Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

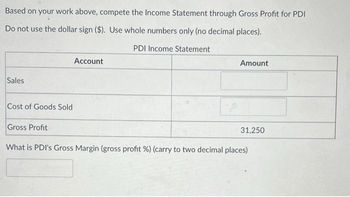

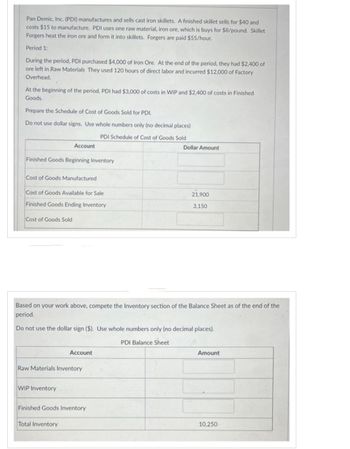

During the period, PDI purchased $4,000 of Iron Ore. At the end of the period, they had $2,400 of ore left in Raw Materials They used 120 hours of direct labor and incurred $12,000 of Factory

At the beginning of the period, PDI had $3,000 of costs in WIP and $2,400 of costs in Finished Goods.

Prepare the Schedule of Cost of Goods Manufactured for PDI.

Do not use dollar signs. Use whole numbers only (no decimal places)

PDI Schedule of Cost of Goods Manufactured?

During the period, PDI purchased $4,000 of Iron Ore. At the end of the period, they had $2,400 of ore left in Raw Materials They used 120 hours of direct labor and incurred $12,000 of Factory

At the beginning of the period, PDI had $3,000 of costs in WIP and $2,400 of costs in Finished Goods.

Prepare the Schedule of Cost of Goods Manufactured for PDI.

Do not use dollar signs. Use whole numbers only (no decimal places)

PDI Schedule of Cost of Goods Manufactured?

- A company manufactures and sells a gold bracelet for $406.00. The company’s accounting system says the unit product cost for this bracelet is $261.00, as shown below: Direct materials $ 147 Direct labor 83 Manufacturing overhead 31 Unit product cost $ 261 A wedding party has approached Imperial Jewelers about buying 18 gold bracelets for the discounted price of $366.00 each. The wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $13. Imperial Jewelers would have to buy a special tool for $460 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order, Imperial Jewelers determined most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $14.00 of the overhead is variable with respect to the number of bracelets produced. The company…arrow_forwardBeta makes a component used in its engine. Monthly production costs for 1,000 component units are as follows: Direct materials $46,000 Direct labor 11,500 Variable overhead costs 34,500 Fixed overhead costs 23,000 Total costs $115,000 It is estimated that 8% of the fixed overhead costs will no longer be incurred if the company purchases the component from an outside supplier. Beta has the option of purchasing the component from an outside supplier at $97.75 per unit. 22) If Beta accepts the offer from the outside supplier, the monthly avoidable costs (costs that will no longer be incurred) total 23) If Beta purchases 1,000 units from the outside supplier per month, then what would be the change in operating income?arrow_forward3B Corporation makes different types of hubcaps for cars. The company accumulates volumes of metal edges as scrap. At least once a month, the scrap metal is sold to a local manufacturer for further processing. This month's scrap sales on account total P14,000.00. The company is using actual cost system. 10: Required: Prepare the appropriate journal entry to record the sale of the scrap for each of the following alternatives: 1 Scrap sale is viewed as additional revenue 2. Scrap sale is viewed as reduction of cost of goods sold 3. When scrap materials are traceable as indirect materials 4. When scrap materials are traceable as direct materialsarrow_forward

- Classical Glasses operates a kiosk at the local mall, selling s unglasses for $30 each. Classical Glasses currently pays $1,000 a month to rent the space and pays two full-time employees to each work 160 hours a month at $10 per hour. The store shares a manager with a neighboring kiosk and pays 50% of the manager’s annual salary of $60,000 and benefits of $12,000. The wholesale cost of the sunglasses to the company is $10 a pair. Q.Assume Classical Glasses pays its employees hourly under the original pay structure, but is able to pay the mall 10% of its monthly revenue instead of monthly rent. At what sales levels would Classical Glasses prefer to pay a fixed amount of monthly rent, and at what sales levels would it prefer to pay 10% of its monthly revenue as rent?arrow_forwardGadubhaiarrow_forwardSam's Auto Shop services and repairs a particular brand of foreign automobile. Sam uses oil filters throughout the year. The shop operates 52 weeks per year and weekly demand is 130 filters. Sam estimates that it costs $20 to place an order and his annual holding cost rate is $3 per oil filter. Currently, Sam orders in quantities of 650 filters. Calculate the total annual costs associated with Sam's current ordering policy. Total annual costs = $arrow_forward

- Markson and Sons leases a copy machine with terms that include a fixed fee each month of $500 plus a charge for each copy made. The company uses the high-low method to analyze costs and Markson paid $360 for 5,000 copies and $280 for 3,000 copies,arrow_forwardSession Company uses 5,000 units of Part Y each year as a component in the assembly of one of its products. The company is presently producing Part Y internally at a total cost of $72,000 as follows: Direct materials $18,000 Direct labor $20,000 Variable MOH $10,000 Fixed MOH $24,000 Total costs $72,000 An outside supplier has offered to provide Part Y at a price of $12 per unit. If Session Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated. Accepting the outside supplier's offer leads to an annual advantage/disadvantage of: Advantage of $4,000 Disadvantage of $4,000 Disadvantage of $12,000 Advantage of $12,000arrow_forwardTeal Mountain Company has been a retailer of audio systems for the past 3 years. However, after a thorough survey of audio system markets, Teal Mountain decided to turn its retail store into an audio equipment factory. Production began October 1, 2022. Direct materials costs for an audio system total $77 per unit. Workers on the production lines are paid $13 per hour. An audio system takes 6 labor hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,070 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,700. Factory janitorial costs are $2,030 monthly. Advertising costs for the audio system will be $9,030 per month. The factory building depreciation is $6,360 per year. Property taxes on the factory building will be $8,520 per year. Assuming that Teal Mountain manufactures, on average, 1,400 audio systems per month, enter each cost item on your answer sheet, placing…arrow_forward

- Vishnuarrow_forwardSouthwest Milling Company purchased a front-end loader to move stacks of lumber. The loader had a list price of $124,960. The seller agreed to allow a 5.00 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cost amounted to $2,820. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $870. The loader operator is paid an annual salary of $15,500. The cost of the.company's theft insurance policy increased by $2,320 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $7,600. Required Determine the amount to be capitalized in the asset account for the purchase of the front-end loader. Note: Round your answers to the nearest whole dollar. Amounts to be deducted should be indicated with minus sign. Costs that are to be capitalized: List price Total costsarrow_forwardVikarmbhaiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education