College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Cost of goods sold___?

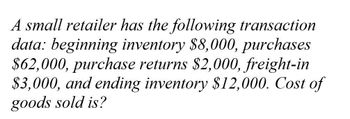

Transcribed Image Text:A small retailer has the following transaction

data: beginning inventory $8,000, purchases

$62,000, purchase returns $2,000, freight-in

$3,000, and ending inventory $12,000. Cost of

goods sold is?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the following information to compute cost of goods sold under the FIFO and LIFO inventory methods. The firm sold 200 units.arrow_forwardInventory Costing Methods Andersons Department Store has the following data for inventory, purchases, and sales of merchandise for December. Andersons uses a perpetual inventory system. All purchases and sales were for cash. Required: 1. Compute cost of goods sold and the cost of ending inventory using FIFO. 2. Compute cost of goods sold and the cost of ending inventory using LIFO. 3. Compute cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations.) 4. Prepare the journal entries to record these transactions assuming Anderson chooses to use the FIFO method. 5. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes?arrow_forwardKulsrud Company would like to estimate the current inventory level. Using the gross profit method and the following information, estimate the current inventory level for Kulsrud Company. Goods available for sale 100,000 Net sales 150,000 Normal gross profit as a percent of sales 40%arrow_forward

- Calculate the cost of goods sold dollar value for B67 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forwardUse the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardUse the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forward

- Uncle Butchs Hunting Supply Shop reports the following information related to inventory: Calculate Uncle Butchs ending inventory using the retail inventory method under the FIFO cost flow assumption. Round the cost-to-retail ratio to 3 decimal places.arrow_forwardCalculate the cost of goods sold dollar value for A65 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forwardThe following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forward

- Determine the cost of merchandise available for sale.arrow_forwardSuppose Perfect Picture Photography Supply's Inventory account showed a balance of $44,700. A physical count showed $43,300 of goods on hand. To adjust the inventory account, Perfect Picture Photography Supply would make which of the following entries? ○ A. Cost of goods sold 1,400 Inventory 1,400 OB. Inventory 1,400 Accounts payable 1,400 ○ C. Accounts payable 1,400 Inventory 1,400 O D. Inventory 1,400 Cost of goods sold 1,400arrow_forwardUsing the data below, calculate the cost of merchandise sold. Beginning inventory, $1,000 Inventory purchased, $3,000 Net Income, $40,000 Ending inventory, $2,000 Sales, $185,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning