insurance. She wants 100/300/100 liability coverage, $250 deductible collision and full coverage comprehensive. She lives in territory 2 and has been assigned to driver class 2 with a rating factor of 1.25. Based on Table 19-6 and Table 19-7, what would be her total premium, if her three-year-old car were in model class L? (Round your answer to the nearest cent.) a. $355.00 b. $365.00 c. $456.25 d. $465.38arrow_forward

- How does the presence of asymmetric information in the used car market impact the behavior of buyers, sellers, and market outcomes?arrow_forward18.7 Suppose 100 cars will be offered on the used-car market. Let 50 of them be good cars, each worth $10,000 to a buyer, and let 50 be lemons, each worth only $2,000. Compute a buyer’s maximum willingness to pay for a car if he or she cannot observe the car’s quality. Suppose that there are enough buyers relative to sellers that competition among them leads cars to be sold at their maximum willingness to pay. What would the mar- ket equilibrium be if sellers value good cars at $8,000? At $6,000?arrow_forward10arrow_forward

- Please find the attached question.arrow_forwardPlease answer precisely and clearly. thank you.arrow_forward4. Consider the market for Citrus used car in which lemons account for 40% of the used cars offered for sale. Suppose that each owner of an orange Citrus values it at $12,000; he is willing to part with it for a price of at least $12,000, but not lower than this. Similarly, each owner of a lemon Citrus values it at $4,000. Suppose that potential buyers are willing to pay more for each type. If a buyer could be confi- dent that the car he was buying was an orange, he would be willing to pay $15,000 for it; if the car was a known lemon, he would be willing to pay $5,000. Suppose that there are many buyers, but a limited number of used cars. What type of used cars - lemons or oranges - will be offered for sale in the market, and at what prices?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education