Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

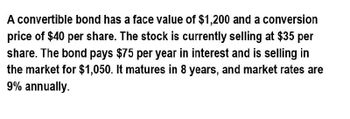

Transcribed Image Text:A convertible bond has a face value of $1,200 and a conversion

price of $40 per share. The stock is currently selling at $35 per

share. The bond pays $75 per year in interest and is selling in

the market for $1,050. It matures in 8 years, and market rates are

9% annually.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Neubert Enterprises recently issued $1,000 par value 15-year bonds with a 5% coupon paid annually and warrants attached. These bonds are currently trading for $1,000. Neubert also has outstanding $1,000 par value 15-year straight debt with a 7% coupon paid annually, also trading for $1,000. What is the implied value of the warrants attached to each bond?arrow_forwardA convertible bond has a face value of $900 and a conversion price of $45 per share. The stock is currently selling at $32 per share. The bond pays $60 per year in interest and is selling in the market for $880. It matures in 6 years, and market rates are 8% annually.arrow_forwardAccountingarrow_forward

- Harrimon Industries bonds have 4 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 9%. What is the YTM at a current market price of $1,104?arrow_forwardPage Enterprise has bonds on the market making annual payments, with 9 years to maturity, and selling for $948. At this price, the bonds yield 5.9 percent. What must the coupon rate be on the bonds?arrow_forwardA bond that matures in 6 years has a par value of $1,000, an annualcoupon payment of $80, and a market interest rate of 9%. What isits price? ($955.14)arrow_forward

- A 15-year bond with a coupon of Sx payable every 6 months has a face (and redemption) value of $10,000. At the nominal annual interest rate of 6.5% convertible semi-annually, the price of the bond is $9,000. Compute X.arrow_forwardKessen Inc.'s bonds mature in 7 years, have a par value of $1,000, and make an annual coupon payment of $70. The market interest rate for the bonds is 8.5%. What is the bond's price?arrow_forwarda coproration bonds have 12 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 8%. The bonds have a yield to maturity of 9%. What is the current market price of these bonds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning