FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:E

?

S

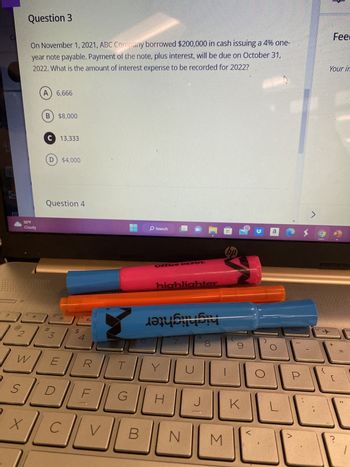

Question 3

W

50°F

Cloudy

X

On November 1, 2021, ABC Company borrowed $200,000 in cash issuing a 4% one-

year note payable. Payment of the note, plus interest, will be due on October 31,

2022. What is the amount of interest expense to be recorded for 2022?

A) 6,666

B) $8,000

C 13,333

D) $4,000

Question 4

#

3

*

E

$

4

R

LL

CV

T

G

Search

Office DEPOT.

highlighter

berisi

Y

H

N

J

00

M

hp

9

K

a

L

AAI

a

$

12

}

+

Fee

Your in

?

=

((

ins

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question Content Area On June 8, Williams Company issued an $82,076, 6%, 120-day note payable to Brown Industries. Assuming a 360-day year, what is the maturity value of the note? When required, round your answer to the nearest dollar. a. $4,925 b. $87,001 c. $83,718 d. $82,076arrow_forward2arrow_forwardL. How much interest income should be reported on December 31, 2020 with regards to the note from Company B? 2-2 Notes Receivables The trial balance for BLUE Corporation prepared at December 31, 2020 showed a balance of P4,000,000 for Notes Receivables broken as follows: Notes receivable from Company A Notes receivable from Company B 3,000,000 1,000,000 Total 4,000,000 Additional information: The notes receivable from Company A is a three-year non- interest bearing note, with face value of P3,000,000. The note was received in exchange for a piece of land sold by BLUE on May 1, 2020. The land was carried in the books at the date of sale at P2,600,000. The difference between the face amount of the note and the carrying value of the land was credited to gain on sale of land. The market interest rate for a note of this type is 10%. The notes receivable from Company B bears interest at 10%. The note was received from sale of goods in the normal course of business. The note is dated October…arrow_forward

- Universal Travel Incorporated borrowed $518,000 on November 1, 2024, and signed a twelve-month note bearing interest at 6% Prinopal and interest are payabl amount of interest payable that should be reported by Universal Travel Incorporated on December 31, 20257 Mutiple Choice 50 $31000 $5.00 $040arrow_forward(The following information applies to the questions displayed below.] On January 1, 2021, Eagle Company borrows $21,000 cash by signing a four-year, 5% installment note. The note requires four equal payments of $5,922, consisting of accrued interest and principal on December 31 of each year from 2021 through 2024. rt 2 of 2 Exercise 10-13 (Algo) Installment note entries LO C1 28 Prepare the journal entries for Eagle to record the note's issuance and each of the four payments. (Round your intermediate lnts calculations and final answers to the nearest dollar amount.) 8 ot56:49 View transaction list eBook Journal entry worksheet 2 4 Eagle borrows $21,000 cash by signing a four-year, 5% installment note. Record the issuance of the note on January 1, 2021. Note: Enter debits before credits. Mc Graw Hill Type here to search 69°F Cloudy 40 4. 6. T PI D. MIarrow_forwardA B E 2 Determine the maturity date and compute interest for each note. 3 Days to be used per year 360 days 4 Note Contract Date Principal Interest Rate Period of Note (Term) 6. 1 1-Mar $10,000 6% 60 days 7 2 15-May 15,000 8% 90 days 8 3 20-Oct 8,000 4% 45 days 9. 10 Required: 11 12 (Use cells A5 to F8 from the given information to complete this question.) 13 14 Note Contract Date Maturity Date Interest Expense 15 16 17 3 18arrow_forward

- Required information Exercise 7-5 (Algo) Notes payable—discount basis LO 2 Skip to question [The following information applies to the questions displayed below.] On April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $255,400. The interest rate charged by the bank was 5.00%. The bank made the loan on a discount basis. Exercise 7-5 (Algo) Part a Required:a-1. Calculate the loan proceeds made available to Powell.arrow_forwardNEED HELP WITH II. III. IV.arrow_forward3. on June 50, Di María's Company sold a car to De Paul's Company on June 30,2022. De Paul's Company signs 1 a $800,000, 4%, 9-month note. What entry will Di María's Company make on March 30,2023? A Cash 824,000 B Cash Notes Receivable Interest Revenue • C Cash D Cash Notes Receivable Notes Receivable Notes Receivable Interest Receivable Interest Revenue 824,000 800,000 24,000 824,000 800,000 800,000 824,000 800,000 16,000 8,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education