FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

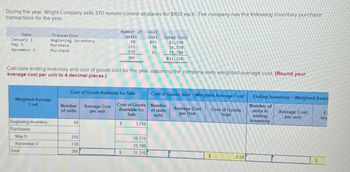

Transcribed Image Text:During the year, Wright Company sells 370 remote-control airplanes for $100 each. The company has the following inventory purchase

transactions for the year.

Number of Unit

Date

January 1

May 5

Transaction

Units

Cost

Total Cost

Beginning inventory

Purchase

50

$75

$3,750

215

78

16,770

November 3

Purchase

130

395

83

10,790

$31,310

Calculate ending inventory and cost of goods sold for the year, assuming the company uses weighted-average cost. (Round your

average cost per unit to 4 decimal places.)

Cost of Goods Available for Sale

Cost of Goods Sold - Weighted Average Cost

Ending Inventory - Weighted Avera

Weighted Average

Cost

Number

Average Cost

Cost of Goods

Available for

of units

per unit

Sale

Number

of units

sold

Average Cost

per Unit

Cost of Goods

Sold

Number of

units in

ending

inventory

Average Cost

per unit

E

Inv

Beginning Inventory

50

$

3,750

Purchases:

May 5

215

16,770

November 3

130

10,790

Total

395

$

31,310

$

0.00

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the year, Wright Company sells 495 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year. Number of Unit Date January 1 May 5 Transaction Units Cost Total Cost Beginning inventory 60 $69 $4,140 Purchase 265 72 19,080 November 3 Purchase 215 77 16,555 540 $39,775 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO. Cost of Goods Available for Sale Cost of Goods Sold LIFO Number Cost per of units unit Beginning Inventory 60 $ 69 $ Cost of Goods Available for Sale 4,140 Number of units Cost per Cost of Goods unit Number Sold of units Ending Inventory Cost per unit Ending Inventory $ 0 Purchases: May 5 265 $ 72 19,080 0 November 3 215 $ 77 16,555 0 Total 540 $ 39,775 $ 0 0 $ 0arrow_forwardGadubhaiarrow_forwardThe following units of an item were available for sale during the year: Beginning inventory 8, 400 units at $160 Sale 4, 800 units at $300 First purchase 15,100 units at $165 Sale 13, 200 units at $ 300 Second purchase 15, 600 units at $174 Sale 13,700 units at $300 The firm uses the perpetual inventory system, and there are 7,400 units of the item on hand at the end of the year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet What is the total cost of the ending inventory according to FIFO? Round your answer to the nearest dollar. $ fill in the blank 2 What is the total cost of the ending inventory according to LIFO? Round your answer to the nearest dollar. $ fill in the blank 3 Feedback Areaarrow_forward

- A company had the following purchases and sales during its first year of operations: Purchases Sales January: 10 units at $120 6 units February: 20 units at $125 5 units May: 15 units at $130 9 units September: 12 units at $135 8 units November: 10 units at $14013 units On December 31, there were 26 units remaining in ending inventory. Using the perpetual LIFO inventory costing method, what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.) $3,405.arrow_forwardPlease read and asnwer question using table provided.arrow_forwardKiwi Ltd. started April with 90 units in inventory costing $16 each. Kiwi Ltd., which uses a perpetual inventory system, had the following inventory transactions in April: Purchases Sales Units Unit Cost Units Selling Price/Unit 4 Purchase 300 18 12 Sale 240 $32 21 Purchase 100 24 29 Sale 165 $35 Instructions Using the FIFO cost formula, calculate the cost of goods sold for the month ended April Show calculations in the table below. Using the average cost formula, calculate the ending inventory at April 30. Show calculations in the table on the next page. Round to two decimals for all calculations. Use the ROUNDED values in your calculations. (a) Perpetual Inventory Record––FIFO PURCHASES COST OF GOODS SOLD INVENTORY ON HAND DA TE…arrow_forward

- Garrison Company uses the retail method of inventory costing. It started the year with an inventory that had a retail sales value of $36,200.During the year, Garrison purchased inventory with a retail sales value of $771,100. After performing a physical inventory, Garrison computed the inventory at retail to be $54,700. The markup is 100% of cost.What is the ending inventory at its estimated cost? A. $27,350 B. $136,750 C.$82,050arrow_forwardA company has beginning inventory for the year of $14,500. During the year, the company purchases inventory for $190,000 and ends the year with $21,000 of inventory. The company will report cost of goods sold equal to: Multiple Choice $211,000. $190,000. $196,500. $183,500.arrow_forwardDuring the year, Wright Company sells 330 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year. DateTransactionNumber of UnitsUnit CostTotal CostJan. 1Beginning inventory 60 $73 $4,380 May. 5Purchase 205 76 15,580 Nov. 3Purchase 110 81 8,910 375 $28,870 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO.arrow_forward

- During the year, Wright Company sells 535 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Date Transaction Number of Units Unit Cost Total Cost January 1 Beginning inventory 40 $65 $2,600 May 5 Purchase 285 68 19,380 November 3 Purchase 235 73 17,155 560 $39,135 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO.arrow_forwardRussell Retail Group begins the year with inventory of $64,000 and ends the year with inventory of $54,000. During the year, the company has four purchases for the following amounts. Purchase on February 17 $219,000 Purchase on May 6 139,000 Purchase on September 8 169,000 Purchase on December 4 419,000 Required: Calculate cost of goods sold for the year. Beginning inventory Cost of goods available for sale Cost of goods soldarrow_forwardDuring the year, TRC Corporation has the following inventory transactions. Date Jan. 1 Beginning inventory Apr. 7 Purchase Jul.16 Purchase Oct. 6 Purchase Weighted Average Cost Total Beginning Inventory Purchases: Apr 07 Jul 16 Oct 06 Transaction Sales revenue Gross profit For the entire year, the company sells 450 units of inventory for $70 each. 3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Average Cost per unit" to 2 decimal places and all other answers to the nearest whole number.) Number of Units 60 140 210 120 530 Cost of Goods Available for Sale # of units 60 140 210 120 530 Average Cost per unit Cost of Goods Available for Sale $ $ Unit Cost 3,120 $ 52 54 57 58 7,560 11,970 6.960 29,610 Total Cost $ 3,120 7,560 11,970 6,960 $29,610 Cost of Goods Sold - Weighted Average Cost of units Sold Average Cost of Cost per Unit Goods Sold Ending Inventory - Weighted Average Cost # of units in Ending Inventory…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education