FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

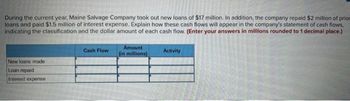

Transcribed Image Text:During the current year, Maine Salvage Company took out new loans of $17 million. In addition, the company repaid $2 million of prior

loans and paid $1.5 million of interest expense. Explain how these cash flows will appear in the company's statement of cash flows,

indicating the classification and the dollar amount of each cash flow. (Enter your answers in millions rounded to 1 decimal place.)

New loans made

Loan repaid

Interest expense

Cash Flow

Amount

(in millions)

Activity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash receipts totaled $875,000 for property taxes and $292,500 from other revenue. Note: Enter debits before credits. Transaction General Journal Debit Credit 04 .arrow_forwardKela Corporation reports net income of $510,000 that includes depreciation expense of $85,000. Also, cash of $46,000 was borrowed on a 3-year note payable. Based on this data, total cash inflows from operating activities are: Multiple Choice O $641,000. $595,000. O $556,000 $425,000arrow_forwardUsing the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forward

- Provide answer this questionarrow_forwardAt the beginning of the current year, a company issued stock for $150,000 and borrowed $80,000 from the bank. By the end of the year, the company had provided services of $83,000 for cash, paid employee salaries of $39,000, and paid utilities of $13,000. Determine the amount of financing cash flows the company will report in the current year. (Cash outflows should be indicated with a minus sign.) Financing cash flowsarrow_forwardAt the beginning of the year, Oriole Company has a cash balance of $25300. During the year, the company expects cash disbursements of $176000, and cash receipts of $154000. If Oriole Company requires an ending cash balance of $22000, how much must the company borrow? O $0. O $44000. O $18700. O $22000.arrow_forward

- A company borrows $10,000 and signs a 2-year nontrade note payable. In preparing a statement of cash flows (indirect method), this event would be reflected as a(n) addition adjustment to net income in the cash flows from operating activities section. cash outflow from investing activities. cash inflow from financing activities. cash inflow from investing activities.arrow_forwardIn 2018 Calvia Corporation had cash receipts of $35,000 and cash disbursments of $20,000. Calvia's ending cash balance at December 31,2018 was $65,000. What was Calvia's beginning cash balance?arrow_forwardSherwood, Inc., had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $4,165 $4,528 Short-term investments, at cost 2,958 8,408 Accounts and notes receivable, net 9,404 8,624 Inventories 1,771 787 Prepaid expenses and other current assets 590 291 Short-term obligations (liabilities) 315 3,342 Accounts payable and other current liabilities 7,453 6,813 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4arrow_forward

- During the year, Next Tec Corp. had the following cash flows: receipt from customers, $16,000; receipt from the bank for long-term borrowing, $6,500; payment to suppliers, $6,000; payment of dividends; $1,600, payment to workers, $2,600; and payment for machinery, $10,500. What amount would be reported for net financing cash flows in the statement of cash flows? Multiple Choice $4,900 ($10,500) $6,500 $5,400arrow_forwardThe following is selected information from L corporation for the fiscal year ending October 21, 2022: Cash received from customers Revenue recognized Cash paid for expenses Cash paid for computers on Nov. 1, 2021 that will be used for 3 years Expenses incurred including any depreciation Proceeds from a bank loan, part of which was used to pay for the computers O $224,000 $254,000 Based on the accrual basis of accounting, what is L corporation's net in some for the year ending October 31, 2022? $208,000 $300,000 440,000 170,000 $270,000 48,000 216,000 100,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education