FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

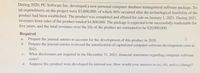

Transcribed Image Text:During 2020. PC Software Inc. developed a new personal computer database management software package. To-

tal expenditures on the project were $3,000,000, of which 40% occurred after the technological feasibility of the

product had been established. The product was completed and offered for sale on January 1, 2021. During 2021,

revenues from sales of the product totaled $4,800,000. The package is expected to be successfully marketable for

five years, and the total revenues over the life of the product are estimated to be $20,000,000.

Required

a. Prepare the journal entries to account for the development of this product in 2020.

b. Prepare the journal entries to record the amortization of capitalized computer software development costs in

2021.

c. What disclosures are required in the December 31, 2021, financial statements regarding computer software

costs?

d. Suppose this product were developed for internal use. How would your answers to (a), (b), and (c) change?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A new solid waste treatment plant is to be constructed in Washington County. The initial installation will cost $35 million (M). After 10 years, minor repair and renovation (R&R) will occur at a cost of $14M will be required; after 20 years, a major R&R costing $20M will be required. The investment pattern will repeat every 20 years. Each year during the 20-year period, operating and maintenance (O&M) costs will occur. The first year, O&M costs will total $2M. Thereafter, O&M costs will increase at a compound rate of 4% per year. Based on a 4% MARR, what is the capitalized cost for the solid waste treatment plant?arrow_forwardDisposable Containers Corp. (DCC) is considering a large plant expansion/modernization which will cost $98 million initially and another $62 million at the end of year 3. This project is expected to produce incremental after-tax profits of $29 million, $32 million, $26 million, $42 million, $40 million and $31 million to be received at the end of years 1, 2, 3, 4, 5 and 6 respectively. If the WACC is 9%, what is the project’s NPV? (Start by drawing a timeline.)arrow_forwardA company began a new software development project in 2023. The project reached technological feasibility on June 30, 2024, and was available for release to customers at the beginning of 2025. Development costs incurred prior to June 30, 2024, were $3,260,000 and costs incurred from June 30, 2024, to the product release date were $1,460,000. The economic life of the software is estimated at four years. For what amount will software be capitalized in 2024?arrow_forward

- On April 30, 2020, Flounder Corporation ordered a new passenger ship, which was delivered to the designated cruise port and available for use as of June 30, 2020. Overall, the cost of the ship was $93 million, with an estimated useful life of 12 years and residual value of $30 million. Flounder expects that the new ship, as a whole, will provide its greatest economic benefits in its early years of operation. After further research and discussion with management, it is determined that the ship consists of major parts with differing useful lives, residual values, and patterns of providing economic benefits: Part Cost Useful life Residual value Pattern ofbenefits Total output(nautical miles) Engines (6) $975,000 per engine 8 years $100,000 per engine Varies with activity 7 million Hull $3,900,000 10 years $503,000 Highest in early years 7.90 million Body $83.25 million 15 years $15.21 million Evenly over life of body 12.30…arrow_forwardAn investment project will involve spending $300,000 at time zero and $450,000 at the end of year one. These investments will generate gross revenues of $420,000 at the end of year one and $660,000 at the end of each year two through eight. A royalty of $42,000 in year one and $66,000 in year two through eight will be incurred along with operating costs of $250,000 in year one and $350,000 at the end of each year two through eight.Calculate the project before-tax cash flow for each year.arrow_forwardA retailer is looking to expand operations at all of their stores for an initial investment of $600. This investment will be depreciated on a straight line basis over the project's 8 year life. The expansion is expected to produce annual cash inflows of $610 in consecutive years over the life of the project beginning one year from today, while also producing annual cash outflows of $310 in consecutive years over the life of the project, also beginning one year from today. What is the project's NPV if the corporate tax rate is 38% and the project's required rate of return is 14%? $391.22 $1116.00 $1595.04 $1.56 $395.04arrow_forward

- You are considering a large CNC equipment purchase. You will need an initial deposit of $165,000. The annual revenues expected to come from the use of the CNC equipment are $85,000 starting in year 1 increasing by $4000 each year (i.e. $85,000 in year 1, $89,000 in year 2, etc.). Annual operating and maintenance costs are expected to be $35,000 every year starting in year 1. The equipment is expected to last for 15 years. What is the ROR? Question 6 Part C: Provide the ROR for the purchase. Enter your answer in the form 12.34 (for example, 12.34% would be entered as 12.34)arrow_forwardAxcel Software began a new development project in 2015. The project reached technological feasibility on June 30, 2016, and was available for release to customers at the beginning of 2017. Development costs incurred prior to June 30, 2016, were $3,200,000 and costs incurred from June 30 to the product release date were $1,400,000. The 2017 revenues from the sale of the new software were $4,000,000, and the company anticipates additional revenues of $6,000,000. The economic life of the software is estimated at four years. Capitalized software costs are: A. $0. B. $3,200,000. C. $1,400,000. D. $4,600,000arrow_forwardIn early 2024, Menz Corporation acquired NeuroLab to obtain technology that NeuroLab was in the process of developing. The total acquisition cost included $2 million for this technology. At the time of acquisition, the technology had not yet reached the point of technological feasibility. During the remainder of 2024, Menz spent an additional $1 million to improve the technology, which then reached the point of technological feasibility by the end of the year. The new technology was expected to provide benefits to Menz over the subsequent five years. What amount of research and development expense would Menz record in 2024? Multiple Choice $2 million $3 million O $1 million $0arrow_forward

- A retailer is looking to expand operations at all of their stores for an initial investment of $760. This investment will be depreciated on a straight line basis over the project's 8 year life. The expansion is expected to produce annual cash inflows of $570 in consecutive years over the life of the project beginning one year from today, while also producing annual cash outflows of $310 in consecutive years over the life of the project, also beginning one year from today. What is the project's NPV if the corporate tax rate is 36% and the project's required rate of return is 9%? Place your answer in dollars and cents without the use of a dollar sign or a comma. If applicable, negative values should be entered with a minus sign in front of the number. Work all analysis out using at least 4 decimal places of accuracy.arrow_forwardRogers Inc.is considering investing $320,000 in hardware and software to develop a business-to-business (B2B) portal. The company expects the portal to save $40,000 each year for seven years of its useful life. Please figure out the payback period. b) AND its accounting rate returnarrow_forwardOn April 30, 2020, Ayayai Corporation ordered a new passenger ship, which was delivered to the designated cruise port and available for use as of June 30, 2020. Overall, the cost of the ship was $93 million, with an estimated useful life of 12 years and residual value of $30 million. Ayayai expects that the new ship, as a whole, will provide its greatest economic benefits in its early years of operation. After further research and discussion with management, it is determined that the ship consists of major parts with differing useful lives, residual values, and patterns of providing economic benefits: Part Cost Useful life Residual value Pattern ofbenefits Total output(nautical miles) Engines (6) $925,000 per engine 8 years $100,000 per engine Varies with activity 6 million Hull $3,350,000 10 years $500,000 Highest in early years 7.50 million Body $84.10 million 15 years $14.98 million Evenly over life of body 12.00 million…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education