FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial accounting 2

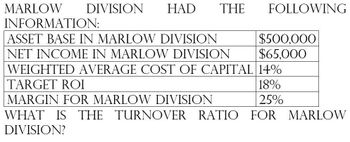

Transcribed Image Text:DIVISION HAD THE

MARLOW

INFORMATION:

ASSET BASE IN MARLOW DIVISION

NET INCOME IN MARLOW DIVISION

FOLLOWING

$500,000

$65,000

WEIGHTED AVERAGE COST OF CAPITAL 14%

TARGET ROI

18%

MARGIN FOR MARLOW DIVISION

25%

WHAT IS THE

TURNOVER RATIO FOR MARLOW

DIVISION?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is EVA for Division Y?arrow_forwardSubject: financial accountingarrow_forwardRequired information Use the following information for the Problems below: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate o on invested capital is 8 percent. Sales revenue Income Average investment Sales margin Capital turnover ROI Residual income Sales revenue Income Average investment Sales margin Capital turnover ROI Residual income Division A ? $ 440,000 ? 40% 2 ? ? Division A $ 8,150,000 $ 1,630,000 $ 8,150,000 20 % 1.00 $ 978,000 20% Required: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return capital is 8 percent. Note: Round "Capital turnover" answers to 2 decimal places. $ $ $ Division B $ 10,000,000 $ 2,160,000 $ 2,600,000 $ Division B 40,300,000 8,866,000 10,075,000 22 % 4.00 88 % ? ? ? 8,060,000 Division C ? $ ? ? 45% ? 40% $ 139,000 Division C 25 % 20 % 471,000arrow_forward

- Presented here is selected information for three regional divisions of Pronghorn Compa Contribution margin Controllable margin Average operating assets Minimum rate of return (a) North Division West Division North South Division $300,800 $141.000 $940.000 12 % Divisions Compute the return on investment for each division. $501.000 $360.800 $1,640,000 West % % % 14 % South $399,600 $210.000 $1,400,000 9 %arrow_forwardConsider the following data for three divisions of a company, X, Y, and Z: Divisional: X Y Z Sales $ 1,359,000 $ 875,000 $ 4,762,000 Operating Income 231,200 108,200 233,300 Investment in assets 591,600 764,100 2,628,100 The return on investment (ROI) for Division Y is: Multiple Choice 19.1%. 8.9%. 39.1%. 12.4%. 14.2%.arrow_forwardComparingarrow_forward

- Consider the following data for three divisions of a company, X, Y, and Z: Divisional: X Y Z Sales $ 1,486,000 $ 830,000 $ 4,503,000 Operating Income 208,700 126,600 286,600 Investment in assets 517,200 493,700 3,788,900 The return on sales (ROS) for Division Y is: Multiple Choice 7.6%. 14.0%. 15.3%. 25.6%. 6.4%.arrow_forwardThe sales, income from operations, and invested assets for each division of Jackson Corporation are as follows: Sales Income from Operations Invested Assets Division E $4,100,000 $550,000 $2,400,000 Division F 4,700,000 760,000 2,500,000 Division G 7,200,000 860,000 2,800,000 (a) Using the Dupont ROI expanded expression, determine the profit margin, investment turnover, and rate of return on investment for each division. You must provide 3 answers for each division! Round all answers to two decimal places. (b) Which Division is the most profitable per dollar invested? (a) (b)arrow_forwardPresented below is selected information for three regional divisions of Medina Company. Contribution margin Controllable margin Average operating assets Minimum rate of return. North $299,100 $140,000 $1,000,000 13 % Divisions West $500,700 $360,000 $1,500,000 15 % South $400,200 $208,600 $1,490,000 10 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education