FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help with the attached question

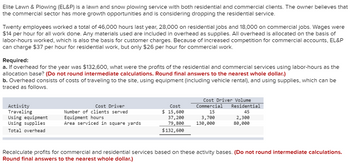

Transcribed Image Text:Elite Lawn & Plowing (EL&P) is a lawn and snow plowing service with both residential and commercial clients. The owner believes that

the commercial sector has more growth opportunities and is considering dropping the residential service.

Twenty employees worked a total of 46,000 hours last year, 28,000 on residential jobs and 18,000 on commercial jobs. Wages were

$14 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of

labor-hours worked, which is also the basis for customer charges. Because of increased competition for commercial accounts, EL&P

can charge $37 per hour for residential work, but only $26 per hour for commercial work.

Required:

a. If overhead for the year was $132,600, what were the profits of the residential and commercial services using labor-hours as the

allocation base? (Do not round intermediate calculations. Round final answers to the nearest whole dollar.)

b. Overhead consists of costs of traveling to the site, using equipment (including vehicle rental), and using supplies, which can be

traced as follows.

Activity

Traveling

Using equipment

Using supplies

Total overhead

Cost Driver

Number of clients served

Equipment hours

Area serviced in square yards

Cost

$ 15,600

37,200

79,800

$132,600

Cost Driver Volume

Commercial

15

3,700

130,000

Residential

45

2,300

80,000

Recalculate profits for commercial and residential services based on these activity bases. (Do not round intermediate calculations.

Round final answers to the nearest whole dollar.)

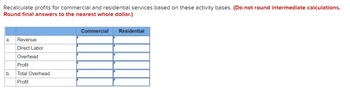

Transcribed Image Text:Recalculate profits for commercial and residential services based on these activity bases. (Do not round intermediate calculations.

Round final answers to the nearest whole dollar.)

a. Revenue

b.

Direct Labor

Overhead

Profit

Total Overhead

Profit

Commercial

Residential

Expert Solution

arrow_forward

Step 1

In order to determine the profit, all the expenses (i.e. direct expenses as well as indirect expenses) are required to be subtracted from the sales revenue.

If the sales revenue is less that the expenses incurred it will result in occurrence of losses whereas if the sales revenue is more than the cost incurred it will result in occurrence of profit.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education