Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please don't give answer with incorrect data if data is unclear comment please i will write values.

otherwise will give unhelpful.

no

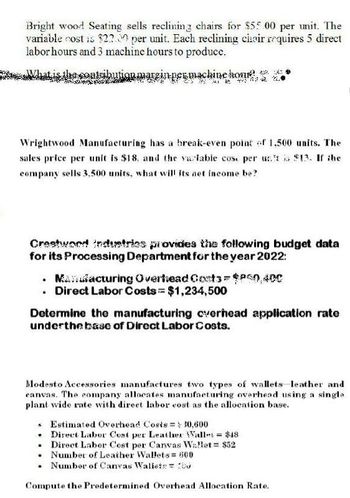

Transcribed Image Text:Bright wood Seating sells reclining chairs for $55.00 per unit. The

variable cost is 322 per unit. Each reclining chair requires 5 direct

labor hours and 3 machine hours to produce.

atribution margin pegmachine home*

Wrightwood Manufacturing has a break-even point of 1,500 units. The

sales price per unit is $18, and the variable cost per u 13. If the

company sells 3,500 units, what will its net income be?

Creatwood Industries provides the following budget data

for its Processing Department for the year 2022:

⚫ Manufacturing Overhead Costs=$250,400

. Direct Labor Costs $1,234,500

Determine the manufacturing overhead application rate

underthe base of Direct Labor Costs.

Modesto Accessories manufactures two types of wallets leather and

canvas. The company allocates manufacturing overhead using a single

plant wide rate with direct labor cost as the allocation base.

$48

Estimated Overhead Costs = 30,600

Direct Labor Cost per Leather Wallet

Direct Labor Cost per Canvas Wallet = $52

Number of Leather Wallets = 300

Number of Canvas Wallets

Compute the Predetermined Overhead Allocation Rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling 44,000 shelves for $32 each. Cutrate Furniture approached Jansen about buying 1,200 shelves for bookcases it is building and is willing to pay $26 for each shelf. No packaging will be required for the bulk order. Jansen usually packages shelves for Home Depot at a price of $1.50 per shell. The $1.50 per-shelf cost is included in the unit variable cost of $27, with annual fixed costs of $320.000. However, the $130 packaging cost will not apply in this case. The fixed costs will be unaffected by the special order and the company has the capacity to accept the order. Based on this information, what would be the profit if Jansen accepts the special order? A. Profits will decrease by $1,200. B. Profits will increase by $31,200. C. Profits will increase by $600. D. Profits will increase by $7,200.arrow_forwardPolaris Inc. manufactures two types of metal stampings for the automobile industry: door handles and trim kits. Fixed cost equals 146,000. Each door handle sells for 12 and has variable cost of 9; each trim kit sells for 8 and has variable cost of 5. Required: 1. What are the contribution margin per unit and the contribution margin ratio for door handles and for trim kits? 2. If Polaris sells 20,000 door handles and 40,000 trim kits, what is the operating income? 3. How many door handles and how many trim kits must be sold for Polaris to break even? 4. CONCEPTUAL CONNECTION Assume that Polaris has the opportunity to rearrange its plant to produce only trim kits. If this is done, fixed costs will decrease by 35,000, and 70,000 trim kits can be produced and sold. Is this a good idea? Explain.arrow_forwardReubens Deli currently makes rolls for deli sandwiches it produces. It uses 30,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: A potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided, If Reuben accepts the offer, what will the effect on profit be?arrow_forward

- Delta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.arrow_forwardMaple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.arrow_forwardMarlin Motors sells a single product with a selling price of $400 with variable costs per unit of $160. The companys monthly fixed expenses are $36,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of November when they will sell 130 units. How many units will Marlin need to sell in order to realize a target profit of $48,000? What dollar sales will Marlin need to generate in order to realize a target profit of $48.000? Construct a contribution margin income statement for the month of February that reflects $200,000 in sales revenue for Marlin Motors.arrow_forward

- Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardManatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows: The current product mix is 4:3:2. The three models share total fixed costs of $430,000. Calculate the sales price per composite unit. What is the contribution margin per composite unit? Calculate Manatoahs break-even point in both dollars and units. Using an income statement format, prove that this is the break-even point.arrow_forward

- Kerr Manufacturing sells a single product with a selling price of $600 with variable costs per unit of $360. The companys monthly fixed expenses are $72,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of January when they will sell 500 units. How many units will Kerr need to sell in order to realize a target profit of $120,000? What dollar sales will Kerr need to generate in order to realize a target profit of $120,000? Construct a contribution margin income statement for the month of June that reflects $600,000 in sales revenue for Kerr Manufacturing.arrow_forwardAble Transport operates a tour bus that they lease with terms that involve a fixed fee each month plus a charge for each mile driven. Able Transport drove the tour bus 4,000 miles and paid a total of $1,250 in March. In April, they paid $970 for 3.000 miles. What is the variable cost per mile if Able Transport uses the high-low method to analyze costs?arrow_forwardLotts Company produces and sells one product. The selling price is 10, and the unit variable cost is 6. Total fixed cost is 10,000. Required: 1. Prepare a CVP graph with Units Sold as the horizontal axis and Dollars as the vertical axis. Label the break-even point on the horizontal axis. 2. Prepare CVP graphs for each of the following independent scenarios: (a) Fixed cost increases by 5,000, (b) Unit variable cost increases to 7, (c) Unit selling price increases to 12, and (d) Fixed cost increases by 5,000 and unit variable cost is 7.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning