FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

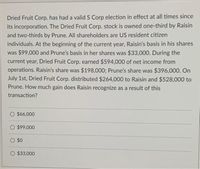

Transcribed Image Text:Dried Fruit Corp. has had a valid S Corp election in effect at all times since

its incorporation. The Dried Fruit Corp. stock is owned one-third by Raisin

and two-thirds by Prune. All shareholders are US resident citizen

individuals. At the beginning of the current year, Raisin's basis in his shares

was $99,000 and Prune's basis in her shares was $33,000. During the

current year, Dried Fruit Corp. earned $594,000 of net income from

operations. Raisin's share was $198,000; Prune's share was $396,000. On

July 1st, Dried Fruit Corp. distributed $264,000 to Raisin and $528,000 to

Prune. How much gain does Raisin recognize as a result of this

transaction?

O $66,000

$99,000

O $0

$33,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presley Corp., a calendar-year corporation, was formed four years ago by its sole shareholder, Smith, who has always operated it as a C corporation. However, at the beginning of 2020, Smith made a qualifying S election for Presley Corp., effective January 1. Presley Corp. reported $140,000 of C corporation earnings and profits on the effective date of the S election. In 2020 (its first S corporation year), Presley Corp. reported business income of $100,000. Smith’s basis in his Presley Corp. stock at the beginning of 2020 was $30,000. What are the amount and character of gain Smith must recognize on the following distributions scenarios, and what is his basis in his Presley Corp. stock at the end of the year? Smith received a $80,000 distribution from Presley Corp. at the end of the year. Smith received a $260,000 distribution from Presley Corp. at the end of the year. Smith received a $300,000 distribution from Presley Corp. at the end of the year.arrow_forwardPine Corporation, a calendar-year corporation, was formed three years ago by its sole shareholder, Connor, who has always operated it as a C corporation. However, at the beginning of this year, Connor made a qualifying S election for Pine Corporation, effective January 1. Pine Corporation reported $70,000 of C corporation earnings and profits on the effective date of the S election. This year (its first S corporation year), Pine Corporation reported business income of $50,000. Connor's basis in his Pine Corporation stock at the beginning of the year was $15,000. What are the amount and character of income or gain Connor must recognize on the following alternative distributions, and what is his basis in his Pine Corporation stock at the end of the year? (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) d. Connor received a $150,000 distribution from Pine Corporation at the end of the year. Character Amount Capital gain Dividend Stock basisarrow_forwardABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares) to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.) Period Income January 1 through April 30 (120 days) $ 203,285 May 1 through December 31 (245 days) 533,285 January 1 through December 31 $ 736,570 If ABC uses the daily method of allocating income between the S corporation short tax year (January 1–April 30) and the C corporation short tax year (May 1–December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2020? Essay Toolbar navigation opens in a dialogarrow_forward

- The Board of Directors of CYZ Corporation votes to issue two shares of stock for each share held as a stock dividend to shareholders. Just prior to the dividend, Cheryl owns 100 shares of CYZ Corporation stock that she purchased for $10 per share. She receives 200 new shares as a result of the dividend. How much gross income must Cheryl report as a result of the dividend and what is her stock basis after the dividend?arrow_forwardG is employed by a Canadian-controlled private corporation. In year 1, G was granted a stock option to acquire 4,000 shares from the treasury of his employer’s corporation for $11 a share. At the time of receiving the option, the shares were valued at $13 per share. In year 3, G exercised his option and purchased 4,000 shares for $44,000. At the purchase date in year 3, the shares were valued at $12 per share. In year 5, G sold 4,000 shares for $17 per share. What amount is included in G’s employment income for tax purposes in year 1?arrow_forwardOn July 1, 2021, Tony and Suzie organize their new company as a corporation, Great Adventures Inc. The articles of incorporation state that the corporation will sell 37,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the company. The following transactions occur from July 1 through December 31. Jul. 1 Sell $18,500 of common stock to Suzie. Jul. 1 Sell $18,500 of common stock to Tony. Jul. 1 Purchase a one-year insurance policy for $4,920 ($410 per month) to cover injuries to participants during outdoor clinics. Jul. 2 Pay legal fees of $1,900 associated with incorporation. Jul. 4 Purchase office supplies of $1,700 on account. Jul. 7 Pay for advertising of $280 to a local newspaper for an upcoming mountain biking clinic to be held on July 15. Attendees will be charged $50 on the day of the clinic. Jul. 8 Purchase 10 mountain bikes, paying $19,500 cash.…arrow_forward

