Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

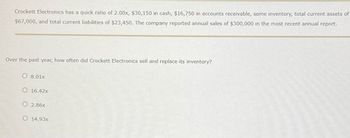

Transcribed Image Text:Crockett Electronics has a quick ratio of 2.00x, $30,150 in cash, $16,750 in accounts receivable, some inventory, total current assets of

$67,000, and total current liabilities of $23,450. The company reported annual sales of $300,000 in the most recent annual report.

Over the past year, how often did Crockett Electronics sell and replace its inventory?

08.01x

O 16.42x

O 2.86x

O 14.93x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- General Forge and Foundry Company has a quick ratio of 2.00; $33,750 in cash; $18,750 in accounts receivable; some inventory; total current assets of $75,000; and total current liabilities of $26,250. In its most recent annual report, General Forge reported annual sales of $100,000 and a cost of goods sold equal to 65% of annual sales. How many times is General Forge and Foundry Company selling and replacing its inventory? O 4.44x O 3.179x O 0.35x O 2.89xarrow_forwardTarmac Co made sales of $1,930,200 during the year ended 31st March X3. Inventory decreased by $132,000 over the year and all sales were made at a mark-up of 45%.What was the cost of purchases during the year, to the nearest $100?arrow_forwardGiven the following information, how many times does the firm turnover its inventory during the year? Beginning inventory = $50,000 Ending inventory = $45,000 Beginning Accounts Receivable = $60,000 Ending Accounts Receivable = $66,000 Beginning Accounts Payable = $70,000 Ending Accounts Payable = $84,000 Sales = $1,000,000 % credit sales = 60% Cost of goods sold = $450,000 Multiple Choice 5.8 times 38.3 days 9.5 timesarrow_forward

- Suppose Domino's had cost of goods sold during the year of $290,000. Beginning merchandise inventory was K $40,000, and ending merchandise inventory was $75,000. Determine Domino's inventory turnover for the year. Round to the nearest hundredth. OA. 8.29 times per year OB. 7.25 times per year OC. 5.04 times per year OD. 3.87 times per yeararrow_forwardLast year, Jumpin' Trampolines (JT) had a quick ratio of 1.0, a current ratio of 1.8, an inventory turnover of 3.5, total current assets of $67,500, and cash and equivalents of $15,00. If the cost of goods sold equaled 70 percent of sales, what were JT's annual sales and DSO?arrow_forwardAverage inventory=1,080,000 Debtors=690,000 Gross Profit ratio=10% Credit sales to total sales=20% Inventory turnover ratio=6 times 1 year is taken as 360 days. With the information given above, find the average collection period.arrow_forward

- Adams Furniture has a quick ratio of 2.00x, $37,575 in cash, $20,875 in accounts receivable, some inventory, total current assets of $83,500, and total current liabilities of $29,225. The company reported annual sales of $100,000 in the most recent annual report. Additionally, the company’s cost of goods sold is 75% of sales. Over the past year, how often did Adams Furniture sell and replace its inventory? 8.01x 3.29x 2.86x 2.99xarrow_forwardA retailer ordered merchandise totaling $128,115.23 with terms 3.5%/10 net 40. What is the effective rate of return? Assume there are 365 days in a year.arrow_forwardDabble, Inc. has sales of $970,000 and cost of goods sold of $461,000. The firm had an average inventory of $41,000. What is the length of the days' sales in inventory? (Use 365 days a year. Round your answer to 2 decimal places.) Days' sales in inventory daysarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education