FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

| Required: 1. Prepare a bank reconciliation as of February 28. 2. Prepare 3. What is the amount of cash that should be reported on the February 28 |

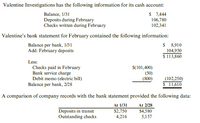

Transcribed Image Text:Valentine Investigations has the following information for its cash account:

Balance, 1/31

Deposits during February

Checks written during February

$ 1,444

106,780

102,341

Valentine's bank statement for February contained the following information:

Balance per bank, 1/31

Add: February deposits

$ 8,910

104,950

$ 113,860

Less:

Checks paid in February

Bank service charge

Debit memo (electric bill)

Balance per bank, 2/28

$(101,400)

(50)

(800)

(102,250)

$ 11,610

A comparison of company records with the bank statement provided the following data:

At 1/31

At 2/28

Deposits in transit

Outstanding checks

$2,750

4,216

$4,580

5,157

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The bank reconciliation ? Please explain with full explanation. a. should be prepared by an employee who records cash transactions b. is part of the internal control system c. is for information purposes only d. is sent to the bank for verificationarrow_forwardCash receipts should be deposited on the day of receipt or the following business day. Select the most appropriate audit procedure to determine that cash is promptly deposited. a. Review the functions of cash receiving and disbursing for proper separation of duties. b. Review cash register tapes prepared for each sale. c. Review the functions of cash handling and maintaining accounting records for proper segregation of duties. d. Compare the daily cash receipts totals with the bank depositsarrow_forwardPlease help me with this practice question?arrow_forward

- Which one of these documents is not required for bank reconciliation? (A) Bank Column of cash book (B) Bank pass book (C) Previous year's balance sheet (D) Bank statementarrow_forwardPlease provide correct answerarrow_forwardWhich of the following can be considered as an effective control of cash?A. One person handles the receipts and disbursements of cash.B. Cash is deposited monthly into a bank.C. There is approval of cash payments.D. A reconciliation of the bank balance with the cash balance is prepared twice a year.arrow_forward

- After preparing a bank reconciliation, journal entries are necessary to record Bank service charges Deposits in transit Outstanding checks Both B and C are correct A, B, and C are correctarrow_forwardSolve this problemarrow_forwardWhich of the following practices contributes to efficientcash management? a. Never borrow money—maintain a cash balance suffi-cient to make all necessary payments. b. Record all cash receipts and cash payments at the endof the month when reconciling the bank statements.c. Prepare monthly forecasts of planned cash receipts,payments, and anticipated cash balances up to a year inadvance.d. Pay each bill as soon as the invoice arrives.arrow_forward

- On the Excel worksheet are the T- accounts for cash and other accounts need to record the bank reconciliation. Also, the format for the bank reconciliation is provided. Complete the bank reconciliation, using formulas when possible.arrow_forwardWhich one of the following items requires an adjustment on the bank side of the bank reconciliation? A. interest earned B. a bank service charge C. a note collected by the bank D. deposits in transitarrow_forward4. Which of the following audit procedures is most appropriate to address the occurrence assertion for sales? a. Confirm receivables balances. b. Perform analytical procedures. c. Review collectability. d. Confirm cash deposits in banks.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education