Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

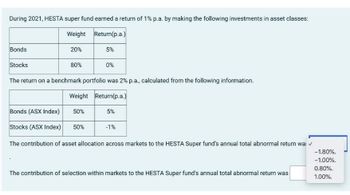

Transcribed Image Text:During 2021, HESTA super fund earned a return of 1% p.a. by making the following investments in asset classes:

Weight

Return(p.a.)

Bonds

20%

5%

Stocks

80%

0%

The return on a benchmark portfolio was 2% p.a., calculated from the following information.

Weight Return(p.a.)

Bonds (ASX Index) 50%

5%

Stocks (ASX Index) 50%

-1%

The contribution of asset allocation across markets to the HESTA Super fund's annual total abnormal return wa: ✓

-1.80%.

-1.00%.

0.80%.

The contribution of selection within markets to the HESTA Super fund's annual total abnormal return was

1.00%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A hedge fund with a 1 and 15 fee structure has a hard hurdle rate of 7.45%. If the incentive fee and management fee are calculated independently and the management fee is based on beginning-of-period asset values, an investor’s net return over a period during which the grows value of the fund has increase 19.45% is closest to A. 10.85%. B. 12.65%. C. 16.65%. D. 21.74%.arrow_forwardA hedge fund with $25 million of assets under management has a standard 2/20 fee structure and earns 14 percent this year. Assume that management fees are paid at the beginning of each year and performance fees are paid at the end of each year. Assume that the fund’s fee structure also contains a high-water mark provision. What is the management fee collected by the fund managers? What is the performance fee collected by the fund managers? What is the investor’s net return?arrow_forwardConsidering the following trading and performance data for 3 different equality mutual funds from JHancock asset management company for the year 2020: Emerging market fund Principal Balance Small Cap Fund Income Fund Average asset (RM' Mill) Security 310 655 520 40.1 570 575 Expenses ratio 0.35% 0.71% 1.65% Pre-tax return, 3-year 10.2% 11.1% 15.2% average Tax-adjusted return, 9.5% 8.91% 13.4% 3-year average i)Calculate the portfolio turnover ratio for each fund ii) Which fund is most likely to be actively managed and which is most likely to be passively managed? iii) Calculate the tax cost ratio for each fund iv) Determine which fund is the most and least tax efficient in their operations? Explain v) Explain what expenses ratio is and which portfolio is considered expenses efficient.arrow_forward

- Required: A hedge fund with $0.7 billion of assets charges a management fee of 3% and an incentive fee of 20% of returns over a money market rate, which currently is 6%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: (Enter your answers in millions rounded to 1 decimal place.) Required: A hedge fund with $0.7 billion of assets charges a management fee of 3% and an incentive fee of 20% of retums over a money market rate, which currently is 6%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: (Enter your answers in millions rounded to 1 decimal place.) Required: A hedge fund with $0.7 billion of assets charges a management fee of 3% and an incentive fee of 20% of returns over a money market rate, which currently is 6%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: (Enter your answers in millions rounded to…arrow_forwardABC CAPITAL is a hedge fund with $300 million of initial investment capital. They charge a 2 percent management fee based on assets under management at year- end and a 20 percent incentive fee. In its first year, ABC Capital has a 80 percent return. Assume management fees are calculated using end-of-period valuation. 1. What are the fees earned by ABC if the incentive and management fees are calculated independently? What is an investor’s effective return given this fee Structure? 2. What are the fees earned by ABC assuming that the incentive fee is calculated based on return net of the management fee? What is an investor’s net return given this fee structure? 3. If the fee structure specifies a hurdle rate of 5 percent and the incentive fee is based on returns in excess of the hurdle rate, what are the fees earned by ABC assuming the performance fee is calculated net of the management fee? What is an investor’s net return given this fee structure? 4. In the second year, the fund…arrow_forwardMansukharrow_forward

- Use this info to answer question 10, please don't answer 8: Use the following information to answer questions 8-10. In a particular year, the Pontipines Fund earned a return of 1% by making the following investments in asset classes: The return on a bogey portfolio was 2%, calculated from the following information: The total abnormal return on the Pontipines Fund's managed portfolio was: A) - 1.80% B) -1.00% C) 0.80% D ) 1.00% 10) The contribution of selection within markets to the Pontipines Fund's total abnormal return was: A) -1.80% B ) -1.00% C) 0.80% D) 1.00%arrow_forwardAnalyze the following three years of data relating to the MoMoney Mutual Fund, . It should report the amount of dividend income and capital gains distributed to the shareholders, along with any other changes in the fund's net asset value (b = 0.5). (Click the icon here ☐ in order to copy the contents of the data table below into a spreadsheet.) 2019 2018 NAV (beginning of period) ? ? 2017 $35.56 Net investment income 0.64 0.74 0.56 Net gains on securities 5.48 4.52 - 3.41 Dividends from net investment income 0.64 0.56 Distributions from realized gains 1.61 1.96 0.51 1.44 a. What is the total income from the investment operations? b. What are the total distributions from the investment operations? a. The total income from investment operations in 2019 is $ The total income from investment operations in 2018 is $ (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) The total income from investment operations in 2017 is $ b. The total distributions from…arrow_forwardIn a particular year, Hoosier Mutual Fund earned a return of 1% by making the following investments in asset classes: Weight Return Bonds 20 % 5 % Stocks 80 % 0 % The return on a bogey portfolio was 2%, calculated from the following information. Weight Return Bonds (Lehman Brothers Index) 50 % 5 % Stocks (S&P 500 Index) 50 % -1 % The contribution of asset allocation across markets to the Hoosier Fund's total abnormal return wasarrow_forward

- Subject:- financearrow_forwardThe Vanguard Windsor II mutual fund had a net asset value of $15.07 at the beginning of 1992 and $24.04 at the beginning of 1997. What was the approximate (rounded up nearest %) average annual growth rate in this measure over this period? A)8% B)60% C)10% D)18% E)15%arrow_forwardRequired: A fund manages a $4.8 billion equity portfolio with a beta of 0.60. If the S&P contract multiplier is $50 and the index is currently at 3,000, how many contracts should the fund sell to make its overall position market neutral? Number of contractsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education