FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Using all the information detailed above, prepare and present:

-

a) The Statement of Financial Performance (also known as the

Profit and Loss Account or Income Statement) for the financial year ended 31 December 2020. -

b) The

Statement of Financial Position (also known as the Balance Sheet) as at 31December 2020.

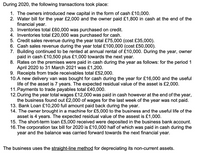

Transcribed Image Text:During 2020, the following transactions took place:

1. The owners introduced new capital in the form of cash £10,000.

2. Water bill for the year £2,000 and the owner paid £1,800 in cash at the end of the

financial year.

3. Inventories total £60,000 was purchased on credit.

4. Inventories total £20,000 was purchased for cash.

5. Credit sales revenue during the year total £75,000 (cost £35,000).

6. Cash sales revenue during the year total £100,000 (cost £50,000).

7. Building continued to be rented at annual rental of £10,000. During the year, owner

paid in cash £10,500 plus £1,000 towards the next year.

8. Rates on the premises were paid in cash during the year as follows: for the period 1

April 2020 to 31 March 2021 was £1,200.

9. Receipts from trade receivables total £52,000.

10.A new delivery van was bought for cash during the year for £16,000 and the useful

life of the asset is 7 years. The expected residual value of the asset is £2,000.

11.Payments to trade payables total £40,000.

12. During the year total wages £12,000 was paid in cash however at the end of the year,

the business found out £2,000 of wages for the last week of the year was not paid.

13. Bank Loan £10,200 full amount paid back during the year.

14. The owner brought in a machine for £5,000 to the business and the useful life of the

asset is 4 years. The expected residual value of the assest is £1,000.

15. The short-term loan £5,000 received were deposited in the business bank account.

16. The corporation tax bill for 2020 is £10,000 half of which was paid in cash during the

year and the balance was carried forward towards the next financial year.

The business uses the straight-line method for depreciating its non-current assets.

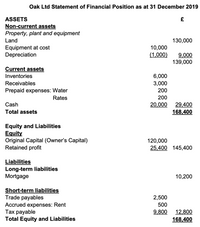

Transcribed Image Text:Oak Ltd Statement of Financial Position as at 31 December 2019

ASSETS

Non-current assets

Property, plant and equipment

Land

130,000

Equipment at cost

Depreciation

10,000

(1,000)

9,000

139,000

Current assets

Inventories

6,000

Receivables

3,000

Prepaid expenses: Water

200

Rates

200

Cash

20,000

29,400

Total assets

168,400

Equity and Liabilities

Equity

Original Capital (Owner's Capital)

Retained profit

120,000

25,400 145,400

Liabilities

Long-term liabilities

Mortgage

10,200

Short-term liabilities

Trade payables

2,500

Accrued expenses: Rent

Тах рayable

Total Equity and Liabilities

500

9,800

12,800

168,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What amounts did Target report for the following items for the year ended January 30, 2016?a. Total Revenuesb. Income from current operationsc. Net income or net lossd. Total assetse. Total equityarrow_forwardWith a given information below: (A) Prepare Income Statement and Balance Sheet in the Year 2020. (B) Analyze Income Statement and Balance Sheet in the Year 2020 Vertically. (C) Compute Financial Ratios: (1) ROE, (2) ROA, (3) Average Collection Period, (4) Debt to Asset, (5) Debt to Equity, (6) Time Interest Earned, (7) Total Assets Turnover, (8) Operating Profit Margin, (9) Return On Common Equity (ROCE), (10) Net Working Capital Ratio, (11) Quick Ratio, (12) Current Ratio. Cash $6,000 Sales $100,000 Utility Expense $8,000 Buildings $65,000 Common Stock $45,000 Accounts Payable $12,000 Supplies $4,000 Cost of Goods Sold $58,000 Interest Expense $5,000 Additional Paid in Capital $20,000 Bonds Payable $40,000 Supplies Expense $3,000 Salaries Expense $16,000 Accounts Receivable $10,000 Inventories $45,000 Retained Earnings $5,000 (beg. bal.) Income Tax Rate 20%arrow_forwardIndicate where each of the following items is reported on financial statements. Choose from the followingcategories: (a) current assets, (b) long-term investments, (c) current liabilities, (d) long-term liabilities,(e) other revenues and gains, ( f ) other expenses and losses, and (g) equity. Fair value adjustment—Tradingarrow_forward

- The image uploaded is the calculation of Societe Generale Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardUsing the given information, create a pro forma balance sheet. Covering all Assets and Liabilities listed within both photos.arrow_forwardBelow are three independent scenarios concerning the GST account balance and the effect on the Statement of Financial Position in the previous year (2023) and the current year (2024). SFP as at 31/3/2023 Scenario 1 GST liability of $267 Scenario 2 GST asset of $267 Scenario 3 GST asset of $267 SFP as at 31/3/2024 GST asset of $769 GST asset of $769 GST liability of $769 Required: Correctly insert the opening and closing balances into the three independent GST general ledger accounts provided in the answer booklet. Balance each of the three GST general ledger accounts and insert the opening balance for 1 April 2024.arrow_forward

- Calculate the following profitability ratios for 2018 and 2019. a. Gross profit ratio b. Return on assets c. Profit margin d. assets turnoverarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardSwifty Park, a public camping ground near the Four Corners National Recreation Area, has compiled the following financial information as of December 31, 2022 Revenues during 2022-camping fees $145,600 Revenues during 2022-general store 48,880 Accounts payable 11,440 Cash on hand 20,800 Original cost of equipment. 109,720 Fair value of equipment 145,600 Notes payable Expenses during 2022 Supplies on hand Common stock Retained earnings $62,400 156,000 2,600 20,800 ?arrow_forward

- Use the following financial statements and additional information. Assets Cash STREAMLINE INCORPORATED Comparative Balance Sheets June 30, 2021 and 2020 Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable. Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity STREAMLINE INCORPORATED Income Statement For Year Ended June 30, 2021 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses Total operating expenses Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 2021 $ 100,200 73,000 63,000 4,900 241,100 147,000 (36,000) $ 352,100 $ 26,000 7,000 4,700 37,700 33,000 70,700 240,000 41,400 $ 352,100 $ 66,000 74,000 195,200 136,000 (12,000) $319,200 $ 772,000…arrow_forwardHow are open encumbrances at year-end reported in the financial statements?arrow_forwardJoseph Bright lists the following transactions for the period ended 30 September 2017. Classify EACH item as follows: i. Write either capital or revenue in the expenditure type column to indicate the type of expenditure involved or EACH item. ii. Insert a-check mark (√) in the appropriate column to indicate whether the item is reported-in the Statement of profit or loss or in the Statement of financial position. The first one is done as an example. Description CLASSIFICATION OF EXPENDITURE Expenditure Type Statement where item should be reported Statement of Profit Statement of Example Wages of the computer operators 1 Cost of customizing software for use in business 2 Installing thief detection equipment 3 Cost of paper used for printing receipts during the year 4 Cost of toner used by the computer printer 5 Cost of adding extra memory to the compute or loss Revenue financial positionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education