FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Good afternoon

5 mayo 1:06 pm

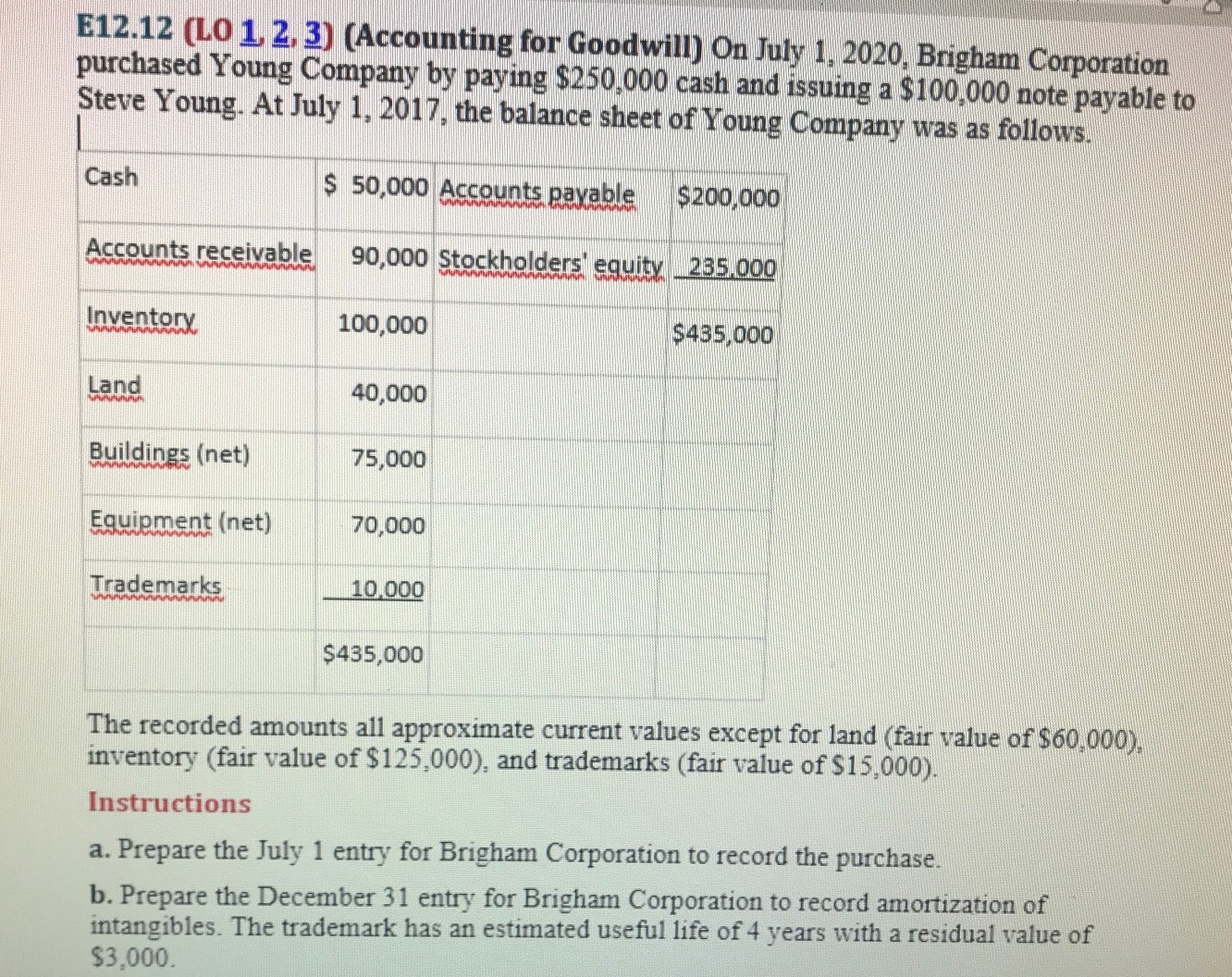

Transcribed Image Text:E12.12 (LO 1, 2,3) (Accounting for Goodwill) On July 1, 2020, Brigham Corporation

purchased Young Company by paying $250,000 cash and issuing a $100,000 note payable to

Steve Young. At July 1, 2017, the balance sheet of Young Company was as follows.

Cash

$ 50,000 Accounts payable

$200,000

Accounts receivable

90,000 Stockholders' equity 235.000

Inventory

100,000

$435,000

Land

40,000

unutun

Buildings (net)

75,000

Equipment (net)

70,000

Trademarks

10,000

$435,000

The recorded amounts all approximate current values except for land (fair value of $60,000),

inventory (fair value of $125,000), and trademarks (fair value of $15,000).

