FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Computing and Interpreting

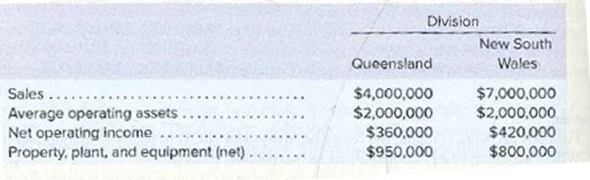

Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below:

Required:

1. Compute the

2. Which divisional manager seems to be doing the better job? Why?

Transcribed Image Text:Division

New South

Queensland

Wales

$7,000,000

$2,000,000

Sales......

Average operating assets.

Net operating income

Property, plant, and equipment (net)

$4,000,000

$2,000,000

$360,000

$950,000

$420,000

$800,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. Marley's ManufacturingIncome StatementMonth Ending August 31, 2018 Dept. A Dept. B Sales $23,000 $50,000 Cost of goods sold 11,270 25,500 Gross profit $11,730 $24,500 Expenses: Utility expenses $1,380 $3,000 Wages expense 5,520 10,000 Costs allocated from corporate 2,070 14,000 Total expenses $8,970 $27,000 Operating income/(loss) in dollars $fill in the blank 1 $fill in the blank 2 Operating income/(loss) in percentage fill in the blank 3 % fill in the blank 4 %arrow_forward3. If management desires a minimum acceptable return on investment of 10%, determine the residual income for each division.arrow_forwardWhich one of the following is not a step in allocating the support department cost to the production department? Select one: a. Trace all the overhead cost b. Divide the departments in to support and producing departments c. Undertake a breakeven analysis d. Divide the company in departmentsarrow_forward

- Jalancu Juviai u The following are a number of measures associated with the Balanced Scorecard. Required: 1. Classify each performance measure as belonging to one of the following perspectives: financial, customer, internal business process, or learning and growth. a. Number of new customers b. Percentage of customer complaints resolved with one contact C. Unit product cost d. Cost per distribution channel e. Suggestions per employee f. Warranty repair costs Consumer satisfaction (from surveys) Cycle time for solving a customer problem Strategic job coverage ratio j. On-time delivery percentage k. Percentage of revenues from new products 2. Select an additional measure that would be appropriate for each of the four perspectives. Contribution margin by product ▾ Number of complaints Number of accidents per month Hours of continuing education provided per month g. h. i. Financial Customer Customer Internal business process Financial Financial Learning and growth Learning and growth…arrow_forwardTennair Corporation manufactures cooling system components. The company has gathered the following information about two of its customers: Evans Equipment and Rogers Refrigeration. Evans Equipment Sales revenue Rogers Refrigeration $ 160,000 61,000 Cost of goods sold General selling costs $ 229,000 102,000 37,000 23,800 28,500 General administrative costs 17,850 Cost-driver data used by the firm and traceable to Evans and Rogers are: Customer Activity Sales activity Order taking Special handling Special shipping Customer Activity Sales activity Order taking Special handling Special shipping Cost Driver Sales visits Sales orders Units handled Shipments Evans Equipment 12 visits 31 orders 460 units. 33 shipments Pool Rate $ 970 278 44 460 Rogers Refrigeration 9 visits 36 orders 410 units 44 shipments Required: A. Perform a customer profitability analysis for Tennair. Compute the gross margin and operating income on transactions related to Evans Equipment and Rogers Refrigeration.arrow_forwardDo not give image formatarrow_forward

- Exercise 10-12 Evaluating New Investments Using Return on Investment (ROI) and Residual Income (LO10-1, LO10-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A $ 6,300,000 $ 1,260,000 340,200 Division B $ 10,300,000 $ 5,150,000 968,200 18.80% Division C $ 9,400,000 $ 1,880,000 24 Sales Average operating assets Net operating income Minimum required rate of return 2$ 249,100 20.00% 17.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 20% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or…arrow_forwardWhat is downsizing? A. An integrated approach configuring processes, products, and people to match costs to the activities that need to be performed for operating effectively and efficiently in the present and future. B. A comparison of the quantity of output produced with the quantity of an individual input used. C. The amount of productive capacity available over and above the productive capacity employed to meet customer demand in the current period. D. An organization's ability to achieve lower costs relative to competitors through productivity and efficiency improvements, elimination of waste, and tight cost control.arrow_forwardPlease help with the attached questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education