Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

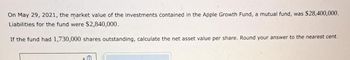

Transcribed Image Text:On May 29, 2021, the market value of the investments contained in the Apple Growth Fund, a mutual fund, was $28,400,000.

Liabilities for the fund were $2,840,000.

If the fund had 1,730,000 shares outstanding, calculate the net asset value per share. Round your answer to the nearest cent.

sm

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- i need the answer quicklyarrow_forwardThe investments in the almo basics contingency fund have current market value of 230 million the fund also has liablities that total 50 million if this mutual fund has 7.5 million shares what is the net asset valuearrow_forwardWhen Fund H started on 1/1/21, it had $318,225,000 in assets under management (AUM). The annual holding period return was 3.65% in 2021, -20.48% in 2022, and 31.48% in 2023. Some investors redeemed shares, resulting in a net cash outflow of $120,204,000 on 12/31/21. There were also new investors buying the fund shares, resulting in a net cash inflow of $27,885,000 on 12/31/22. The dollar- weighted average return of the fund is % per year during the three-year period. Multiple Choice O O O O O 3.55 3.86 5.12 4.32 2.97arrow_forward

- A mutual fund sold $58 million of assets during the year and purchased $64 million in assets. If the average daily assets of the fund were $216 million, what was the fund turnover? (Enter your answer as a percent rounded to 2 decimal places.) Fund turnover %arrow_forwardYou invested $25,000 in a mutual fund at the beginning of the year when the NAV was $33.16. At the end of the year the fund paid $.27 in short-term distributions and $.44 in long-term distributions. If the NAV of the fund at the end of the year was $37.81, what was your return for the year?arrow_forwarda. The performance of the fund over the past 1-year period from the 14th of September 2020 to the 13th of September 2021 is presented in the figure below. Based on the figure and given information, which of the following best describes the type of fund TFX: open-end active fund, index fund, close-end fund, or exchange traded fund (ETF). Please explain your answers. Value of Fund's shares 25.00 20.00 15.00 10.00 5.00 0.00 14/09/2020 23/11/2020 Fund TLW Performance -NAV -Share Price 5/02/2021 20/04/2021 30/06/2021 Date Over the past 1-year period, this fund had a portfolio turnover ratio of 10%. 10/09/2021arrow_forward

- Louis Hall read in the paper that Fidelity Growth Fund has an NAV of $13.94. He called Fidelity and asked how the NA Fidelity gave him the following information: Current market value of fund investment Current liabilities Number of shares outstanding Did Fidelity provide Louis with the correct information? O Yes O No $8,780,000 $ 975,000 560,000arrow_forwardPlease help!arrow_forwardSuppose you own a mutual fund which has 13,000,000 shares outstanding. If its total assets are $36,000,000 and its liabilities are $5,000,000, find the net asset value (in $) of the fund. Round to the nearest cent. 2$arrow_forward

- please answer within 30 minutes.arrow_forwardYou purchased 1,000 shares of the New Fund at a price of $32 per share at the beginning of the year. You paid a front- end load of 2%. The securities in which the fund invests increase in value by 11% during the year. The fund's expense ratio is 1%. What is your rate of return on the fund if you sell your shares at the end of the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Rate of return This is a numeric cell, so % Xarrow_forwardYou invested in the no - load Best Mutual Fund one year ago by purchasing 700 shares of the fund at the net asset value of $18.89 per share. The fund distributed dividends of $ 2.52 and capital gains of $2.12. Today, the NAV is $20.31. What was your holding period (Round to return Your holding period return was two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education