Instructions

a. Prepare the July 1 entry for Brigham Corporation to record the purchase.

b. Prepare the December 31 entry for Brigham Corporation to record amortization of

intangibles. The trademark has an estimated useful life of 4 years with a residual value of

$3,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- mid term q1 (1).jpg 8°C Partly sunny 2021 QS 10-2 Current portion of long-term debt LO1 On January 1, 2020, La Petite Macaron, a local French bakery, borrowed $84,000 from the bank. Interest is calculated at the rate of 4% and the term of the note is four years. Four equal annual payments will be made in the amount of $23,141 each December 31. The payment schedule is shown below: 2022 Year Annual Payment Principal Portion of Payment Interest Portion of Payment Principal Balance at Year-End 2020 $19,781 $3,360 $64,219 20,572 2,569 43,647 21,395 22,252 22,252 2023 $23,141 23,141 23,141 23,141 e Show how La Petite Macaron will show the note on its year-end balance sheet: 1. December 31, 2020 2. December 31, 2021 H Q Search : 444 hp 1,746 889 6 -0- Q 100% ENG IN 23:48 05-11-2023 0 pa dnarrow_forward9arrow_forwardchapter ten q1arrow_forward

- Module 09 Homework: Problem 7 (1 point) Loans Richard S Flores Vertical Adventures has an open line of credit with a zero balance at its credit union using a fixed interest rate of 7.15%. On the last day of every month, the accrued interest must be paid. On July 8 and August 14, the company made advances of $11,000.00 and $14,000.00, respectively. On July 30, it made a payment of $7,000.00. Vertical Adventures will restore its zero balance on August 31. Construct a full repayment schedule from July 8 to August 31. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63".) (Give all "Number of Days" quantities as fractions with denominator 365.) Date Balance Annual before Interest Transaction Rate Number Interest Accrued of Days Charged Interest Payment (+) or Advance Principal Amount (-) Jul 8 Jul 30 7.15% Jul 31 7.15% Aug 14 7.15% Aug 31 7.15% Note: You can earn partial credit on this…arrow_forwardQS 11-8 (Algo) Recording employee payroll taxes LO P2 On January 15, the end of the first pay period of the year, North Company's employees earned $28,000 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $2,100 of federal income taxes, $459 of medical insurance deductions, and $230 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. No 1 Date January 15 X Answer is complete but not entirely correct. General Journal Salaries expense FICA-Social security taxes payable FICA-Medicare taxes payable Employee medical insurance payable Employee union dues payable Salaries payable Federal unemployment taxes payable × Debit 28,000 Credit 1,736 406 678 X 190 X 21,190 X 3,800 Xarrow_forwardndow Help mework.pdf Aa v Question 5 You have been recently hired as general manager of Lucky's. It is September 1, and you must prepare the operating budget of this establishment for the first quarter of the upcoming calendar year, and submit it to the corporate office. Since you have been at the operation for only a month or so, you must rely solely on historical data. You gather sales reports and records for the months of January through August of the current year. Using the data provided, prepare the operating budget for Lucky's for the months of January through March of the upcoming year. Here is the information you determined from the most recent sales and costs records: Sales are 10 percent higher than those of the same month during the previous year. Food cost percentage is steady at 32 percent. Fixed labor costs are steady at $9,000 per month. Variable labor costs are 15 percent of sales. Occupancy costs will remain steady at $2,000 per month. Other controllable costs are…arrow_forward

- 6:48 PM Thu May 18 K 7 APPLICATION: 14.04b Homework Catrina's Budget Catrina recently graduated from college with a degree in political science. She started a job that pays her $48,000 per year. Her monthly net income is $2,800. She's moving into her own one-bedroom apartment. She has a car that she makes payments on and she pays for car insurance. She also adopted a cat, so she now has to pay for cat food and vet bills. Catrina has budgeted for the following monthly expenses based on what she expects to spend: Expense Type Rent Dashboard Assignment Details 19262 Economics & Personal Finance 2223-FYb-Sem2 Food Clothing College Loan Entertainment/restaurants Car and insurance payment Utilities Cell Phone Savings Renters' insurance Pet care Cable/Internet Using the information about Catrina's proposed monthly budget above, answer the following questions. 000 1. Is Catrina budget balanced? If not, what can Catrina do to balance her budget? 2. Is Catrina following the 50, 30 and 20…arrow_forwardExercise Al-9 Payment of payroll deductions LO3 yeltell me the journaurnal entry Paradise Hills Berry Farm has 26 employees who are paid blweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. \table[[Gross Pay, El Preniun, Income Taxes, CPP, Medical Ins, United Kay, ], [83,950.69, 1, 393.57, 11, 579.00, 3,90t2.28, 1, 600.00, 1, 769.00arrow_forwardQuestion 11 A nine months 15% note for $9,000 dated April 15 is reciebed from a customer. The maturity value of the note is ____arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education