ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

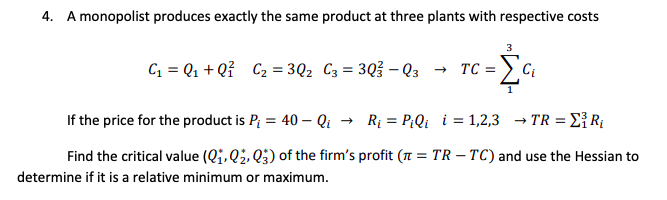

Transcribed Image Text:4. A monopolist produces exactly the same product at three plants with respective costs

C = Q1 + Qỉ C2 = 3Q2 C3 = 3Q3 – Q3

Ci

If the price for the product is P; = 40 – Qi

Rị = P;Qi i = 1,2,3 → TR = E{ R{

Find the critical value (Qj, Q2, Q3) of the firm's profit ( = TR – TC) and use the Hessian to

determine if it is a relative minimum or maximum.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- 1) A monopoly faces a demand curve P(Q) = 120 – 2Q, and has a marginal cost of 60. a. What is profit-maximizing level of output? What is the profit-maximizing price? How much profit the firm will make? b. Assume that a second firm enters the market. The new firm has an identical cost function. If the two firms enter in a Cournot competition, what will be the price in equilibrium? How much will each firm produce in equilibrium? How much profit will each firm make? c. If, instead, the two firms compete in a Stackelberg game (assume the incumbent firm is the leader), what will be the price in equilibrium? How much each firm will produce in equilibrium? How much profit will each firm make? d. Now assume the follower has to pay a fixed cost, f =100 if q>0. Does it change the follower's decision? Assume again they are playing a Stackelberg game.? e. The leader knows that the follower has to pay the fixed cost and decides produce one third more than the quantity found in part c). Does it…arrow_forwardExercise 3.8. Dayna's Doorstops, Inc. (DD) is a monopolist in the doorstop industry. Its cost is C = 100 - 5Q + Q², and demand is P = 55 - 2Q. a) What price should DD set to maximize profit? What output does the firm produce? How much profit and consumer surplus does DD generate? b) What would output be if DD acted like a perfect competitor and set MC = P? What profit and consumer surplus would then be generated? c) What is the deadweight loss from monopoly power in part (a)? d) Suppose the government, concerned about the high price of doorstops, sets a maximum price at $27. How does this affect price, quantity, consumer surplus, and DD's profit? What is the resulting deadweight loss? e) Now suppose the government sets the maximum price at $23. How does this decision affect price, quantity, consumer surplus, DD's profit, and deadweight loss? f) Finally, consider a maximum price of $12. What will this do to quantity, consumer surplus, profit, and deadweight loss?arrow_forwardAssume a firm engaging in selling its product and promotional activities in monopolisti ccompetition face short run demand and cost functions as Q = 20-0.5P and TC= 4Q2-8Q+15, respectively. Having this information a) Determine the optimal level of output and price in the short run. b) Calculate the economic profit (loss) the firm will obtain (incur). c) Show the economic profit (loss) of the firm in a graphic representationarrow_forward

- 3arrow_forwardPlease answer question d, e and farrow_forwardQ. No. 4. A pharmaceutical firm faces the following demand and cost curves. P=100 – 20 and C = 50+ 40Q Suppose the pharmaceutical firm is a single seller and sells its product at the same price both in Nepal and Bangladesh. a) Determine the firm equilibrium price and quantity. b) How much is the monopolist's profits?arrow_forward

- Refer to the accompanying table, which represents the costs and production for a monopolist. Price Quantity Fixed Cost Variable Cost $20 0 $10 $0 $18 1 $10 $5 $16 2 $10 $8 $14 3 $10 $18 $12 4 $10 $30 $10 5 $10 $44 1) At Q=2, the marginal cost of this firm is $ ____ 2)The profit made by this profit-maximizing firm is $ __arrow_forwardQUESTION 3 A monopolist has a cost function of c(x) = x so that its marginal cost is constant at $1 per unit. It faces the following demand curve: D(p) = {100/p 100/p if p > 20 if p ≤ 20 A. What is the profit-maximizing choice of output/price for the monopolist? Graphically represent the monopoly market. B. If the government sets a price ceiling on the monopolist in order to force it to act as a competitor, what price should the government set? C. What output would the monopolist produce if forced to behave as a competitor? D. Based on the information in parts A - C, find the consumer-, producer-, and social surpluses before and after the government intervention.arrow_forwardSuppose that a unique technology is developed that allowed for the production of lightsabers. The inspired entrepreneur (let's say, Lucas George) who developed the technology immediately slaps a patent on the design and hoards kyber crystals (necessary input). Demand and production costs are given below: P(Q) = 14,000 - 600Q C(Q) = 3,000 + 100² 1. How much profit does Lucas the monopolist earn? 2. Solve for the market failure of Lucas operating as a monopolist relative to what would be observed if Lucas operated as a competitive firm. Martin the Martian (not to be confused with any other martian that might be copyrighted...) observes the profits being made by Lucas. Determining that ray guns are not that different from lightsabers, Martin begins competing with Lucas: P'(Q) = 12,000 - 600Q' 3. A third potential business owner, Dr. When, has watched this market carefully and is trying to decide whether or not to market her Sonic Screwdriver (a near-substitute). Based on your previous…arrow_forward

- Price 180 168 156 144 132 120 108 96 84 72 60 48 36 24 12 0 1 0 45 90 135 180 225 270 315 360 405 450 495 540 585 630 Quantity MR <<--MC=AC A monopoly face the following demand, marginal revenue and marginal cost functions Note that in this case MC(Q) = AC(Q) for all Q. Calculate consumer surplus if the monopoly charges the (single) profit maximizing price 675arrow_forward5. Tom is a monopolist input supplier to Dick and Harry. Tom's marginal cost is 1. Dick and Harry are duopolists with production function q x/2 No firm has fixed costs. The demand for the final product is given by Q 100-p. a) Assume Dick and Harry buy the input from Tom at price k. What are their cost functions? b) Find the Cournot equilibrium quantities. c) What price, k, should Tom set? d) Now suppose Dick could buy Tom's firm and stop supplies of the input to Harry so that Dick would be a monopolist. How much is Dick willing to pay for Tom's firm? e) How much is Tom willing to sell his firm for?arrow_forwarda) Find and highlight the consumer surplus in the monopoly in the diagram.b) Draw a possible marginal cost curve for the monopolist into the diagram that is consistentwith all the other curves that are already given. c) Based on the marginal cost curve that you constructed in part (b), find and highlight themonopolist’s total costs at the monopoly price in the diagram. d) Briefly (200 words max) explain the shape of the marginal revenue curve as compared tothe demand curve in the diagram.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education