FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

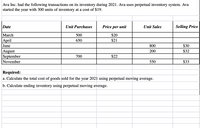

Transcribed Image Text:Ava Inc. had the following transactions on its inventory during 2021. Ava uses perpetual inventory system. Ava

started the year with 300 units of inventory at a cost of $19.

Date

Unit Purchases

Price per unit

Unit Sales

Selling Price

March

500

$20

April

650

$21

June

800

$30

August

September

November

200

$32

700

$22

550

$33

Required:

a. Calculate the total cost of goods sold for the year 2021 using perpetual moving average.

b. Calculate ending inventory using perpetual moving average.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- MN Ltd had 50 units of commodity A on hand on 1 January 2021. The following purchases and sales were made during January: Opening Balance Purchases Sales Jan 1 50 units @ $200 Opening Inventory Plus: Purchase Less: Ending Inventory COGS Jan 3 Jan 12 500 units @ $280 200 units @ $250 Jan 25 150 units @ $210 MN Ltd uses the LIFO assumption. Fill in the table below. Please fill in the blanks by entering numbers only. Do not include space, dollar signs, or commas. Jan 7 $ Jan 27 10000 221500 44900 420 units 186600 300 units The financial year is from 1 Feb 2020 to 31 Jan 2021. The following transactions also happened in the financial year: a. MN Ltd raised a share capital of $1,000,000. b. Paid off the beginning balance of accounts payable. c. Purchased office supplies for $8,400 on credit from OfficeMax. The amount was still outstanding at the end of the financial year. d. Collected cash from a customer on account, $13,700. e. Paid dividends of $130,000. f. All the inventory purchased was…arrow_forwardDuring the year, TRC Corporation has the following inventory transactions. Date Transaction Number of Units Unit Cost Total Cost January 1 Beginning inventory 60 $52 $3,120 April 7 Purchase 140 54 7,560 July 16 Purchase 210 57 11,970 October 6 Purchase 120 58 6,960 530 $29,610 For the entire year, the company sells 450 units of inventory for $70 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold.1-c & d. Using FIFO, calculate sales revenue and gross profit.2-a & b. Using LIFO, calculate ending inventory and cost of goods sold.2-c & d. Using LIFO, calculate sales revenue and gross profit.3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold.3-c & d. Using weighted-average cost, calculate sales revenue and gross profit.4. Determine which method will result in higher profitability when inventory costs are rising.arrow_forwardKingsley Company uses the periodic inventory system to account for its inventories. Here are Kingsley’s inventory records for January and February of 2020: Date Event Quantity Cost per Unit Total Cost January 1 Inventory on hand 15 units $10/unit $150 8 Purchase 20 units $11/unit $220 12 Purchase 40 units $12/unit $480 29 Purchase 50 units $13/unit $650 31 Ending inventory 20 units ? ? February 8 Purchase 15unit $14/unit $210 15 Purchase 40units $15/unit $600 22 Purchase…arrow_forward

- Ivanhoe Company uses a perpetual inventory system. The company began 2024 with 1,100 lamps in inventory at a cost of $10 per unit. During 2024, Ivanhoe had the following purchases and sales of lamps: February 15 April 24 June 6 October 18 December 4 Purchased Sold Purchased Sold Purchased 2,200 units @ $16 per unit 2,750 units @ $28 per unit 3,850 units @ $21 per unit 2,200 units @ $31 per unit 1,540 units @ $24 per unit All purchases and sales are on account.arrow_forwardRequired Information [The following information applies to the questions displayed below.] During the year, TRC Corporation has the following inventory transactions. Total Cost $ 3,120 Date Transaction Number of Units Unit Cost Jan. 1 Beginning inventory Apr. 7 Purchase 60 $ 52 140 54 7,560 Jul.16 Purchase 210 57 11,978 Oct. 6 Purchase 120 58 6,960 530 $29,610 For the entire year, the company sells 450 units of inventory for $70 each. 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. LIFO Beginning Inventory Ending Inventory Ending Cost of Goods Available for Sale Cost of Goods Sold # of units Cost per Cost of Goods # of units unit Available Cost per unit Cost of Goods Sold # of units for Sale 60 $ 52 $ 3,120 60 S 52 S 3.120 60 S 52 $ 3,120 Cost per unit Inventory Purchases: Apr 07 140 S 54 7,560 120 $ 54 6,480 20 $ 54 1,080 Jul 16 210 S 57 11,970 210 $ 57 11.970 Oct 06 120 S 58 Total 530 $ 6,960 29.610 120 $ 58 6,960 450 $ 25,410 80 $…arrow_forwardVaughn Company uses a periodic inventory system. Details for the inventory account for the month of January, 2020 are as follows: Per Units Unit Price Total Balance, 1/1/20 170 $5.00 $850 Purchase, 1/15/20 130 5.10 663 Purchase, 1/28/20 130 5.40 702 12 An end of the month (1/31/20) inventory showed that 240 units were on hand. If the company uses FIFO, what is the value of the ending inventory?arrow_forward

- Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions. Date Activities Units Acquired at Cost Units Sold at Retail January 1 Beginning inventory 700 units @ $50 per unit February 10 Purchase 300 units @ $46 per unit March 13 Purchase 100 units @ $40 per unit March 15 Sales 780 units @ $70 per unit August 21 Purchase 110 units @ $55 per unit September 5 Purchase 570 units @ $52 per unit September 10 Sales 680 units @ $70 per unit Totals 1,780 units 1,460 units Required:1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (For specific identification, units sold consist of 700 units from beginning inventory, 200 from the February…arrow_forwardABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 May 3 May 8 May 13 May 18 May 20 May 24 May 30 Beginning inventory 1,900 units @ $10.20 cost per unit Purchased 2,100 units @ $11.60 cost per unit Sold 1,400 units Purchased 3,700 units @ $8.10 cost per unit Sold 2,600 units Purchase 4,100 units @ $14.70 cost per unit Sold 2,900 units Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the amount of net income shown on ABC Company's income statement for May using the LIFO method.arrow_forwardsarrow_forward

- During 2021, a company sells 280 units of inventory for $89 each. The company has the following inventory purchase transactions for 2021: Number of Units 69 169 189 Unit Cost $64 Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3 Purchase Total Cost $ 4,416 10,985 12,663 $28,064 65 67 427 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses FIFO. Ending inventory %24 147 Cost of goods soldarrow_forwardplease answer within 30 minutes..arrow_forwardQuestion: Langley Inc. inventory records for a particular development program show the following at October 31, 2020: At October 31, ten of these programs are on hand. Langley uses the perpetual inventory system. 1. Journalize for Langley: a. Total October purchases in one summary entry. All purchases were on credit. b. Total October sales and cost of goods sold in two summary entries. The selling price was $500 per unit, and all sales were on credit. Langley uses the FIFO inventory method. (Please show the calculations/where the number is from) Ex: I didn't understand the part of the answer for the entry Cost of Goods Sold & Inventory 1,710. 2. Under FIFO, how much gross profit would Langley earn on these transactions? What is the FIFO cost of Langley’s ending inventory?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education