ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

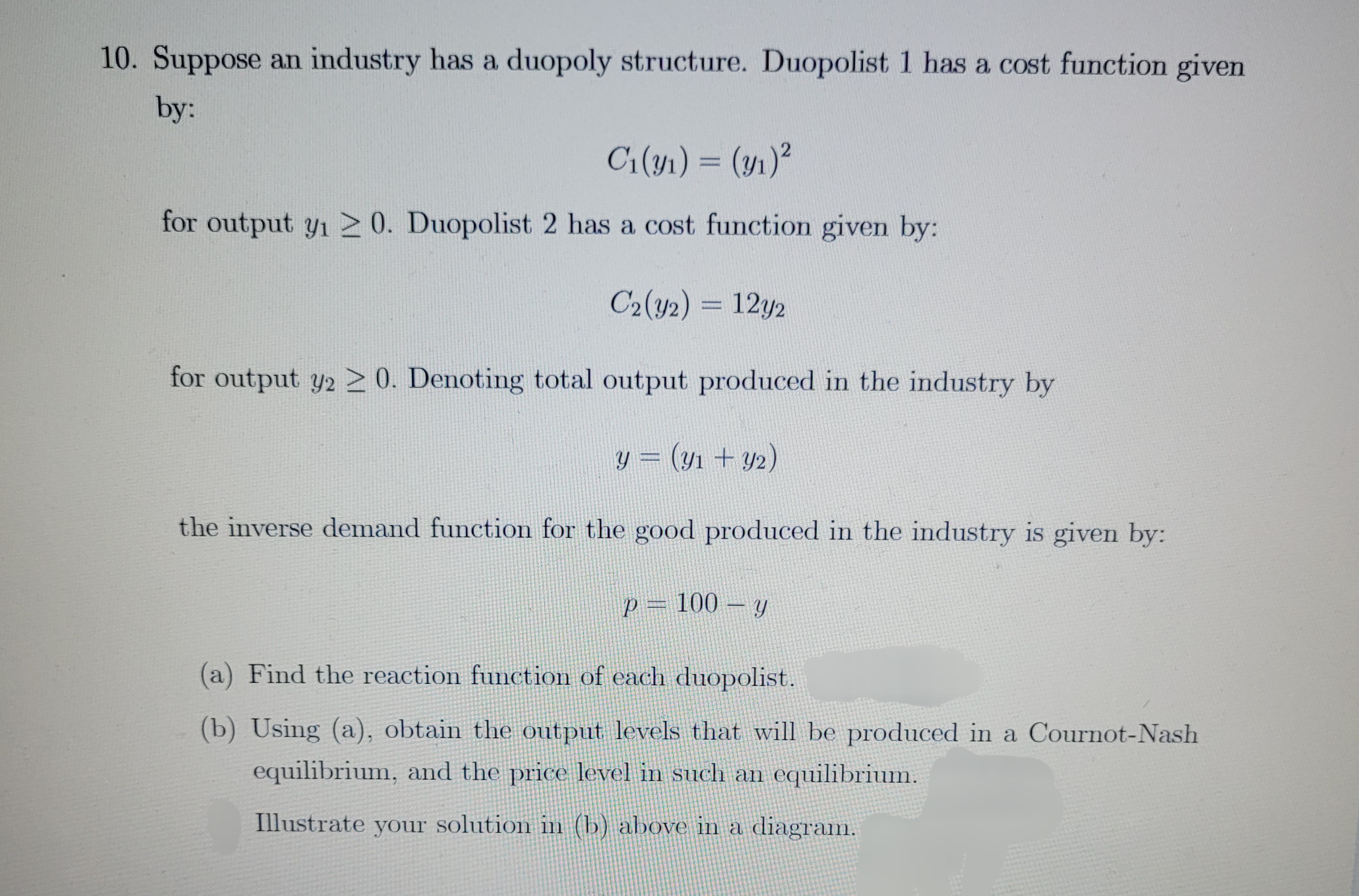

Transcribed Image Text:10. Suppose an industry has a duopoly structure. Duopolist 1 has a cost function given

by:

C₁(y₁) = (y₁)²

for output y₁20. Duopolist 2 has a cost function given by:

C2(y2) = 12y2

for output y2 20. Denoting total output produced in the industry by

y = (y₁ + y₂)

the inverse demand function for the good produced in the industry is given by:

p = 100 - y

(a) Find the reaction function of each duopolist.

(b) Using (a), obtain the output levels that will be produced in a Cournot-Nash

equilibrium, and the price level in such an equilibrium.

