Multiple choice. (CPA) Choose the best answer.

- The Cozy Company manufactures slippers and sells them at $10 a pair. Variable

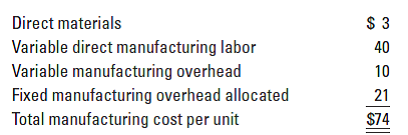

manufacturing cost is $5.75 a pair, and allocated fixed manufacturing cost is $1.75 a pair. It has enough idle capacity available to accept a one-time-only special order of 25,000 pairs of slippers at $7.50 a pair. Cozy will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $43,750 increase, (c) $143,750 increase, or (d) $187,500 increase? Show your calculations. - The Manchester Company manufactures Part No. 498 for use in its production line. The manufacturing cost per unit for 10,000 units of Part No. 498 is as follows:

The Remnant Company has offered to sell 10,000 units of Part No. 498 to Manchester for $71 per unit. Manchester will make the decision to buy the part from Remnant if there is an overall savings of at least $45,000 for Manchester. If Manchester accepts Remnant’s offer, $11 per unit of the fixed

Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 4 images

- The pipes and plastic company manufactures wiring tools. The company is currently producing well below its full capacity. An Accra based company has approached pipes and plastics limited with an offer to buy 10,000 tools at ghc 1.75 each. Pipes and plastic limited sells its tools wholesale for ghc 1.85each; the average cost per unit is gh1.83 of which ghc 0.27 is fixed costs. If pipes and plastics were to accept the Accra based company's offer, what will be the increase in pipes and plastic operating profit?arrow_forwardPeppertree Company has two divisions, East and West. Division East manufactures a component that Division West uses. The variable cost to produce this component is $1.56 per unit; full cost is $1.98. The component sells on the open market for $4.96. Assuming Division East has excess capacity, what is the lowest price Division East will accept for the component? What is the highest price that Division West will pay for it? (Enter your answers in 2 decimal places.)arrow_forwardUrmilabenarrow_forward

- Diamond Boot Factory normally sells its specialty boots for $34 a pair. An offer to buy 85 boots for $30 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost Determine the differential income or loss per pair of boots from selling to the organization. Should Diamond Boot Factory accept or reject the special offer?arrow_forwardAdams Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Adams produces and sells only 6,200 bikes each year. Due to the low volume of activity, Adams is unable to obtain the economies of scale that larger producers achieve. For example, Adams could buy the handlebars for $30 each; they cost $33 each to make. The following is a detailed breakdown of current production costs. Item Unit-level costs Materials Labor Overhead Allocated facility-level costs Total Unit Cost $15 9 2 7 $33 Total $ 93,000 55,800 12,400 43,400 $204,600 After seeing these figures, Adams's president remarked that it would be foolish for the company to continue to produce the handlebars at $33 each when it can buy them for $30 each. Required Calculate the total relevant cost. Do you agree with the president's conclusion? Answer is complete but not entirely correct. Per Unit Totalarrow_forwardSweet Acacia Inc. makes unfinished bookcases that it sells for $58. Production costs are $38 variable and $9 fixed. Because it has unused capacity, Sweet Acacia is considering finishing the bookcases and selling them for $72. Variable finishing costs are expected to be $7 per unit with no increase in fixed costs. Prepare an analysis on a per-unit basis that shows whether Sweet Acacia should sell unfinished or finished bookcases. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Sales per unit Variable cost per unit Fixed cost per unit Total per unit cost Net income per unit The bookcases 69 $ Sell ✓processed further. LA GA Process Further $ $ Net Income Increase (Decrease)arrow_forward

- sarrow_forwardMarigold Corp. is unsure of whether to sell its product assembled or unassembled. The unit cost of the unassembled product is $27 and Marigold would sell it for $60. The cost to assemble the product is estimated at $13 per unit and the company believes the market would support a price of $64 on the assembled unit. What decision should Marigold make and why? Sell before assembly because the company will be better off by $9 per unit. Sell before assembly because the company will be better off by $4 per unit. Process further because the company will be better off by $18 per unit. Process further because the company will be better off by $20 per unit.arrow_forwardPlease help me to solve this problemarrow_forward

- Whitmore Glassware makes a variety of drinking glasses and mugs. The company's designers have discovered a market for a 16 ounce mug with college logos. Market research indicates that a mug like this would sell well in the market priced at $26.65. Whitmore only introduces a product if they can an operating profit of 30 percent of costs. Required: What is the highest acceptable manufacturing cost for which Whitmore would be willing to produce the mugs? (Round your answer to 2 decimal places.) Highest acceptable manufacturing costsarrow_forwardCampbell Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high- quality racing bikes with limited sales. Campbell produces and sells only 7,700 bikes each year. Due to the low volume of activity, Campbell is unable to obtain the economies of scale that larger producers achieve. For example, Campbell could buy the handlebars for $33 each; they cost $36 each to make. The following is a detailed breakdown of current production costs. Item Unit Cost Total Unit-level costs $13 $100, 100 92,400 23,100 61,600 Materials Labor 12 Overhead Allocated facility-level costs 8 Total $36 $277,200 After seeing these figures, Campbell's president remarked that it would be foolish for the company to continue to produce the handlebars at $36 each when it can buy them for $33 each. Required Calculate the total relevant cost. Do you agree with the president's conclusion? Per Unit Total Total relevant cost Do you agree with the president's…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education