FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

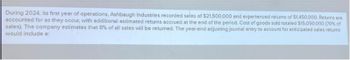

Transcribed Image Text:During 2024, its first year of operations, Ashbaugh Industries recorded sales of $21,500,000 and experienced returns of $1,450,000. Returns are

accounted for as they occur, with additional estimated returns accrued at the end of the period. Cost of goods sold totaled $15,050,000 (70% of

sales). The company estimates that 8% of all sales will be returned. The year-end adjusting journal entry to account for anticipated sales returns

would include a:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC Ltd. reports that its sales are growing at the rate of 1.25% per month. DEF Inc. reports sales increasing by 3.90% each quarter. What is each company's effective annual rate of sales growth? (Do not round intermediate calculations and round your final answers to 2 decimal places.)arrow_forwardFlingen Inc. reveals the following information in their annual report for FY 2021 Selected Income Statement Items: Sales $10,500,000 Cost of goods sold $5,500,000 Pretax earnings $650,000 Selected Balance Sheet Items: Merchandise inventory $800,000 Total assets $2,500,000 Upper management plans to cut cost of goods sold by 4.5% for the coming year but retain the same sales and weeks of inventory. What is the return on assets estimated to be for 2022? Group of answer choices 33.7% 32.1% 36.8% 34.1%arrow_forwardThomas Company had the following information related to September 2020: 1) Depreciation on the store equipment was $60,000 for the month. 2) Sales of merchandise inventory for the month of September were $1,800,000, of which $1,200,000 was paid in cash and the remaining amount sold on credit. The cost of the merchandise sold was $1,080,000. 3) The next payroll will be $144,000 and will be paid on October 12. This payroll will cover wages earned during the last week of September and the first week of October. 4) The utility bill of $72,000 for the month of September was both received and paid in early October. 5) Thomas sold a company car for a gain of $12,000 on September 22. 6) On September 3, Thomas paid $6,000 for August’s telephone bill. 7) On October 1, Thomas received the September telephone bill, which totaled $12,000. The bill will be paid in mid-October. 8) Wages paid in cash to employees during the month totaled $288,000. This amount included $60,000 paid for work done in…arrow_forward

- During its first year of operations, Purple Company recorded sales of $4,000,000. Based on industry statistics, Purple estimates 5% of all sales will be returned. Actual returns during the year totaled $160,000. The year-end adjusting journal entry to account for estimated sales returns would include a: Credit to Refund Liability of $40,000 Debit to Sales Returns of $200,000 Credit to Sales Returns of $40,000 Debit to Refund Liability of $200,000 7 DOarrow_forwardSales receipts. California Cement Company anticipates the following fourth-quarter sales for 2014: $1,816,000 (October), $1,570,000 (November), and $2,074,000 (December). It posted the following sales figures for the third quarter of 2014: $1,859,000 (July), $1,945,000 (August), and $2,164,000 (September). The company sells 44% of its products on credit, and 56% are cash sales. The company collects credit sales as follows: 29% in the following month, 50% two months later, and 18% three months later, with 3% defaults. What are the anticipated cash inflows for the last quarter of 2014? Given the July sales of $1,859,000, The amount collected in July is (Round to the nearest dollar.) The amount collected in August is (Round to the nearest dollar.) The amount collected in September is (Round to the nearest dollar.) The amount collected in October is (Round to the nearest dollar.) The amount not collected is (Round to the nearest dollar.) Given the August…arrow_forwardThe Runner Antique Mall expects to make purchases in the first quarter of 2021 as follows: January $85,500 February 108,000 March 76,500 Purchases in December 2020 are expected to be $82,600. The company expects that 50 percent of a month's purchases will be paid in the month of purchase and 50 percent will be paid in the following month. Estimate cash disbursements related to purchases for each month of the first quarter of 2021.arrow_forward

- The table given below summarizes the 2019 income statement and end-year balance sheet of Drake’s Bowling Alleys. Drake’s financial manager forecasts a 10% increase in sales and costs in 2020. The ratio of sales to average assets is expected to remain at 0.40. Interest is forecasted at 5% of debt at the start of the year. Income Statement $ in thousands Sales $ 2,600 (40% of average assets)a Costs 1,950 (75% of sales) Interest 105 (5% of debt at start of year)b Pretax profit 545 Tax 218 (40% of pretax profit) Net income $ 327 aAssets at the end of 2018 were $6,240,000. bDebt at the end of 2018 was $2,100,000. Balance Sheet $ in thousands Net assets $ 6,760 Debt $ 2,100 Equity 4,660 Total $ 6,760 Total $ 6,760 a. What is the implied level of assets at the end of 2020? (Enter your answer in dollars not in thousands.) b. If the company pays out 50% of net income as dividends, how much cash will Drake need…arrow_forwardCompute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable. 2024 2023 Sales Cost of goods sold Accounts receivable $ 553,119 290,122 26,882 $ 363,894 190,775 21,215 2022 $ 292,284 155,088 20,021 2021 $ 210,276 110,844 12,322 2020 $ 159,300 82,836 10,928 2024: 2023: 2022: 2021: 2020: Numerator: Trend Percent for Net Sales: 1 Is the trend percent for Net Sales favourable or unfavourable? 2024: 2023: 2022: 2021: 2020: Denominator: = Trend percent 0 % 0% 0% 0% 0 % Trend Percent for Cost of Goods Sold: Numerator: Denominator: Is the trend percent for Cost of Goods Sold favourable or unfavourable? = Trend percent 0% 0% 0% 0% 0%arrow_forwardThe following tables summarizes the 2019 income statement and end-year balance sheet of Drake’s Bowling Alleys. Drake’s financial manager forecasts a 10% increase in sales and costs in 2020. The ratio of sales to average assets is expected to remain at 0.40. Interest is forecasted at 5% of debt at the start of the year. INCOME STATEMENT, 2019 (Figures in $ thousands) Sales $ 1,120 (40% of average assets)a Costs 840 (75% of sales) Interest 26 (5% of debt at start of year)b Pretax profit $ 254 Tax 101 (40% of pretax profit) Net income $ 152 a Assets at the end of 2018 were $2,700,000. b Debt at the end of 2018 was $530,000. BALANCE SHEET, YEAR-END (Figures in $ thousands) Assets $ 2,900 Debt $ 530 Equity 2,370 Total $ 2,900 $ 2,900 a. What is the implied level of assets at the end of 2020? (Do not round your intermediate calculations. Enter your answer in thousands.) b. If the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education