Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Get correct answer general accounting question

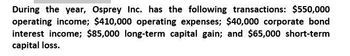

Transcribed Image Text:During the year, Osprey Inc. has the following transactions: $550,000

operating income; $410,000 operating expenses; $40,000 corporate bond

interest income; $85,000 long-term capital gain; and $65,000 short-term

capital loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Westwind Corporation reports the following results for the current year: Gross profit on sales $250,000 Long-term capital gain 25,000 Long-term capital loss 10,000 Short-term capital gain 7,500 Short-term capital loss 12,500 Operating expenses 80,000 What are Westwind's taxable income and regular tax liability before credits for the current year?arrow_forwardRadnor Corporation reports the following results for the current year: Gross profits on sales $135,000 Long-term capital loss $ 15,000 Short-term capital loss $ 4,000 Dividends from 60% owned domestic corporation $20,000 Operating expenses $ 55,000 Charitable contributions $15,000 What are Radnor’s taxable income and income tax liability?arrow_forwardIn its first year of operations corporation Lauzer has the following results for the year: Gross income from operations $700,000 operating deductible expenses (200,000) short term capital gains 5,000 short term capital losses (14,000) long term capital gains 8,000 long term capital losses 3,000 What is the corporation's taxable income for the year?arrow_forward

- Radnor Corporation reports the following results for the current year: Gross profits on sales $135,000 Long-term capital loss $ 15,000 Short-term capital loss $4,000 Dividends from 60% owned domestic corporation $20,000 Operating expenses $ 55,000 Charitable contributions $15,000 What are Radnor's taxable income and income tax liability? What carrybacks and carryovers are available? If any?arrow_forwardSamson Corporation has $200,000 of outstanding long-term debt, $400,000 in total liabilities, and $1,000,000 of total assets of which $75,000 is goodwill. Its long-term debt to tangible assets would bearrow_forwardThe Warner Corporation has gross income of $560,000. It has business expenses of $325,000, a capital loss of $20,000, and $2,500 of interest income on temporary investments.arrow_forward

- In its first year of operations, Martha Enterprises Corp. reported the following information: a. Income before income taxes was $640,000. b. The company acquired capital assets costing $2,400,000; depreciation was $160,000, and CCA was $120,000. c. The company recorded an expense of $155,000 for the one-year warranty on the company's products; cash disbursements amounted to $79,000. d. The company incurred development costs of $77,000 that met the criteria for capitalization for accounting purposes. Development work was still ongoing at year-end. These costs could be immediately deducted for tax purposes. e. The company made a political contribution of $30,000 and expensed this for accounting purposes. f. The income tax rate was 28% and the year 2 tax rate was enacted, at 30%. In the second year, the company reported the following: a. Earnings before income tax were $1,700,000. b. Depreciation was $160,000; CCA was $360,000. c. The estimated warranty costs were $250,000, while the cash…arrow_forwardAt the end of last year, River Side Company achieved $9 million in revenues (EBITDA). Depreciation expense was $2.2 million, with interest paid of $900,000 and a corporate tax rate of 32%. At the end of the fiscal year it had current assets totaling $12 million, $2 million in accounts payable, $1.4 million in accrued liabilities, $1.2 million in other payables, and $7 million in property, plant, and equipment. Assume that River Side has no excess cash, uses debt and equity to finance its operations, has no current liabilities, and recognizes depreciation periodically. Determine the company's net income or loss. Calculate net working capital and operating working capital.arrow_forwardThe Pearson corporation reported an EBITDA of $7.5 million, net income of $1.8 million, $2 million of interest expense. The applicable corporate tax rate was 40%. Calculate the firm’s depreciation and amortization expense.arrow_forward

- (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,522,000 in revenues, $3,362,000 in cost of goods sold, $458,000 in operating expenses which included depreciation expense of $140,000, and a tax liability equal to 34 percent of the firm's taxable income. Sandifer Manufacturing Co. plans to reinvest $52,000 of its earnings back into the firm. What does this plan leave for the payment of a cash dividend to Sandifer's stockholders? Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar.) Revenues = Less: Cost of Goods Sold = Less: Operating Expenses Less: Interest Expense Less: Income Taxes = = $ $ $ $ Equals: Gross Profit = ... Equals: Net Operating Income = 0 Equals: Earnings before Taxes Equals: Net Income = = $ GA GA $arrow_forwardZYX Inc has average gross receipts of $40 million per year over the last several years. In the current year, ZYX has $2,000,000 of taxable income before considering interest.ZYX has $150,000 of business interest income, S1, 200,000 of interest expense, and no floor plan financing. How much interest expense can ZYX deduct?arrow_forwardTrevi Corporation recently reported an EBITDA of $32,800 and $9,500 of net income. The company has $6,700 interest expense, and the corporate tax rate is 35 percent. What was the company’s depreciation and amortization expense? Round to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning