FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

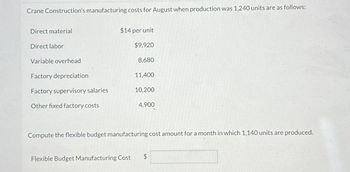

Transcribed Image Text:Crane Construction's manufacturing costs for August when production was 1,240 units are as follows:

Direct material

$14 per unit

Direct labor

$9,920

Variable overhead

8,680

Factory depreciation

11,400

Factory supervisory salaries

10,200

Other fixed factory costs

4,900

Compute the flexible budget manufacturing cost amount for a month in which 1,140 units are produced.

Flexible Budget Manufacturing Cost

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following describes production activities of Mercer Manufacturing for the year. Actual direct materials used 18,000 lbs. at $4.15 per lb. Actual direct labor used 5,555 hours for a total of $106,656 Actual units produced 30,060 Budgeted standards for each unit produced are 0.50 pound of direct material at $4.10 per pound and 10 minutes of direct labor at $20.20 per hour.AH = Actual HoursSH = Standard HoursAR = Actual RateSR = Standard RateAQ = Actual QuantitySQ = Standard QuantityAP = Actual PriceSP = Standard Price (1) Compute the direct materials price and quantity variances and classify each as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Round "Cost per unit" answers to 2 decimal places.)(2) Compute the direct labor rate and efficiency variances and classify each as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no…arrow_forwardMannitou Company made the following predictions for the year: Budgeted factory overhead costs Budgeted direct labor hours Budgeted machine hours $300,000 50,000 hours 100,000 hours Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs. If factory overhead is applied based on machine hours, the cost of Job A2 for Mannitou Company is Oa. $75,000. Ob. $63,000. Oc. $69,000. Od. $66,000.arrow_forwardTiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 6,200 hours. Variable costs: Indirect factory wages $20,460 Power and light 13,826 Indirect materials 11,346 Total variable cost $45,632 Fixed costs: Supervisory salaries $10,410 Depreciation of plant and equipment 26,700 Insurance and property taxes 8,150 Total fixed cost 45,260 Total factory overhead cost $90,892 During May, the department operated at 6,600 standard hours. The factory overhead costs incurred were indirect factory wages, $22,000; power and light, $14,450; indirect materials, $12,300; supervisory salaries, $10,410; depreciation of plant and equipment, $26,700; and insurance and property taxes, $8,150. Required: Prepare a factory overhead cost…arrow_forward

- ABC Pillow produces and sells animal pillow for $80.00 per unit. In the first month of operation, 3,000 units were produced and 2,250 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes: Variable manufacturing costs Variable marketing costs Fixed manufacturing costs Administrative expenses, all fixed $12,000 per month Ending inventories: Direct materials $38 per unit $ 2 per unit $60,000 per month -0- WIP -0- Finished goods 750 units 11) What is gross margin when using absorption costing? A) $95,000 B) $109,500 C) $154,500 D) $49,500arrow_forwardBotosan Factory has budgeted factory overhead for the year at $615,285, and budgeted direct labor hours for the year are 372,900. If the actual direct labor hours for the month of May are 339,300, the overhead allocated for May is a. $559,845 b. $576,640 c. $475,868 d. $677,412arrow_forwardMorris Company allocates manufacturing overhead based on machine hours. Each chair produced should require 4 machine hours. According to the static budget, the following is expected to incur: 2,200 machine hours per month (550 chairs x 4 hours per chair) $11,440 in variable manufacturing overhead costs $9,000 in fixed manufacturing overhead costs During January, Morris Company actually used 2,100 machine hours to make 510 chairs. The company spent $6,800 in variable manufacturing overhead costs and $9,100 in fixed manufacturing overhead costs. What is the fixed overhead cost variance?arrow_forward

- The total factory overhead for Big Light Company is budgeted for the year at $448,060. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 10,900 units. Each night light requires 3 hours of direct labor. Desk lamps are budgeted for 9,700 units. Each desk lamp requires 2 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year. direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. Night lights $ per unit Desk lamps $ per unitarrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $1,163,800. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 17,900 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 21,800 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year. direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. $ per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. Night lights $ Desk lamps $ per unit per unitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education