- On January 1, 2023, Kinney, Inc., an S corporation, reports $33,600 of accumulated E & P and a balance of $84,000 in AAA. Kinney has two shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nonseparately stated ordinary income for the year is $42,000. Kinney distributes $50,400 to each shareholder on July 1, and it distributes another $25,200 to each shareholder on December 21. How are the shareholders taxed on the distributions? Ignore the 20% QBI deduction. Do not round intermediate computations. If required, round your final answers to the nearest dollar. Erin and Frank each report $ dividend income for the July 1 distribution and $ distribution. Assuming that the shareholders have sufficient basis in their stock, Erin and Frank each receive a tax-free distribution from AAA. $ each for the December 21arrow_forwardAt the beginning of the current year, Tymoe, an S corporation, was owned by two individual shareholders, Tyler and Moe. Tyler owns 52% and Moe owns 48%. During the year, Tymoe had ordinary income of $480,000, a net long-term capital gain of $45,000, and charitable contributions of $12,000. What is the amount of ordinary income, capital gain, and charitable contribution from Tymoe's activities that Tyler and Moe must each report in the current year?arrow_forwardPine Corporation, a calendar-year corporation, was formed three years ago by its sole shareholder, Connor, who has always operated it as a C corporation. However, at the beginning of this year, Connor made a qualifying S election for Pine Corporation, effective January 1. Pine Corporation reported $70,000 of C corporation earnings and profits on the effective date of the S election. This year (its first S corporation year), Pine Corporation reported business income of $50,000. Connor's basis in his Pine Corporation stock at the beginning of the year was $15,000. What are the amount and character of income or gain Connor must recognize on the following alternative distributions, and what is his basis in his Pine Corporation stock at the end of the year? (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) a. Connor received a $40,000 distribution from Pine Corporation at the end of the year. Character Amount N/A N/A Stock basisarrow_forward

- Stevie recently received 1,080 shares of restricted stock from her employer, Nicks Corporation, when the share price was $9 per share. Stevie's restricted shares vested three years later when the market price was $12. Stevie held the shares for a little more than a year and sold them when the market price was $15. Assuming Stevie made a section 83(b) election, what is the amount of Stevie's ordinary income with respect to the restricted stock?arrow_forwardWhat will be the Compensation for officers in the 1120, 2020 form? Please show the calculation as well. EC is owned by four related shareholders from the same family for the entire year: Raphael Giordano (father) and his three children Silvia, Andrea, and Marco. None of EC’s shareholders are non-U.S. persons. There are currently 10,000 shares of EC common stock issued and outstanding (EC has never issued preferred stock). The shareholders are also employees of EC and its only corporate officers. The relevant shareholder and officer information for the current year is provided below. Officer compensation is included in Employee Salaries on the income statement. Given in Income Statement for the period ending December 31, 2020 Salaries & Wages: $743,500. Their personal information is provided below. Raphael Giordano, Shares owned 5,500, 100% of time devoted to the business, compensation of $150,000 Silvia Giordano Costa, Shares owned 1,500, 100% of time devoted to the business,…arrow_forwardWRT, a calendar year S corporation, has 100 shares of outstanding stock. At the beginning of the year, Mr. Wallace owned all 100 shares. On September 30, he gave 25 shares to his brother and 40 shares to his daughter. WRT’s ordinary income for the year was $232,000. Required:What portion of this income must each shareholder include in income? (Assume 365 days in a year. Round income per day of ownership to 4 decimal places. Round other intermediate calculations and final answers to the nearest whole dollar amount.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education