FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

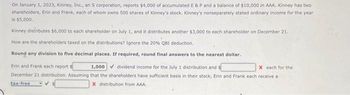

Transcribed Image Text:On January 1, 2023, Kinney, Inc., an S corporation, reports $4,000 of accumulated E & P and a balance of $10,000 in AAA. Kinney has twor

shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nonseparately stated ordinary income for the year

is $5,000.

Kinney distributes $6,000 to each shareholder on July 1, and it distributes another $3,000 to each shareholder on December 21.

How are the shareholders taxed on the distributions? Ignore the 20% QBI deduction.

Round any division to five decimal places. If required, round final answers to the nearest dollar.

Erin and Frank each report

December 21 distribution. Assuming

tax-free

1,000

dividend income for the July 1 distribution and s

X each for the

that the shareholders have sufficient basis in their stock, Erin and Frank each receive a

X distribution from AAA.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oreo Corporation has AEP of $5,000 and negative CEP of $18,000. The corporation distributes $11,000 on March 1 to Morris, its sole shareholder, who has a $9,000 basis for his stock which he has held for 6 years. The treatment of the distribution will be Select one: a. $2,000 dividend and a $9,000 capital gain. b. $500 dividend, $9,000 tax free return of stock basis and $1,500 long-term capital gain. c. $2,000 dividend and a $9,000 tax free return of basis. d. $8,000 dividend and a $3,000 return of capital. e. None of the above.arrow_forwardIndigo Corporation has $15,000 AEP and CEP of $30,000. Renee, the sole shareholder of Indigo Corporation, sold all her stock of Indigo to Chad on July 1 for $180,000. Renee's stock basis at the beginning of the year was $125,000. Indigo made a $60,000 cash distribution to Renee immediately before the sale and Chad received a $140,000 cash distribution from Indigo on November 1. Which of the following statements is correct? Select one: a. Renee recognizes a $91,000 gain on the sale of the stock. b. Renee recognizes a $84,000 gain on the sale of the stock. c. Chad recognizes dividend income of $21,000 and his stock basis is $61,000 d. Both a and c. are correct. e. None of these.arrow_forwardDeli Corporation (an S Corporation) is owned 100% by individual A. Deli earns business income of $40,000 in year one and distributes $30,000 to A in December of year one. The result is:arrow_forward

- WRT, a calendar year S corporation, has 100 shares of outstanding stock. At the beginning of the year, Mr. Wallace owned all 100 shares. On September 30, he gave 25 shares to his brother and 40 shares to his daughter. WRT’s ordinary income for the year was $232,000. Required:What portion of this income must each shareholder include in income? (Assume 365 days in a year. Round income per day of ownership to 4 decimal places. Round other intermediate calculations and final answers to the nearest whole dollar amount.)arrow_forward2.arrow_forwardJessica is a one-third owner in Bikes-R-Us, an S corporation that experienced a $52,200 loss this year (year 1). Assume her stock basis is $12,880 at the beginning of the year and that at the beginning of year 1 Jessica loaned Bikes-R-Us $3,720. In year 2, Bikes-R-Us reported ordinary income of $13,440. What is her debt bases in the corporation at the end of year 2?arrow_forward

- Ted Coverdale and Jim Kulak set up a new limited liability company on May 16, 2020. Ted contributes a warehouse and land worth a combined $1,098,000. Market value of the warehouse is $264,000. Jim contributes $893,000 in cash. Write the journal entry to record the contributions to the LLC.arrow_forwardSonny and Cher equally own Song Corporation, an 5 corporation. Each has a $50,000 stock basis at the beginning of the year. Song Corporation has a $100,000 mortgage on its balance sheet, as well as a note payable to Cher for $25,000. During the current year, Song Corporation reports an ordinary loss of $105,000. 1. What is Sonny's stock basis at the end of the year? 2. What is Sonny's debt basis at the end of the year? 3. What loss will Sonny report on his tax return for the year? 4. What is Cher's stock basis at the end of the year? 5. What is Cher's debt basis at the end of the year? 6. What loss will Cher report on her tax return for the year?arrow_forwardOn July 1, 2021, Tony and Suzie organize their new company as a corporation, Great Adventures Inc. The articles of incorporation state that the corporation will sell 37,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the company. The following transactions occur from July 1 through December 31. Jul. 1 Sell $18,500 of common stock to Suzie. Jul. 1 Sell $18,500 of common stock to Tony. Jul. 1 Purchase a one-year insurance policy for $4,920 ($410 per month) to cover injuries to participants during outdoor clinics. Jul. 2 Pay legal fees of $1,900 associated with incorporation. Jul. 4 Purchase office supplies of $1,700 on account. Jul. 7 Pay for advertising of $280 to a local newspaper for an upcoming mountain biking clinic to be held on July 15. Attendees will be charged $50 on the day of the clinic. Jul. 8 Purchase 10 mountain bikes, paying $19,500 cash.…arrow_forward

- You’re a 40% shareholder of ABC, Inc., an S corporation. ABC’s ordinary busi-ness income for 2019 was exactly $100,000. ABC distributed $20,000 to you in your capacity as a shareholder during 2019. On your 2019 Form 1040, you will report ___ of gross income from ABC. Why is that the correct amount plzzz ans asap.....arrow_forwardOn January 1, 2023, Kinney, Inc., an S corporation, reports $33,600 of accumulated E & P and a balance of $84,000 in AAA. Kinney has two shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nonseparately stated ordinary income for the year is $42,000. Kinney distributes $50,400 to each shareholder on July 1, and it distributes another $25,200 to each shareholder on December 21. How are the shareholders taxed on the distributions? Ignore the 20% QBI deduction. Do not round intermediate computations. If required, round your final answers to the nearest dollar. Erin and Frank each report $ dividend income for the July 1 distribution and $ distribution. Assuming that the shareholders have sufficient basis in their stock, Erin and Frank each receive a tax-free distribution from AAA. $ each for the December 21arrow_forwardLarry, the sole shareholder of Brown Corporation, sold his Brown stock to Ed on July 30 for $270,000. Larry’s basis in the stock was $200,000 at the beginning of the year. Brown had accumulated E & P of $120,000 on January 1 and has current E & P of $240,000. During the year, Brown made the following distributions: $450,000 of cash to Larry on July 1 and $150,000 of cash to Ed on December 30. How will Larry and Ed be taxed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education