Illustrate your solution in (b) above in a diagram.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (b) Consider two firms, 1 and 2 , operating in a monopolistic competitive market. The cost functions of the firms are: TC_(1)=20+20 Q and TC_(2)=80+80Q, respectively. Would it be rational for both firms to compete in the world market, given the market demand curve of Q=100-P, and they have to bear a trade cost of $30 per unit? Explain with the help of a diagram. please give answer with compleete steps and diagram.arrow_forwardsuppose Rosaria is a simple monopolist who sells rose water measured in ounces. her marginal costs are constant and equal to $1, regardless of who she sells to, and she has no fixed costs to consider. the market for rose water has only two consumers, Ying and Kay. Ying's deman is Q^y = 10 - 2P, while Kay's deman is Q^k = 2 - P Rosalina is able to practice third degree price discrimination. Her total profits arearrow_forwardThere are two firms. Firm 1 (or, a small firm) produces a single product, product A, at zero cost. Firm 2 (or, a big firm) is a multi-product firm that sells both products A and B. Firm 2 is less efficient in producing A. It incurs a constant marginal cost c > 0 for producing A. However, firm 2 is a monopolist of the market of product B and its cost of producing productB is zero. A unit mass (i.e. a total measure of 1) of consumers all have the same preference which is known to producers, and view the two products as independent. To consumers, the value of product A is vA > c while the value of product B is vB > 0. If a consumer buys both products, the gross payoff is vA + vB . (Note that, unlike in the lecture slides where consumers are heterogenous and their values are distributed in [0, 1], here the setting is simpler and all consumers are homogenous and have the same vA and vB) Firms compete in prices and set their prices simultaneously and independently. We assume…arrow_forward

- Problem 2.3. Monopoly with increasing marginal cost (15 points) A firm with cost function 2 CQ Q () 0.50 = is a monopoly in a market where the inverse demand function is pQ Q ( ) 120 2 = - . (a) Find the monopolist's marginal revenue and marginal cost. (b) Find the monopolist's profit- maximizing quantity and price Update: C(q)=.5q^2 and P(q)=120-2qarrow_forwardThe demand function in a duopoly market is P(Q) = 300-0.3Q, where P is the price and Q is the total quantity demanded. Both companies have the same constant marginal cost, What is the deadweight loss if both companies maximize their profits and they are not allowed to cooperate? (MR is not MC since its not monopoly)arrow_forwardLagatt Green is a monopoly beer producer and distributor operating in the hypothetical economy of Lightington. Assume that Lagatt Green is not able price discriminate, and so it sells its beer to all customers at the same price per bottle. The following graph gives the marginal cost (MC), marginal revenue (MR), average total cost (ATC), and demand (D) curves that Lagatt Green faces for beer in Lightington. Place the black point (plus symbol) on the graph to indicate the profit-maximizing price and quantity for Lagatt Green. If Lagatt Green is making a profit, use the green rectangle (triangle symbols) to shade in the area representing its profit. On the other hand, if Lagatt Green is suffering a loss, use the purple rectangle (diamond symbols) to shade in the area representing its loss. PRICE (Dollars per bottle) 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 D MC D 15 20 25 30 3.5 QUANTITY (Thousands of bottles of beer) 45 ATC MR Price (Dollars per bottle) 2.00 2.25 40 Monopoly Outcome…arrow_forward

- 4. A monopolist produces exactly the same product at three plants with respective costs C = Q1 + Qỉ C2 = 3Q2 C3 = 3Q3 – Q3 Ci If the price for the product is P; = 40 – Qi Rị = P;Qi i = 1,2,3 → TR = E{ R{ Find the critical value (Qj, Q2, Q3) of the firm's profit ( = TR – TC) and use the Hessian to determine if it is a relative minimum or maximum.arrow_forwardYou are the manager of a monopoly. Your analytics department estimates that a typical consumer's inverse demand function for your firm's product is P = 350-20Q, and your cost function is C(Q) = 70Q. a. Determine the optimal two - part pricing strategy. Per-unit fee: $ Fixed fee: $ b. How much additional profit do you earn using a two-part pricing strategy compared with charging this consumer a per- unit price? $arrow_forwardAssume that one of the hot dog vendors successfully lobbies the city council to obtain the exclusive right to sell hot dogs within the city limits. This firm buys up all the rest of the hot dog vendors in the city and operates as a monopoly. Assume that this change doesn't affect demand and that the new monopoly's marginal cost curve corresponds exactly to the supply curve on the previous graph. Under this assumption, the following graph shows the demand (D), marginal revenue (MR), and marginal cost (MC) curves for the monopoly firm. Place the black point (plus symbol) on the following graph to indicate the profit-maximizing price and quantity of a monopolist. PRICE (Dollars per hot dog) 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 0 45 Monopoly MC MR 90 135 180 225 270 315 QUANTITY (Hot dogs) D 360 405 450 Monopoly Outcome Deadweight Loss ?arrow_forward

- Assume that a local train station has a monopoly over train rides. The firm has estimated that its market demand curve can be drawn from the following equation P = 60 - (1/2) Q. Let MC AC = 15. The firm has determined that younger consumers (under 50) are willing to pay up to $30 per ticket for a train ride and that older consumers (50 or older) are willing to pay up to $50 per ticket for a train ride. If the firm price discriminates what is their profit?arrow_forward3. Suppose a software monopolist faces two markets for its software, students and professionals. The demand curve of professionals is given by Qp = 200-2Pp and the demand curve by students is given by Qs = 150 - 3Ps. The firm's cost function is C(Q) = 400+5Q. (a) If the firm can price discriminate, what price should it charge in each market to maximize profits? How much profit does it earn? (b) If the firm cannot price discriminate, what price should it charge? Verify that it sells to both markets at this price. How much profit does it earn? Hint: If the firm cannot price discriminate, this means it must treat the two markets as a single combined market.arrow_forwardHand written solutions are strictly prohibitedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education