FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

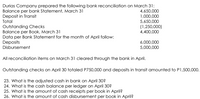

Transcribed Image Text:Durias Company prepared the following bank reconciliation on March 31:

Balance per bank Statement, March 31

Deposit in Transit

Total

4,650,000

1,000,000

5,650,000

Outstanding Checks

Balance per Book, March 31

Data per Bank Statement for the month of April follow:

Deposits

Disbursement

(1,250,000)

4,400,000

6,000,000

5,000,000

All reconciliation items on March 31 cleared through the bank in April.

Outstanding checks on April 30 totaled P750,000 and deposits in transit amounted to P1,500,000.

23. What is the adjusted cash in bank on April 30?

24. What is the cash balance per ledger on April 30?

25. What is the amount of cash receipts per book in April?

26. What is the amount of cash disbursement per book in April?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bank Reconciliation The following June 30 bank reconciliation was prepared for Poway Co. Poway Co. Bank Reconciliation For the Month Ended June 30 Cash balance according to bank statement $16,185 Add outstanding checks: No. 1067 $575 1106 470 1110 1,050 1113 910 3,005 $19,190 Deduct deposit of June 30, not recorded by bank 6,600 Adjusted balance $12,590 Cash balance according to company’s records $8,985 Add: Proceeds of note collected by bank: Principal $6,000 Interest 300 $6,300 Service charges 15 6,315 $15,300 Deduct: Check returned because of insufficient funds $890 Error in recording June 17 deposit of $7,150 as $1,750 5,400 6,290 Adjusted balance $ 9,010 a. Identify the errors in the above bank reconciliation. Item Correct Heading…arrow_forwardCalculator Thompson Company gathered the following reconciling information in preparing its October bank reconciliation. Cash balance per bank, October 31 $14,391 Note receivable collected by bank 4,306 Outstanding checks 7,664 Deposits in transit 5,297 Bank service charge 146 NSF check 2,231 Determine the cash balance per company records (before adjustment) on October 31. Oa. $12,024 Ob. $13,953 Oc. $10,095 Od. $27,352 3:09 PM 10/23/2020 8.arrow_forwardThompson Corporation gathered the following reconciling information in preparing its October bank reconciliation: Line Item Description Amount Cash balance per bank, October 31 $15,554 Note receivable collected by bank 4,010 Outstanding checks 7,718 Deposits in transit 5,145 Bank service charge 140 NSF check 1,521 Determine the cash balance per the company’s records (before adjustments). a. $17,903 b. $10,632 c. $12,981 d. $15,330arrow_forward

- Mazaya Company gathered the following reconciling information in preparing its November bank reconciliation: Cash balance per books (11/30) R.O.4,400; Deposits in transit R.O. 60o; Notes receivable and interest collected by bank R.O.1,400; Bank charge for check printingarrow_forwardBank Reconciliation and Entries The cash account for Brentwood Bike Co. at May 1 indicated a balance of $13,080. During May, the total cash deposited was $65,740 and checks written totaled $61,040. The bank statement indicated a balance of $22,290 on May 31. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a. Checks outstanding totaled $9,930. b. A deposit of $8,090, representing receipts of May 31 had been made too late to appear on the bank statement. c. The bank had collected for Brentwood Bike Co. $4,270 on a note left for collection. The face of the note was $3,940. d. A check for $360 returned with the statement had been incorrectly charged by the bank as $630. e. A check for $410 returned with the statement had been recorded by Brentwood Bike Co. as $140. The check was for the payment of an obligation to Adkins Co. on account. f. Bank service charges for May amounted to $70. g. A check for…arrow_forwardIn the process of reconciling its bank statement for April, Donahue Enterprises' accountant compiles the following information: Cash balance per company books on April 30 Deposits in transit at month-end Outstanding checks at month-end Bank charge Note collected by bank on Donahue's behalf A check paid to Donahue during the month by a customer is returned by the bank as NSF The adjusted cash balance per the books on April 30 is: $6,275 $1,300 $ 620 $ 45 $770 $ 480arrow_forward

- Which of the following items is exempt from including into the assessable income for salaries tax purposes? Select one: a. Leave pay b. Commission c. Compensation for termination of employment not provided in the contract d. End of contract gratuitiesarrow_forwardMazaya Company developed the following reconciling information in preparing its April bank reconciliation: Cash balance per bank, 4/30 RO.15,400; Note receivable collected by bank 8,400; Outstanding checks 12,600; Deposits in transit 6,300; Bank service charge 150; NSF check 1,680; Using the above information, determine the cash balance per books (before adjustments) for the Mazaya Company.arrow_forwardR&L Company provided the following bank reconciliation on May:Balance per bank 2,100,000Deposit Outstanding 300,000Checks Outstanding ( 50,000)Correct Cash Balance 2,350,000 Balance per book 2,360,000Bank Service Charge ( 10,000)Correct Cash Balance 2,350,000 Data for the Month of JuneBank BookChecks Recorded 2,300,000 2,400,000Deposits Recorded 1,700,000 1,800,000Collection by bank, plus interest 550,000NSF Check returned with June 100,000Balance 1,950,000 1,750,000 What is the amount of checks Outstanding on June? * What is the amount of deposit in transit on June?arrow_forward

- Bank Reconciliation and Entries The cash account for Brentwood Bike Co. at May 1 indicated a balance of $14,370. During May, the total cash deposited was $71,780 and checks written totaled $66,650. The bank statement indicated a balance of $24,330 on May 31. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: Checks outstanding totaled $10,840. A deposit of $8,830, representing receipts of May 31, had been made too late to appear on the bank statement. The bank had collected for Brentwood Bike Co. $4,670 on a note left for collection. The face of the note was $4,310. A check for $490 returned with the statement had been incorrectly charged by the bank as $940. A check for $520 returned with the statement had been recorded by Brentwood Bike Co. as $250. The check was for the payment of an obligation to Adkins Co. on account. Bank service charges for May amounted to $50. A check for $1,080 from Jennings…arrow_forwardRequired:1. Prepare a bank reconciliation as of February 28.2. Prepare adjusting entries for Valentine based on the information developed in the bank reconciliation.3. What is the amount of cash that should be reported on the February 28 balance sheet?arrow_forwardMazaya Company gathered the following reconciling information in preparing its November bank reconciliation: Cash balance per books (11/30) R.O.4,400; Deposits in transit R.O. 6oo; Notes receivable and interest collected by bank R.O. 1,400; Bank charge for check printingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education