FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

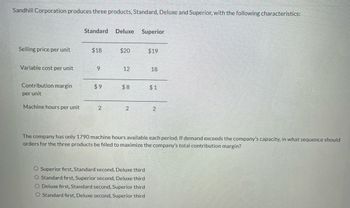

Transcribed Image Text:Sandhill Corporation produces three products, Standard, Deluxe and Superior, with the following characteristics:

Selling price per unit

Variable cost per unit

Contribution margin

per unit

Machine hours per unit

Standard Deluxe Superior

$18

9

$9

2

$20

12

$8

2

$19

O Superior first, Standard second, Deluxe third

O Standard first, Superior second, Deluxe third

O Deluxe first, Standard second, Superior third

O Standard first, Deluxe second, Superior third

18

$1

2

The company has only 1790 machine hours available each period. If demand exceeds the company's capacity, in what sequence should

orders for the three products be filled to maximize the company's total contribution margin?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Division A has the capacity to produce 120,000 units. The normal selling price of each unit is P80. The variable cost incurred for each unit is P42. Total direct fixed cost for the relevant range is P1,150,000. Division B can use the products of Division A as an input in its manufacturing process but is currently acquiring the said products from an outside supplier. The price per unit is P75. Total annual demand is 30,000 units. Assuming sufficient capacity, what is the minimum acceptable transfer price to Division A? Assuming only 22,500 excess capacity, what is the minimum acceptable transfer price to Division A? Assuming only 22,500 excess capacity and that Division A can avoid variable selling cost per unit of P4 but will incur a one-time fixed cost of P30,000 for the order, what is the minimum acceptable transfer price to Division A? Assuming no excess capacity, what is the minimum acceptable transfer price to Division A? What is the maximum acceptable transfer…arrow_forwardRitchie manufacturing company makes a product that it sells for $170 per unit. The company incurs variable manufacturing costs of $86 per unit variable selling expenses are 416 per unit, annual fixed manufacturing costs are $458,000, and fixed selling and administrative costs are $242,400 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a) use the equation method b) use the contribution margin per unit approach c) prepare a contribution margin income statement for the break-even sales volume.arrow_forwardBelow are details of the four products made by Krane Ltd. A B C D Selling price per unit 60 80 100 120 Variable cost per unit 24 36 48 50 Machine time per unit 3 4 6.5 8 Weekly demand for all products is the same. Unfortunately, time available on the machine used to produce all four products is likely to be reduced in the coming week due to maintenance work required. If output of one of the products needs to be restricted and management want to lose as little profit as possible, which of the product line’s outputs should they restrict? Product A Product B Product C Product Darrow_forward

- oncorde Ltd has been asked to quote a price for an order of 8 units of Product Delta. Making this product will require skilled labour, which is currently in hort supply and is paid £15 an hour. If the order is accepted, all necessary labour will have to be transferred from existing work. As a result, other orders will be lost. It is estimated that for each hour transferred to this contract £45 will be lost (calculated as lost sales revenue £75, less materials £15 and labour 15). The production manager believes that, owing to a learning process, the time taken to make each unit will reduce, from 20 hours to make the first one, by one hour a unit made. (That is 20 hours to make the first one, 19 hours to make the second, 18 hours to make the third one and so on.) What is the total relevant cost of skilled labour for the purposes of the order? The relevant cost for skilled labour will be will be £. ... Time Remaining: 00:43:50 Nextarrow_forwardOlsen Company produces two products. Product A has a contribution margin of $30 and requires 10 machine hours. Product B has a contribution margin of $24 and requires 4 machine hours. Determine the more profitable product assuming the machine hours are the constraint. Unit contribution margin per bottleneck hour:Product A $_____Product B $_____ Product ____ is most profitable.arrow_forwardAny manufacturing company has costs which include fixed costs such as plant overhead, product design, setup, and promotion; and variable costs that depend on the number of items produced. The revenue is the amount of money received from the sale of its product. The company breaks even if the revenue is equal to the cost. A company manufactures dog leashes that sell for $18.13, including shipping and handling. The monthly fixed costs (advertising, rent, etc.) are $22,920 and the variable costs (materials, shipping, etc.) are $9.78 per leash. How many leashes must be produced and sold each month for the company to break even? leashes. Round to the nearest leash.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education