FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

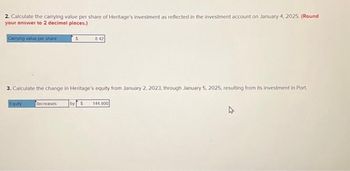

Transcribed Image Text:2. Calculate the carrying value per share of Heritage's investment as reflected in the investment account on January 4, 2025. (Round

your answer to 2 decimal places.)

S

Carrying value per share

3.Calculate the change in Heritage's equity from January 2, 2023, through January 5, 2025, resulting from its investment in Port.

Equity

8.42

decreases

by S 144.800

Transcribed Image Text:Heritage Ltd. was organized on January 2, 2023. The following investment transactions and events occurred during the following

months:

2023

Jan. 6 Heritage paid $581,500 (including transaction fees of $50) for 50,600 shares (20%) of Port Inc. outstanding common shares.

Ape. 30 Port declared and paid a cash dividend of $1.20 per share..

Dec.31 Port announced that its profit for 2023 was $540,000. Fair value of the shares was $12.40 per share.

2024

Oct.15 Port declared and paid a cash dividend of $0.80 per share.

Dec. 31 Port announced that its profit for 2024 was $690,000. Fair value of the shares was $12.78 per share.

2025

Jan. 5 Heritage sold all of its investment in Port for $688,000 cash.

Assume that Heritage has a significant influence over Port with its 20% share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sh4arrow_forwardUnder US GAAP ABC Company has provided the following information related to its investment in marketable equity securities: MARKETABLE VALUES COST. YEAR 2 YEAR 1 Trading $150,000. $155,000. $100,000 Available for sale $150,000. 130,000. $120,000 Based on the above information provided, what amount should ABC Company report in earnings Year 2?arrow_forwardSubject;arrow_forward

- (a) Show the workings for the following financial ratios for Ka Ming Metal Manufacturing Ltd. (KM) and Sun Tool Metal Engineering works Ltd. (ST) during the year of 2021. (Shown in the photo below) (round final answer to 2 decimal places, thanks)arrow_forwardPacquired a 70% of S on January 1, 2020, for S380,000. During 2020 S had a net income of $30,000 and paid a cash dividend of $10,000. Applying the cost method would give a balance in the Investment account at the end of 2020 of: Select one: $394,000 $400,000 O $380,000 $373,000arrow_forwardEB12. LO 5.3 Using the following Balance Sheet summary information, calculate for the two years presented: A. working capital B. current ratio Current assets Current liabilities 12/31/2018 $366,500 120,000 12/31/2019 $132,000 141,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education