FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

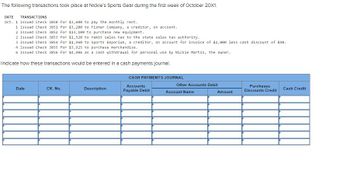

Transcribed Image Text:The following transactions took place at Nickle's Sports Gear during the first week of October 20X1.

DATE TRANSACTIONS

Oct. 1 Issued Check 3850 for $3,600 to pay the monthly rent.

1 Issued Check 3851 for

2 Issued Check 3852 for

$3,200 to Fisher Company, a creditor, on account.

$13,100 to purchase new equipment.

2 Issued Check 3853 for

$1,520 to remit sales tax to the state sales tax authority.

3 Issued Check 3854 for

$1,960 to Sports Emporium, a creditor, on account for invoice of $2,000 less cash discount of $40.

4 Issued Check 3855 for $3,925 to purchase merchandise.

6 Issued Check 3856 for $4,906 as a cash withdrawal for personal use by Nickie Martin, the owner.

Indicate how these transactions would be entered in a cash payments journal.

Date

CK. No.

Description

CASH PAYMENTS JOURNAL

Accounts

Payable Debit

Other Accounts Debit

Account Name

Amount

Purchases

Discounts Credit

Cash Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The accounting records and bank statement of Orison Supply Store provide the following information at the end of April. The closing 'Cash' account balance was $28,560, and the bank statement shows a closing balance of $32,000. On reviewing the bank statement it is found an account customer has deposited $2,000 into the bank account for a March sale and the monthly insurance premium of $4,500 was automatically charged to the account. Interest of $5,10 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $1,500 to a supplier has been recorded twice in the accounts. After the ,calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. 31 Issued a 30-day, 8% note for $225,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $600,000 from Triple Creek Bank, issuing a 45-day, 6% note. Jul. 1 Purchased tools by issuing a $50,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 7% note for $600,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $280,000, paying $80,000 cash and issuing a series of ten 9% notes for…arrow_forwardRincoe Company does not ring up sales taxes separately on the cash register. Total receipts for October amounted to $390,527. If the sales tax rate is 5%, what amount must be remitted to the state for October's sales taxes? Round your answer to 2 decimal places.arrow_forward

- 1. Prepare general journal entries for the following transactions for the current year: April 25 Sold $3,500 of merchandise to Phillip Corporation receiving a 9%, 60-day, $3,500 note receivable (the merchandise cost $2,000) June 24 The note of Phillip Corporation was dishonored. Date Description Post Ref Debit Creditarrow_forwardPlease help mearrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $175,000, terms n/30. 31 Issued a 30-day, 6% note for $175,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $400,000 from Triple Creek Bank, issuing a 45-day, 5% note. Jul. 1 Purchased tools by issuing a $45,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6% note for $400,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $260,000, paying $40,000 cash and issuing a series of ten 9% notes for…arrow_forward

- Prepare journal entries for each of the following sales transactions by Elegant Electronics, including a 3.5% sales tax, and the remittance of all sales tax to the tax board on October 23. Accounts Payable Merchandise Inventory Sales Discount Cash Sales Sale Tax Payable PLEASE NOTE: You must follow the format in the textbook and enter the account names exactly as written above and all dollar amounts will be rounded to two decimal places with "$" and commas as needed (i.e. $12,345.67). Elegant Electronics sells a cellular phone on September 2 for $450: DR DR or CR? CR On September 6, Elegant sells another cellular phone for $500: DR DR or CR? CR The remittance of all sales tax to the tax board on October 23: DR CRarrow_forwardRecord these transactions in general journal ledger: Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. Dec 4: Accepted a sales return from Eastern for an item having an original gross sales price of $6,000. The original sale to Eastern occurred in November with terms 2/15, n/30. Dec 5: Specifically wrote off the receivable balance owed by Baker as uncollectible. Dec 7: Returned defective inventory with a gross cost of $4,000 back to Hunt Corp. Dec 14: Wilson returned an item originally purchased on Dec 12 with a gross sales price of $7,000. Dec 14: Returned inventory with a gross cost of $2,000 back to Nelson Industries. Dec 18: Bought office supplies on account for $9,000 from Staples Inc. (open a new Accounts Payable in the subsidiary ledger--Vendor # 210-30). Invoice # is OM1218. Staples Inc.’s terms are n/30 Dec 19: Received the December utilities bill for the amount of $15,000. The bill will be paid in January of next year.…arrow_forwardDecimal Corporation is a monthly depositor whose December federal taxes are displayed below. Record one journal entry to account for the payment of the federal taxes. All tax payments are made in a timely manner on the payment due date (which, for this month, is not impacted by a weekend or holiday). Chart of Accounts Notes: • Enter the transaction date on the first line only (if multiple transactions are required, enter the date on the first line of each transaction). Enter all debits within the transaction prior to entering any credits. • See the Chart of Accounts provided for the proper account names to use. • To earn any credit for a given line within the journal entry, the account name must be correct. Partial credit is given for a correct account name with an incorrect amount; full credit is given for a correct account name with the correct amount. • Do not include journal entry explanation when submitting your answer. December Tax Totals Federal Income Tax $3250 Employee's…arrow_forward

- Ivanhoe Auto Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $18,900. All sales are subject to a 5% sales tax.(a1) Compute sales taxes payable. Sales taxes payable (a2) Give the journal entry to record sales taxes payable and sales revenue. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit March 16arrow_forwardRecord the following transactions in the cash receipts journal. Jun. 12 Your company received payment in full from Jolie Inc. in the amount of $1,715 for merchandise purchased on June 4 for $1,750, invoice #1032. Jolie Inc. was offered terms of 2/10, n/30. Record the payment. Jun. 15 Portman Inc. mailed you a check for $2,600. The company paid for invoice #1027, dated June 1, in the amount of $2,600, terms offered 3/10, n/30. Jun. 17 Your company received a refund check (its check #12440) from the State Power Company because you overpaid your electric bill. The check was in the amount of $62. The Utility Expense account number is #450. Record receipt of the refund. If an amount box does not require an entry, leave it blank. CASH RECEIPTS JOURNAL Page: 24 Date Account InvoiceNo. Ref. CashDR SalesDiscountsDR AccountsReceivable,Sales, orotheraccounts CR 2019 Jun. 12 fill in the blank 3 fill in the blank 4 fill in the blank 5 fill in the blank 6 Jun. 15…arrow_forwardWould you help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education