ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

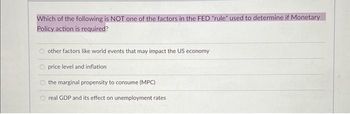

Transcribed Image Text:Which of the following is NOT one of the factors in the FED "rule" used to determine if Monetary

Policy action is required?

other factors like world events that may impact the US economy

price level and inflation

the marginal propensity to consume (MPC)

real GDP and its effect on unemployment rates

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please correct answer and don't use hand ratingarrow_forwardAre you concerned about the inflation come back due to such easy monetary policy with zero interest rate for long time? if so, how fast is the Fed supposed to tighten its monetary policy as an normalizing strategy?arrow_forwardSuppose the Bank of Canada orders a contractionary monetary policy. Explain briefly what will happen to the following variables relative to what would have happened without the policy: a. The money supply b. Interest rates c. Investment d. Consumption e. Net Exports f. The aggregate demand curve g. Real GDP h. The price levelarrow_forward

- If the money demand function is unstable and undergoes substantial, unpredictable changes, then the level of interest rates set by the central banks will provide more information about the stance of monetary policy than will the money supply. Is this statement true, false, or uncertain? Explain your answerarrow_forwardShift the curve on the graph to show the general impact of the central bank's new interest rate target on aggregate demand. PRICE LEVEL OUTPUT Aggregate Demand Aggregate Demand ?arrow_forwardSuppose the Federal Reserve (the US central bank) increases the money stock. Create a graph that explains the effect of the Fed's expansionary monetary policy in the Short Run.arrow_forward

- suppose the economy suffers an adverse supply shock. if the federal reserve responds by increasing the money supply, the short run results will bearrow_forwardWith a policy of nominal GDP targeting, if the Fed expected 6% growth in real GDP and wanted an inflation rate of 2%, it would set a target for nominal GDP growth of 8% per year. True Falsearrow_forwardIn response to the Great Recession, the Federal Reserve had to take drastic and largely untested measures to stabilize both the financial system and macroeconomy. These measures caused the monetary base to increase from approximately $850 billion to over $4 trillion. Indicate whether each school of macroeconomic thought—classical, Keynesian, monetarist, real business cycle, and secular stagnationist—would support the Fed’s actions.arrow_forward

- Given an inflationary gap, the Federal Reserve will use monetary policy to _________ real GDP and the interest rate. A) increase; increase B) increase; decrease C) decrease; increase D) decrease; decreasearrow_forwardAssume the economy is suffering from massive inflation and you are the Chairperson of the FED. What type of monetary policy would you employ and describe what changes are made to the “three tools” of monetary policy. Describe the subsequent impact on the money supply, interest rates, aggregate spending, and real GDP.arrow_forwardDraw a correctly labeled graph of the country’s reserve market, and show how the central bank’s action to move the economy toward its long-run equilibrium affects the policy rate in the short runarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education