ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

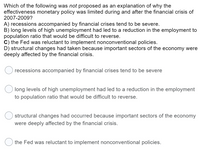

Transcribed Image Text:Which of the following was not proposed as an explanation of why the

effectiveness monetary policy was limited during and after the financial crisis of

2007-2009?

A) recessions accompanied by financial crises tend to be severe.

B) long levels of high unemployment had led to a reduction in the employment to

population ratio that would be difficult to reverse.

C) the Fed was reluctant to implement nonconventional policies.

D) structural changes had taken because important sectors of the economy were

deeply affected by the financial crisis.

recessions accompanied by financial crises tend to be severe

long levels of high unemployment had led to a reduction in the employment

to population ratio that would be difficult to reverse.

structural changes had occurred because important sectors of the economy

were deeply affected by the financial crisis.

the Fed was reluctant to implement nonconventional policies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Discuss the impact of expansionary and contractionary monetary policy, specifically the change in interest rate and credit availability, and the process by which these changes impact businesses' decision making process.arrow_forwardRespond to the following in a minimum of 175 words: Explain the chain of events that occurs for expansionary and contractionary monetary policy to affect the long-run equilibrium level of real gross domestic product (GDP). Compare and contrast expansionary and contractionary fiscal policy.arrow_forwardWhat explanations have Post-Keynesians forwarded for the comparative failure of Central Banks policy response during the global financial crisis?arrow_forward

- "Assess the role of central banks in managing economic recessions. Discuss how monetary policy tools such as interest rate adjustments, quantitative easing, and open market operations are used to stimulate economic activity and stabilize financial markets. Additionally, analyze the limitations and potential risks of these monetary policy measures in the context of zero-lower-bound interest rates and high public debt."arrow_forwardSuppose that the central bank finds that the economy is operating as depicted in the accompanying macroeconomy graph and they wish to conduct expansionary monetary policy. Adjust the graph for the market for loanable funds and the macroeconomy to depict how successful expansionary monetary policy will impact both.arrow_forwardAccording to the rational expectations model, how would an announcement of expansionary monetary policy affect aggregate output? a) It would decrease aggregate output. b) It would increase aggregate output in both the short run and the long run. c) It would increase aggregate output in the short run. d) It would have no effect on aggregate output.arrow_forward

- Q2: Using the three-equation model of an inflation targeting central bank and a banking system, explain what factors determine the mark-up of the lending rate over the policy rate. Does the introduction of banks into the model change the way in which monetary policy is conducted in the 3-equation model? Use diagrams to illustrate how the central bank responds to an aggregate demand shock.arrow_forwardConsider a hypothetical economy where: • C(Ya) = 12 + 0.75 × (Y – T) • I(r) = 124 – 1 x r • G = 120 • t = 20% 3. Assume that inflation is zero, so that i = r. This economy's central bank follows a given Monetary Policy Rule:r =i= 0.025 ×Y+0.0003 × P , where P is the price level. Given this and the expression for the IS Curve, write down an expression for the Aggregate Demand Curve. (Hint: Remember that the AD Curve takes the form P =....)arrow_forwardSuppose the economy has just entered a downturn due to a decrease in investment spending. While of the following actions could a central bank take to successfully counteract the downturn? a) Increase capital investment spending on the part of government agencies. b) Issue treasury bills in order to lower the interest rate. c) Buy back treasury bills in order to lower the interest rate. d) Buy back treasury bills in order to raise the interest rate. e) Lower the tax rate on real estate and capital gains assetsarrow_forward

- The equilibrium output level in the country of Plutonia is $44 billion, while its potential output is $74 billion. Suppose the central bank of the country implements an expansionary monetary policy. Which of the following is likely to occur? a) An increase in interest rates will stimulate investment, shifting the aggregate demand curve to the right. b) A reduciton in interest rates will lower investment, shifting the aggregate demand curve to the left. c) An increase in interest rates will lower investment, shifting the aggregate demand curve to the left. d) An reduction in interest rates will stimulate investment, shifting the aggregate demand curve to the right.arrow_forwardThe monetary policy rate is the rate at which the Central Bank of Ghana lends to commercial banks. The results from table 4.4.1 shows that the monetary rate in Ghana declined from 2019 to 2021, before rising in 2022. The decline in the monetary rate from 2019 to 2021 can be attributed to an expansionary monetary policy, which was implemented to boost the economy of Ghana by reducing unemployment. The rise in the monetary rate in 2022 is a sign of a contractionary monetary policy, which is intended to reduce money supply and increase the cost of borrowing. This can help control inflation but may also lead to lower economic growth due to reduced aggregate demand (consumption). Consumption which is a component of GDP, the decrease in Aggregate demand will lead to decrease GDP and economic growth at large. Digitalization has become the norm in all parts of life, including finance. Mobile money has acquired substantial acceptance in Ghana as a simple mechanism for fund transfers, payments,…arrow_forwardHigher unemployment rates for those 25 years old and younger in many European nations, in comparison to the United States, is best explained by the differing monetary policies between the European Central Bank and the Federal Reserve. True Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education