FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

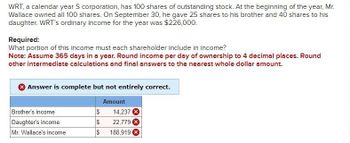

Transcribed Image Text:WRT, a calendar year S corporation, has 100 shares of outstanding stock. At the beginning of the year, Mr.

Wallace owned all 100 shares. On September 30, he gave 25 shares to his brother and 40 shares to his

daughter. WRT's ordinary income for the year was $226,000.

Required:

What portion of this income must each shareholder include in income?

Note: Assume 365 days in a year. Round income per day of ownership to 4 decimal places. Round

other intermediate calculations and final answers to the nearest whole dollar amount.

Answer is complete but not entirely correct.

Brother's income

Daughter's income

Mr. Wallace's income

Amount

$

14,237

$

22,779

$ 188,919

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sonny and Cher equally own Song Corporation, an 5 corporation. Each has a $50,000 stock basis at the beginning of the year. Song Corporation has a $100,000 mortgage on its balance sheet, as well as a note payable to Cher for $25,000. During the current year, Song Corporation reports an ordinary loss of $105,000. 1. What is Sonny's stock basis at the end of the year? 2. What is Sonny's debt basis at the end of the year? 3. What loss will Sonny report on his tax return for the year? 4. What is Cher's stock basis at the end of the year? 5. What is Cher's debt basis at the end of the year? 6. What loss will Cher report on her tax return for the year?arrow_forwardMari owns 500 shares of stock work $5000. This year she received 100 additional shares of this stock from stock dividend. Her 600 shares are now worth $6,250. Must Mari include the dividend in stock in income?arrow_forwardSubject: accountingarrow_forward

- Sharon Slotten purchased shares in ATCO Ltd. during the current year as follows: Jan. 1: 200 shares for $25 per share April 2: 300 shares for $30 per share July 1: 100 shares sold for $45 per share Sept. 8: 500 shares for $24 per share On December 22, of the current year Sharon sells 200 ATCO Ltd. shares for $35 per share and pays $100 in sales commission. Required: Calculate the taxable capital gain or loss included in Sharon's NET INCOME under paragraph 3(b) of the Income Tax Act. Solution: Date No. of shares Cost per share Cost in Pool Jan.1 200 $ 25.00 $ 5,000 Apr.2 300 $ 30.00 $ 9,000 Subtotal 01-Jul 100 $ 45.00 $ 4,500 Sept.8 Total Calculation of Capital Gain: Proceeds of disposition Selling costs Adjusted cost base Capital Gain (loss) Capital Gains reserve Capital Gain Inclusion rate Taxable capital gain Total 01-Jul Dec.22 $ 200 $arrow_forwardAssume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,560. Marcus is Johnstone's sole shareholder, and he has a stock basis of $46,000 at the end of year 1. Johnstone Corporation Income Statement December 31, Year 2 Year 2 (S Corporation) $ 174,000 ( 41,000) (66,000) (56,500) (10,000) ( 4,600) 12,540 $ 8,440 Sales revenue Cost of goods sold Salary to owners Employee wages Depreciation expense Miscellaneous expenses Interest income Overall net income What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) b. Johnstone distributed $11,200 to Marcus in year 2. Accumulated adjustments account Dividend incomearrow_forwardLarry, the sole shareholder of Brown Corporation, sold his Brown stock to Ed on July 30 for $270,000. Larry’s basis in the stock was $200,000 at the beginning of the year. Brown had accumulated E & P of $120,000 on January 1 and has current E & P of $240,000. During the year, Brown made the following distributions: $450,000 of cash to Larry on July 1 and $150,000 of cash to Ed on December 30. How will Larry and Ed be taxed.arrow_forward

- 22. At the beginning of the tax year, Tim had a $2,000 stock basis in the S corporation, World, Inc. Tim owns 25% of the outstanding World, Inc. stock. At the end of the tax year, World, Inc. reported on its Schedule K, a $16,000 ordinary loss, $4,000 of interest income, and $2,000 in nondeductible expense. Tim also has $10,000 in flow-through reportable income from other S corporations. How much of the World, Inc. ordinary loss can Tim deduct on his personal return? . $0 • $2,500 . $3,000 $4,000arrow_forwardBetty and John Martinez own 140 shares of McDonald's common stock. McDonald's annual dividend is $0.79 per share. What is the amount of the dividend check the Martinez couple will receive for this year? (Round your answer to 2 decimal places.) Annual dividend check amountarrow_forwardLandry owns 50 of 250 outstanding shares of Kelly Manufacturing corporation. How many of Landry’s shares must be redeemed in order for the redemption to qualify as disproportionate? Assume that Kelly Manufacturing corporation has $100,000 in current earnings & profits, has no accumulated e&p, and there were no dividends or other distributions this year. If Landry’s stock is redeemed for $15,000 on December 31, what is the effect on earnings and profits?arrow_forward

- Prepare your answers using excel or clearly written computations. Show your work for maximum points. 4. Grady exchanges qualified property, basis of $12,000 and fair market value of $18,000, for 60% of the stock of Eadie Corporation. The other 40% of the stock is owned by Pedro, who acquired it five years ago. Calculate Grady’s current income, gain, or loss and the basis he takes in his shares of Eadie stock as a result of this transaction.arrow_forwardShow your work On January 1 of the current year, Rhondell Corporation has accumulated E & P of $174,000. Current E & P for the year is $522,000, earned evenly throughout the year. Elizabeth and Jonathan are sole equal shareholders of Rhondell from January 1 to April 30. On May 1, Elizabeth sells all of her stock to Marshall. Rhondell makes two distributions to shareholders during the year: a total of $278,400 ($139,200 to Elizabeth and $139,200 to Jonathan) on April 30 and a total of $487,200 ($243,600 to Jonathan and $243,600 Marshall) on December 31. Determine the allocation of the distributions by completing the table below. Assume that the shareholders have sufficient basis in their stock for any amount that is treated as return of capital.arrow_forwardT corporation (E & P $800,000) has 1,000 shares of stock outstanding. The shares are owned as followed: James 600 shares; Stephanie (James's sister) 300 shares; Luke (James son) 100 shares. T corporation owns land (basis of 300,000, FMV of $260,000) that it purchased as an investment years ago. James had a basis of $275,000 in his shares. What are the tax consequences for both T corporation and James if the distribution is: A. A qualified stock redemption B. A liquidating distributionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education