FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

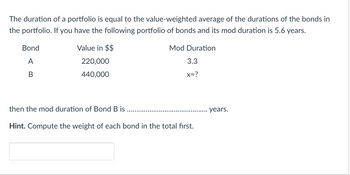

Transcribed Image Text:The duration of a portfolio is equal to the value-weighted average of the durations of the bonds in the portfolio. If you have the following portfolio of bonds and its mod duration is 5.6 years:

| Bond | Value in $$ | Mod Duration |

|------|-------------|--------------|

| A | 220,000 | 3.3 |

| B | 440,000 | x=? |

then the mod duration of Bond B is ..................................... years.

**Hint:** Compute the weight of each bond in the total first.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A 12-cylinder heavy-duty diesel engine will have a guaranteed residual value of $1,000 in five years. Today (year 0) the equivalent worth of this engine is how much if the interest rate is 9% per year? Click the icon to view the interest and annuity table for discrete compounding when i = 9% per year. Today (year 0) the equivalent worth of this engine is $ (Round to the nearest cent.)arrow_forwardCarmel Corporation is considering the purchase of a machine costing $54,000 with a 7-year useful life and no salvage value. Carmel uses straight- line depreciation and assumes that the annual cash inflow from the machine will be received uniformly throughout each year. In calculating the accounting rate of return, what is Carmel's average investment? Multiple Choice O O C $54,000. $30,857 $8,816. $27,000.arrow_forwardam. 176.arrow_forward

- Question 12 of 28 Use these present value factors to answer the following question: Present Value of $1 Discounted at 6% per Periods Period 0.943 2 0.890 3 0.840 0.792 4 5 0.747 If an individual deposits $20600 in a savings account today, what amount of cash would be available two years from toda O $20600÷0.943 × 2 $20600 x 0.890 $20600 0.890 $20600 x 0.890 × 2arrow_forwardDon't give answer in imagearrow_forwardements What is the total Wealth Accumulation of the following investment assuming the available after tax reinvestment rate is 5%? IRR 10.70% O $4,690,000 O $4,821,078 O $4,848,844 $4,905.989 n 0 $ 1 S 2 $ 3 $ AS 5 $ Investment $ (3,000,000) 240,000 250,000 260,000 266,000 3,674,000arrow_forward

- The answers to the question is either A. $0 B. $30,000 C. $42,000 or D. $60,000arrow_forwardQuestion 3: The annual contribution limit to a 401(k) plan is Answer: А. O $6,000 В. O $7.000 С. O $13,500 D. O $19,500arrow_forward1. 2. 3. 4. 5. Present Value ? $36,289 15,884 46,651 15,376 Future Value $ 40,000 65,000 40,000 100,000 ? i 10% 5 ? 10 8 ? n 7 ? 8 20arrow_forward

- On November 1, Jasper Company loaned another company $230,000 at a 12.0% interest rate. The note receivable plus interest will not be collected until March 1 of the following year. The company's annual accounting period ends on December 31. The amount of interest revenue that should be reported in the first year is: Multiple Choice $4,600. $6,675. $0. here to search 8:01 PM 100% 2/21/2022arrow_forwardQ6.1arrow_forwardIf discretionary expenses are $500, cash flow before discretionary expenses are $2,000, and discretionary capital expenditures are $500, what is the discretionary payout percentage? A. 50% B. 25% C. 20% D. 250%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education