FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

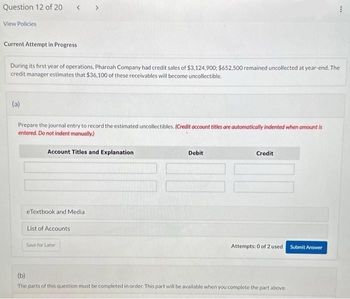

Transcribed Image Text:Question 12 of 20 < >

View Policies

Current Attempt in Progress

During its first year of operations, Pharoah Company had credit sales of $3,124,900; $652,500 remained uncollected at year-end. The

credit manager estimates that $36,100 of these receivables will become uncollectible.

(a)

Prepare the journal entry to record the estimated uncollectibles. (Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

Account Titles and Explanation

eTextbook and Media

List of Accounts

Save for Later

Debit

Credit

Attempts: 0 of 2 used

(b)

The parts of this question must be completed in order. This part will be available when you complete the part above.

***

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the current period, Waterway Industries had balances in Accounts Receivable of $190,800 and in Allowance for Doubtful Accounts of $9,670 (credit). During the period, it had net credit sales of $730,800 and collections of $749,620. It wrote off as uncollectible accounts receivable of $7,511. However, a $3,339 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $23,000 at the end of the period. (Omit cost of goods sold entries.) (a) Prepare the entries to record sales and collections during the period. (b) Prepare the entry to record the write-off of uncollectible accounts during the period. (c) Prepare the entries to record the recovery of the uncollectible account during the period. (d) Prepare the entry to record bad debt expense for the period. (Credit account titles are automatically indented when…arrow_forwardView Policies Current Attempt in Progress Assume the following information for Teal Mountain Corp. Accounts receivable (beginning balance) Allowance for doubtful accounts (beginning balance) Net credit sales Collections Write-offs of accounts receivable Collections of accounts previously written off (a) Account Titles and Explanation Uncollectible accounts are expected to be 6% of the ending balance in accounts receivable. (To record sales on account) (To record collection of accounts receivable) Prepare the entries to record sales and collections during the period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) eTextbook and Media $143.000 List of Accounts 11,340 Save for Later Using multiple attempts will impact your score. 10% scare reduction after attempt 5 930,000 912.000 6,400 2,200…arrow_forwardThis question uses the same facts as the previous question and is repeated for your convenience. The following information relates to Hanover Foods, Inc. for the year 20X1: Accounts receivable (January 1, 20X1) Credit sales during 20X1 Collections from credit customers during 20X1 Customer account written off as uncollectible during 20X1 Allowance for Doubtful (Uncollectible) Accounts $334,000 850,000 725,000 12,000 (this balance is given after writing-off uncollectible accounts and has a credit balance) Estimated uncollectible accounts based on aging analysis If the aging approach is used to estimate bad debts, what amount should be recorded as bad debts expense for 20X1? 1,700 13,200arrow_forward

- Sipacore Ltd. has an Accounts Receivable amount of $363,700 and an unadjusted credit balance in Allowance for Expected Credit Losses of $8,600 at March 31. The company's accounts receivable and percentage estimates of uncollectible accounts are as follows: Number of Days Outstanding 0-30 (a) 31-60 61-90 Over 90 Total Your answer is correct. Age of Accounts 0-30 days 31-60 days Accounts Receivable $258,000 45,800 32,600 27,300 $363,700 61-90 days Over 90 days Prepare an aging schedule to determine the total estimated uncollectibles at March 31. Amount % $258,000 2% 45,800 10% 32,600 30% Estimated Percentage Uncollectible 27,300 50% 2% 10% 30% 50% Estimated Uncollectible 5160 4580 9780 13650 33170arrow_forwardPresented below is information for Blossom Company. 1. Beginning-of-the-year Accounts Receivable balance was $20,800. 2. Net sales (all on account) for the year were $109,600. Blossom does not offer cash discounts. 3. Collections on accounts receivable during the year were $81,000. (a) Prepare (summary) journal entries to record the items noted above. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation 1. 2. Your answer is correct. 3. (b) No Entry No Entry Accounts Receivable Sales Revenue Cash Accounts Receivable eTextbook and Media List of Accounts Accounts receivable turnover Debit Days to collect accounts receivable times 0 days 109,600 81000 Compute Blossom's accounts receivable turnover and days to collect receivables for the year. The company does not believe it will have any bad debts. (Round answers…arrow_forwardAt the beginning of the current period, Skysong, Inc. had balances in Accounts Receivable of $197,000 and in Allowance for Doubtful Accounts of $9,040 (credit). During the period, it had net credit sales of $862,700 and collections of $838,670. It wrote off as uncollectible accounts receivable of $7,477. However, a $3,049 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $26,310 at the end of the period. (Omit cost of goods sold entries.) (a-d) (a) Prepare the entries to record sales and collections during the period. (b) Prepare the entry to record the write-off of uncollectible accounts during the period. (c) Prepare the entries to record the recovery of the uncollectible account during the period. (d) Prepare the entry to record bad debt expense for the period.arrow_forward

- Required information. [The following information applies to the questions displayed below] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $15,000. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 840,000 336,000 67,200 33,600 13,440 Age of Accounts Receivable Not yet due 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due Expected Percent Uncollectible 1.15% 1.90 6.40 View transaction list View journal entry worksheet 32.25 67.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Note: Round percentage answers to nearest whole percent. Do not round intermediate calculations.arrow_forwardAt the end of the first year of operations, mayberry advertising had accounts receivable of $21100. Management of the company estimates that 8% of the accounts will not be collected What adjutment would mayberry advertising record to established allowance for uncollectible accounts Do the journal entry worksheetarrow_forwardAt the beginning of the current period, Sunland company had balances in accounts receivables of $201,900 and in Allowance for Doubtful Accounts of $9,590 (credit). During the period, it had credit sales of $875,700 and collections of $796,820. It was written off as uncollectible accounts receivable of $7,410. However, a $2,808 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,830 at the end of the period (Omit the cost of goods sold entries). a) Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. b) What is the net realizable value of the receivables at the end of the period?arrow_forward

- Presented below is information for Vaughn Company. 1. Beginning-of-the-year Accounts Receivable balance was $24,900. 2. Net sales (all on account) for the year were $105,300. Vaughn does not offer cash discounts. 3. Collections on accounts receivable during the year were $84,300. All Boo (a) Prepare (summary) journal entries to record the items noted above. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation 1. Debit Credit 2. 3.arrow_forwardSun City Greenhouse had trouble collecting its account receivable from Sharma Suiza. On June 19, 2025, Sun City Greenhouse finally wrote off Suiza's $700 account receivable. On December 31, Suiza sent a $700 check to Sun City Greenhouse. Journalize the entries required for Sun City Greenhouse, assuming Sun City Greenhouse uses the direct write-off method. On June 19, 2025, Sun City Greenhouse wrote off Suiza's $700 account receivable. Journalize the entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Jun. 19 Accounts and Explanation Debit Creditarrow_forwardAbbott Company uses the allowance method of accounting for uncollectible receivables. Abbott estimates that 1% of credit sales will be uncollectible. On January 1, Ailowance for Doubtful Accounts had a credit balance of $3,000. During the year, Abbott wrote off accounts receivable totaling $2,500 and made credit sales of $106,000. There were no sales returns during the year. After the adjusting entry, the December 31 balance in Bad Debt Expense will be Ca. $1.060 Ob. $1.500 Oc. $4.060 Od. $1.560arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education