FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

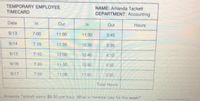

Transcribed Image Text:TEMPORARY EMPLOYEE

TIMECARD

NAME: Amanda Tackett

DEPARTMENT: Accounting

Date

In

Out

In

Out

Hours

9/13

7:00

11:00

11:30

3:45

9/14

7:15

11:35

12:30

3:35

9/15

7:10

12:00

12:40:

4:10

9/16

7:20

11:50

12.50

4:50

9/17

7.05

11.09

11:50

3:30

Total Hours

. Amanda Tackett earns $8.50 per hour What is her-total pay for the week?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Job Number 10 11 12 13 14 (a) April May $4,860 $4,220 3,680 April 30 3,840 May 31 1,100 Your answer is incorrect. June 30 4,390 5,560 Job 12 was completed in April. Job 10 was completed in May. Jobs 11 and 13 were completed in June. Each job was sold for 25% above its cost in the month following completion. $ June $ $1,880 $ 4,230 3,370 What is the balance in Work in Process Inventory at the end of each month? Work in Process Inventory Month Completed May June April June Not completearrow_forwardCh. 8 Homework Question 6 Please answer and solve the following Each visor requires a total of $4.00 in direct materials that includes an adjustable closure that the company purchases from a supplier at a cost of $1.50 each. Shadee wants to have 30 closures on hand on May 1, 20 closures on May 31 and 25 closures on June 30 and variable manufacturing overhead is $1.25 per unit produced. Suppose that each visor takes 0.30 direct labor hours to produce and Shadee pays its workers $9 per hour. Required: 1. Determine Shadee’s budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $2.) (Round your answer to 2 decimal places.) 2. Determine Shadee's budgeted cost of goods sold for May and June.arrow_forwardExercise 17-16 Using ABC In a service company LO P3 Cardiff and Delp is an architectural firm that provides services for residentlal construction projects. The following data pertaln to a recent reporting perlod. Activities Costs Design department Client consultation 2,100 contact hours 1,888 design hours 53, e00 square feet $428, e08 102,600 Drawings Modeling Project management department Supervision Billings Collections 31,800 1,000 days 8 jobs 8 jobs $220,000 8,100 14,380 Required: 1. & 2 Using ABC, compute the firm's activity overhead rates. Form activity cost pools where appropriate. Assign costs to a 8.000- square-foot Job that requires 450 contact hours, 356 design hours, and 125 days to complete. (Round activity rate answers to 2 decimal places.) Activity Rate Activity Driver Incurred Overhead Assigned Activity Expected Costs Expected Activity Driver Client consultation Drawings Modeling Supervision Billings/Collection Total overhead costarrow_forward

- BusinessE b My Questi Reference Chapt X enccinstructure.com/courses/3788/assignments/35967?module ite 0 In the month of June, a department had 19000 units in beginning work in process that were 65% complete. During June, 89000 units were started into production. At the end of June there were 9000 units in ending work in process that were 35% complete. Materials are added at the beginning of the process, while conversion costs are incurred uniformly throughout the process. How many units were transferred out of the department in June? O 89000 units. O 99000 units. O 108000 units. O 80000 units.arrow_forwardQuestion 4 -/1 View Policies Current Attempt in Progress t Cherryville Company charges $61 per hour for labor and has a 42% material loading charge. A recent job required 20 hours and $2,000 of materials. Calculate the total cost of the job. O $4,572.40 O $3,220 O $4,060 O $2,840 4) 11 hp ins prt sc n0 12 delete home encarrow_forwardExercise 15-25 (Algo) Closing over- or underapplied overhead LO P4 Star Promotions Valle Builders Indirect materials $ 12,300 $ 7,000 Indirect labor 56,200 46,100 Other overhead 17,200 49,900 Overhead applied 93,000 98,800 Star Promotions1-a. Determine whether overhead is overapplied or underapplied.1-b. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold.Valle Builders2-a. Determine whether overhead is overapplied or underapplied.2-b. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold.arrow_forward

- Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 3-Year 5-Year 7-Year 10-Year 1 33.33% 20.00% 14.29% 10.00% 2 44.45% 32.00% 24.49% 18.00% 3 14.81% 19.20% 17.49% 14.40% 4 7.41% 11.52% 12.49% 11.52% 5 11.52% 8.93% 9.22% 10 11 678 06 5.76% 8.93% 7.37% 8.93% 6.55% 4.45% 6.55% 6.55% 6.55% 3.28% - Xarrow_forward2021 7:57 PM Submitted At: Mar 31, 2021 9:27 PM 2021 9:27 PM Submitted By: CengageNOWv2 when time ran out During the period, labor costs incurred on account amounted to $175,000, including $150,000 for production orders and $25,000 for general factory use. Factory overhead applied to production was $23,000. The entry to record the factory overhead applied to production is a. Work in Process 25,000 Factory Overhead 25,000 Ob. Factory Overhead Accounts Payable 25,000 25,000 C. Work in Process Factory Overhead Od. Factory Overhead Work in Process 23,000 23,000 23,000 23,000arrow_forwardOtototorrorotoarrow_forward

- units conversion percentage complete beginning work in process inventory 10,000 20% units started 21,000 units completed and transferred out 26,000 Ending work in processs inventory 5,000 80% The conversion cost of the beginning inventory was $6,500. During the month, $112,000 in additional conversion cost was incurred. Required: a) Assume that the company uses the FIFO method. Compute the following: 1. The equivalent units of production for conversion for the month. 2. The cost per equivalent unit for conversion for the month. 3. The total cost transferred out during the month. 4. The cost assigned to the ending work-in-process inventory. b) Assume that the company uses the weighted-average cost method. Compute the following: 1. The equivalent units of production for conversion for the month. 2.…arrow_forwardCas 3 11 oint uest estio Question list Res % Question 1 (0/ O Question 3 (0/3) erial A Copyrig O Question 2 Question 4 Question 5 Question 6 Question 7 K D Lily Music manufactures harmonicas. Lily uses standard costs to judge performance. Recently, a clerk mistakenly threw away some of the records, and only partial data for November exist. Lily knows that the total direct labor variance for the month was $340 F and that the standard labor rate was $8 per hour. A recent pay cut caused a favorable labor rate variance of $0.60 per hour. The standard direct labor hours for actual November outputs were 5,500. Read the requirements. Requirement 1. Find the actual number of direct labor hours worked during November. First, find the actual direct labor price rate per hour. Then, determine the actual number of direct labor hours worked by setting up the computation of the total direct labor variance as given. Select the formula, then calculate the actual price per hour. Actual direct labor rate…arrow_forwardEC 4 Q3 Foster Enterprises makes custom-order draperies. In late 2013, when managers prepared the budget for 2014, they estimated that manufacturing overhead would total $113,750. Because the production process is labor intensive, overhead is allocated to jobs based on direct labor hours. Managers expected total direct labor hours to amount to 455,000 hours. During March and April of 2014, employees worked on only three jobs. Relevant information for each job follows: Monthly Data Recorded Job 76 Job 77 Job 78 March Direct materials cost $13,169 _ _ Direct labor cost $36,160 _ _ Direct labor hours 3,815 _ _ April Direct materials cost $0 $10,883 $6,370 Direct labor cost $9,947 $22,929 $2,846 Direct labor hours 1,083 2,594 405 Job 76 was started in March, finished in April, and delivered to the customer in the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education